The ALZERP Cloud ERP Software offers a comprehensive tax return system designed to facilitate the calculation, moderation, and finalization of VAT and tax returns. This system ensures businesses comply with the Saudi Arabian tax regulations set by the Zakat, Tax, and Customs Authority (ZATCA). By automating and streamlining the tax return process, ALZERP helps businesses achieve accuracy and efficiency in their tax management efforts.

ALZERP Cloud ERP offers a robust VAT & Tax Return system that simplifies the process of calculating, moderating, and finalizing VAT and Tax Return amounts. This integrated feature ensures compliance with ZATCA regulations and provides a user-friendly interface for efficient tax management.

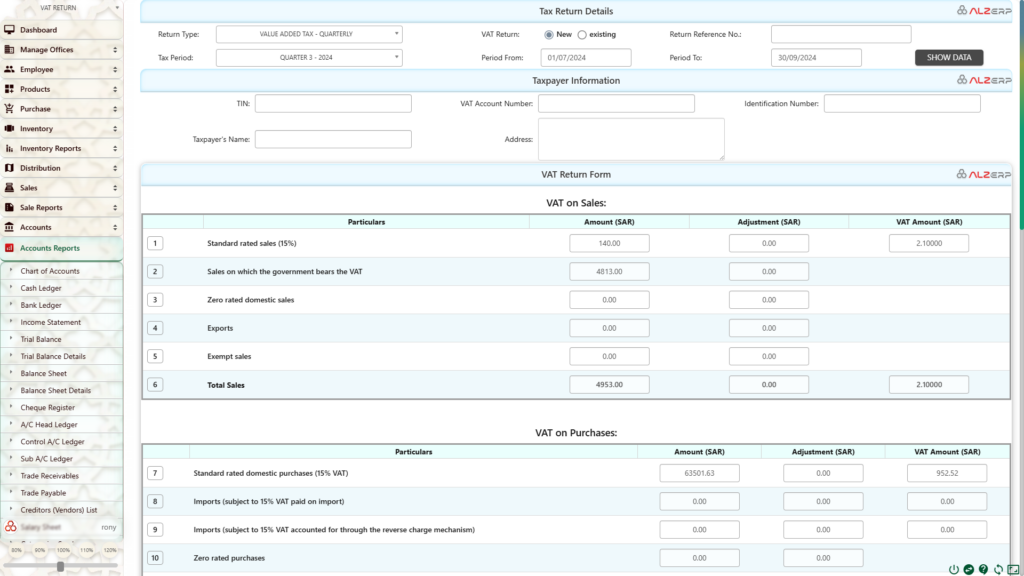

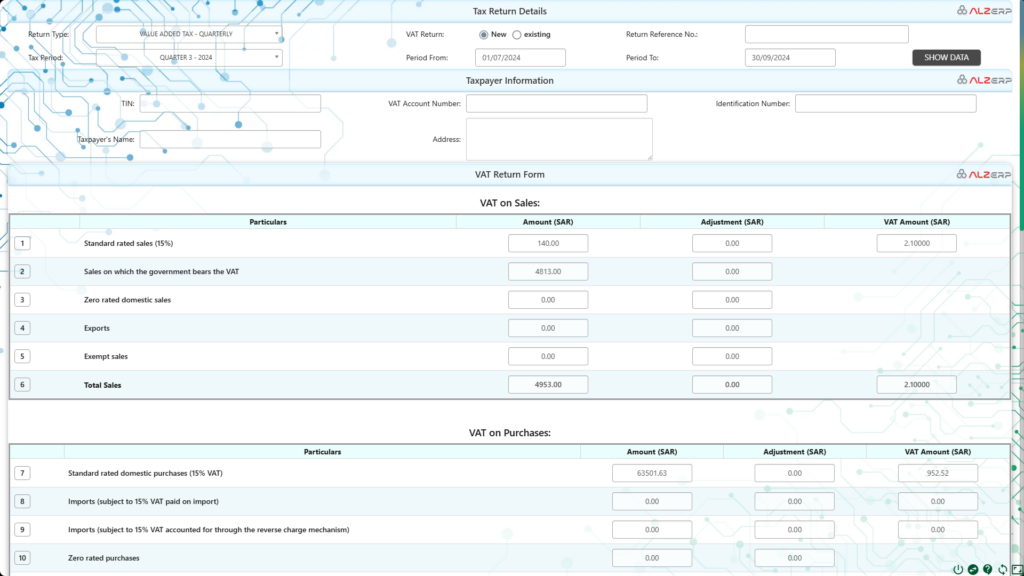

Key Components of the VAT Return System:

- Return Details:

- Specifies the return type (Value Added Tax – Quarterly).

- Indicates whether it’s a new or existing return.

- Assigns a reference number.

- Defines the tax period (e.g., Quarter 3 – 2024).

- Sets the period from and to dates.

- Taxpayer Information:

- Captures the taxpayer’s TIN, VAT Account Number, Identification Number, name, and address.

- VAT Return Form:

- Calculates VAT on sales and purchases.

- Includes sections for standard rated sales, sales on which the government bears the VAT, zero-rated domestic sales, exports, exempt sales, standard rated domestic purchases, imports, zero-rated purchases, exempt purchases, and total purchases.

- Determines the VAT payable amount by considering total VAT due, corrections from previous periods, and VAT credit carried forward.

- VAT-Return History:

- Provides a summary of previous VAT & Tax Return submissions to ZATCA.

Overview of the Tax Return System #

The tax return system in ALZERP is tailored to handle the complexities of VAT and tax calculations, providing an organized approach to manage tax liabilities. This system includes various features such as VAT on sales, VAT on purchases, and VAT payable amount calculations, all structured to align with the quarterly tax reporting requirements mandated by ZATCA.

1. Tax Return Details: The tax return form in ALZERP Cloud ERP Software is designed to capture all relevant details necessary for the VAT and tax return process:

- Return Type: The system supports various return types, including Value Added Tax (VAT) filed on a quarterly basis.

- VAT Return Status: Users can specify whether the VAT return is new or existing.

- Return Reference Number: A unique reference number is assigned to each tax return for tracking and record-keeping purposes.

- Tax Period: The system allows users to define the tax period, such as Quarter 3 of 2024, with the specific period dates from 01/07/2024 to 30/09/2024.

2. Taxpayer Information: Accurate taxpayer information is essential for compliance and reporting. The tax return form captures the following details:

- Taxpayer Identification Number (TIN): A unique identifier for the taxpayer.

- VAT Account Number: The account number associated with the VAT return.

- Identification Number: Additional identification details for verification purposes.

- Taxpayer’s Name and Address: Ensures that all returns are correctly attributed to the registered entity.

3. VAT Return Form:

The VAT return form in ALZERP includes detailed sections for calculating VAT on sales and purchases:

- VAT on Sales: This section details the VAT amounts due on different types of sales. It includes:

- Standard Rated Sales (15% VAT): The amount and VAT calculated on sales that are subject to the standard VAT rate.

- Sales on Which the Government Bears the VAT: Details sales transactions where the VAT burden is borne by the government, commonly seen in specific sectors or promotional periods.

- Zero Rated and Exempt Sales: Tracks sales that are either zero-rated or exempt from VAT, ensuring accurate reporting for compliance.

- Exports: Captures export transactions that typically have different VAT implications.

- Total Sales: Provides a summary of all sales and the associated VAT for the period.

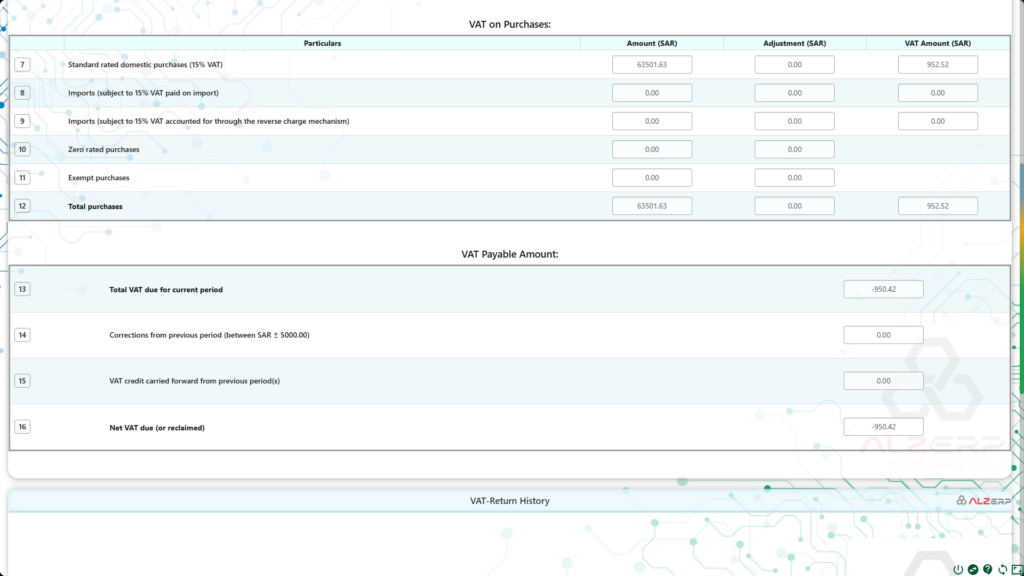

- VAT on Purchases: This section calculates the VAT recoverable on different types of purchases:

- Standard Rated Domestic Purchases: Includes all domestic purchases that attract the standard 15% VAT.

- Imports Subject to VAT: Tracks imported goods that are subject to VAT, including those accounted for through the reverse charge mechanism.

- Zero Rated and Exempt Purchases: Ensures that purchases qualifying for zero-rated or exempt status are correctly accounted for.

- Total Purchases: Summarizes all purchase transactions and the recoverable VAT.

4. VAT Payable Amount: This critical section determines the net VAT payable or reclaimable by the business:

- Total VAT Due for the Current Period: The net VAT amount due for the current tax period.

- Corrections from Previous Period: Adjustments from past periods are accounted for, provided they fall within a specific range (e.g., between SAR ± 5000.00).

- VAT Credit Carried Forward: Any VAT credits from previous periods are applied to the current return.

- Net VAT Due or Reclaimed: The final amount of VAT that the business needs to pay or can reclaim, calculated after considering all applicable credits and adjustments.

5. VAT-Return History: A comprehensive history of previous VAT return submissions to ZATCA is maintained within the system. This feature allows businesses to track their tax compliance over time, ensuring that all submissions are accurately recorded and easily accessible for audits and reviews.

Benefits of the Tax Return System in ALZERP #

- ZATCA Compliant Software: ALZERP is fully compliant with ZATCA requirements, ensuring that all tax returns are prepared in accordance with Saudi regulations.

- Efficient VAT Management: The system automates VAT calculations, reducing manual errors and ensuring accurate reporting.

- Zakat Calculation Software: Provides tools for calculating Zakat, making it easier for businesses to comply with religious and legal obligations.

- Automated Tax Compliance: ALZERP automates the entire tax compliance process, from data synchronization to final submission, saving time and reducing the burden on businesses.

- Real-Time VAT Reporting KSA: The system offers real-time reporting capabilities, allowing businesses to monitor their VAT obligations continuously.

- Saudi Tax Compliance Software: Tailored to meet the specific needs of businesses operating in Saudi Arabia, ensuring compliance with local tax laws.

- Tax Planning Software: Helps businesses optimize their tax liabilities, providing insights and tools for effective tax planning.

- VAT Fraud Detection: Includes features to detect and prevent VAT fraud, ensuring the integrity of the business’s financial transactions.

- ZATCA Penalty Avoidance System: Helps businesses avoid penalties by ensuring timely and accurate VAT filings.

- Saudi Business Financial Compliance: Supports comprehensive financial compliance, integrating tax management with overall business operations.

Summary of ALZERP’s VAT Return System:

- Accuracy and Efficiency: Automatically calculates VAT amounts based on the entered data, reducing errors and saving time.

- Compliance: Ensures adherence to ZATCA regulations by providing a structured format for VAT returns.

- Data Validation: Validates input data to prevent inconsistencies and errors.

- Historical Records: Maintains a record of previous VAT returns for easy reference and analysis.

- Integration with Other Modules: Seamlessly integrates with other modules within ALZERP, such as sales, purchases, and inventory, for a comprehensive view of business operations.

Additional Features:

- Customization: Allows for customization of the VAT Return form to meet specific business requirements.

- Reporting: Generates various reports related to VAT returns, such as VAT summaries and analysis.

- Integration with ZATCA: Facilitates seamless integration with ZATCA for electronic submission of VAT returns.

Conclusion #

The tax return system in ALZERP Cloud ERP Software provides a robust and comprehensive solution for managing VAT and tax obligations. By automating calculations, synchronizing data, and ensuring compliance with ZATCA requirements, ALZERP helps businesses navigate the complexities of tax management with confidence. Whether you are a small business or a large enterprise, ALZERP offers the tools needed to streamline your tax processes, ensuring accuracy, compliance, and efficiency in your operations.

ALZERP’s VAT Return system is a valuable tool for businesses operating in Saudi Arabia. It streamlines the VAT return process, ensures compliance with ZATCA regulations, and provides accurate calculations. By leveraging this feature, businesses can efficiently manage their tax obligations and maintain financial integrity.

Sign up for your free lifetime account of Cloud ERP Software and start transforming your business today!

– Create an account now –

Post by @alz_erpView on Threads

ZATCA VAT & Tax Return System in ALZERP Cloud ERP Software#zatca #VATManagement #SaudiTax #ZakatSoftware #TaxCompliance #ERPZATCA #eInvoicing #VATreporting #ZakatCalculator #TaxAutomation #taxreturnhttps://t.co/BYWZTjmRWu pic.twitter.com/OwYhJ3qlY5

— Alwajeez Technology (@AlwajeezTech) August 31, 2024