Managing VAT-paid expenses is a crucial aspect of maintaining tax compliance and ensuring accurate financial reporting, especially for businesses operating in Saudi Arabia. ALZERP Cloud ERP Software offers a comprehensive solution for recording, tracking, and reporting VAT-paid expenses, fully compliant with the guidelines set by the Zakat, Tax, and Customs Authority (ZATCA).

ALZERP is a leading cloud-based ERP software designed to streamline business operations and ensure compliance with Saudi Arabian tax regulations. Its VAT Paid Expenses feature offers a robust solution for efficiently managing and tracking VAT-related expenses.

Key Features of VAT Paid Expenses in ALZERP #

- Centralized Tracking: Maintain a comprehensive record of all VAT-paid expenses within a single platform.

- ZATKA Compliance: Ensure compliance with ZATKA regulations by accurately recording and reporting VAT-related data.

- Expense Categorization: Categorize expenses for better analysis and reporting.

- Document Uploads: Attach supporting tax invoices to each expense entry for verification.

- VAT Calculation: Automatically calculate VAT amounts based on expense values.

- Expense History: Access a detailed history of all VAT-paid expenses for auditing and reporting purposes.

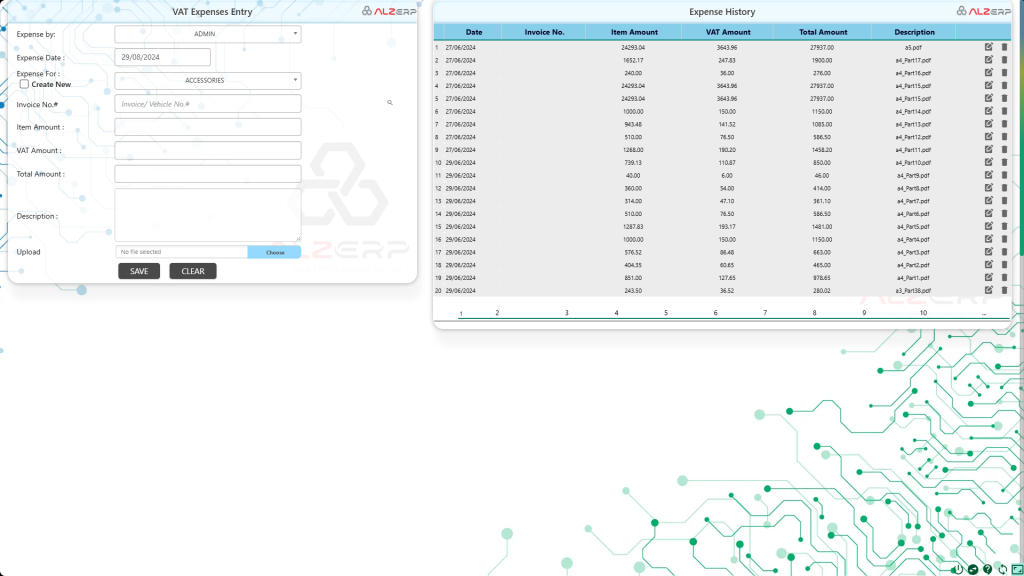

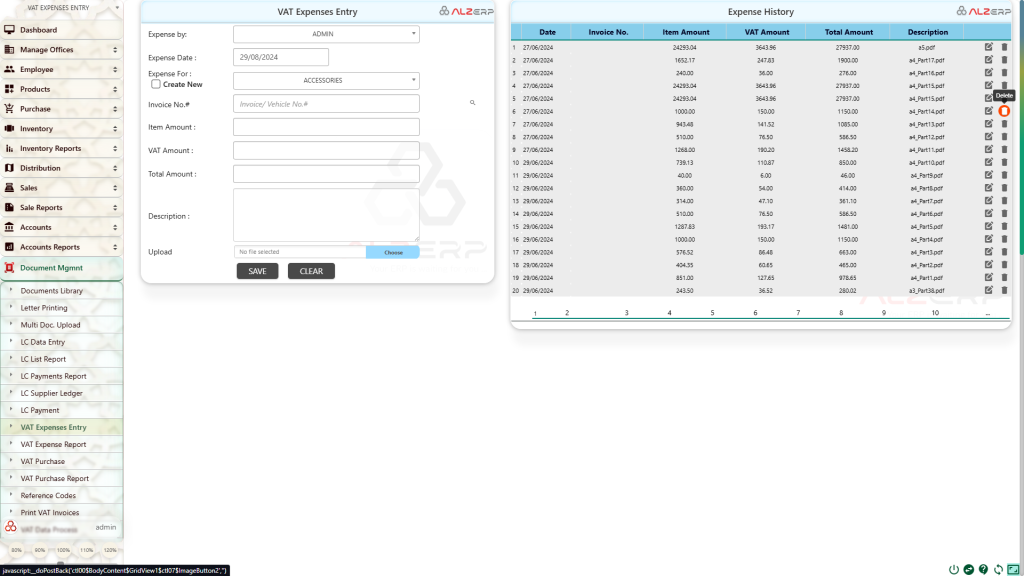

Streamlining VAT-Paid Expense Entry #

In ALZERP, businesses can easily enter their VAT-paid expenses through a dedicated form designed to handle a variety of B2B expenses that are VAT returnable. Common examples include expenses related to fuel or oil for vehicles, furniture purchases, and maintenance costs that include VAT.

The VAT Expenses Entry Form in ALZERP allows users to input detailed information about each expense, including:

- Expense by: The name of the individual or department responsible for the expense.

- Expense Date: The date on which the expense was incurred.

- Expense For: The purpose of the expense, with an option to create a new expense category if needed.

- Invoice/Vehicle No.: The invoice number or vehicle registration number associated with the expense.

- Item Amount: The amount before VAT.

- VAT Amount: The amount of VAT paid on the expense.

- Total Amount: The total amount, including VAT.

- Description: A brief description of the expense for easy identification and reference.

How to Use the VAT Paid Expenses Feature #

- Access the Module: Navigate to the VAT Paid Expenses module within ALZERP.

- Create New Entry: Input expense details, including date, purpose, invoice number, item amount, VAT amount, and total amount.

- Upload Invoice: Attach a scanned copy of the tax invoice as proof of VAT payment.

- Save and Review: Save the expense entry and review the expense history for a comprehensive overview.

Upload and Manage Tax Invoices #

To comply with ZATCA regulations, businesses must provide proof of VAT paid for each expense. ALZERP simplifies this process by allowing users to upload scanned images or PDF files of tax invoices directly into the system. These digital records are securely stored and can be retrieved at any time, ensuring that businesses are prepared for any audits or checks by VAT and tax authorities.

Comprehensive Expense History and Reporting #

ALZERP’s VAT Expenses Entry Form also includes a detailed history of all entered expenses. This history provides a quick overview of each transaction, including the date, invoice number, item amount, VAT amount, total amount, and associated description. Users can easily edit or delete records as needed, ensuring that the data remains accurate and up-to-date.

One of the standout features of ALZERP is the ability to merge and download all expense files at a later time. This feature is particularly useful during tax season or when preparing for audits, as it allows businesses to compile all relevant documents into a single, easily accessible file.

Key Benefits of ALZERP for VAT-Paid Expense Management #

- ZATCA-Compliant Software: ALZERP is fully compliant with ZATCA regulations, ensuring that all VAT-paid expenses are recorded and reported accurately.

- VAT Management: The software simplifies the process of managing VAT-paid expenses, from data entry to reporting.

- Zakat and Tax Automation: ALZERP automates many aspects of Zakat and tax management, reducing the risk of errors and ensuring timely compliance.

- Real-Time VAT Reporting: Businesses can track their VAT-paid expenses in real-time, ensuring that they always have up-to-date information at their fingertips.

- Secure Document Management: ALZERP’s secure document management system ensures that all tax invoices and related documents are safely stored and easily retrievable.

- VAT Return Automation: The software streamlines the process of preparing and submitting VAT returns, saving time and reducing the risk of penalties.

- Audit Preparedness: With ALZERP, businesses can quickly compile and present all necessary documentation during a tax audit, ensuring smooth and hassle-free compliance.

Summary of ALZERP for VAT Expenses #

- Enhanced Compliance: Ensure accurate VAT reporting and avoid penalties.

- Improved Efficiency: Streamline expense tracking and management.

- Centralized Data: Maintain a centralized repository of VAT-related documents.

- Data-Driven Decision Making: Analyze expense data to identify trends and optimize spending.

- Simplified Auditing: Easily access expense records for audits and verification.

ALZERP provides a user-friendly and efficient solution for managing VAT paid expenses in Saudi Arabia. By utilizing this feature, businesses can ensure compliance with ZATKA regulations, streamline their financial processes, and make informed decisions.

Conclusion #

ALZERP Cloud ERP Software offers a robust solution for managing VAT-paid expenses in Saudi Arabia. By providing an easy-to-use interface for entering, tracking, and reporting expenses, along with secure document management features, ALZERP helps businesses stay compliant with ZATCA regulations while optimizing their financial processes.

With ALZERP, managing VAT-paid expenses becomes a seamless part of your overall tax management strategy, ensuring that your business remains compliant, efficient, and well-prepared for any regulatory requirements.

Sign up for your free lifetime account of Cloud ERP Software and start transforming your business today!

– Create an account now –

Post by @alz_erpView on Threads

VAT Paid Expenses Posting in ALZERP Cloud ERP Softwarehttps://t.co/SlVRTuzUJk

— Alwajeez Technology (@AlwajeezTech) August 30, 2024