Managing and reporting VAT-related expenses is a crucial task for businesses operating in Saudi Arabia, where compliance with the Zakat, Tax, and Customs Authority (ZATCA) regulations is mandatory. The ALZERP Cloud ERP Software offers a powerful VAT Expense Report feature, providing businesses with the tools needed to accurately track, report, and manage their VAT-paid expenses, ensuring compliance and financial transparency.

ALZERP’s VAT Expense Report provides businesses in Saudi Arabia with a powerful tool to analyze and track VAT-related expenses. This comprehensive report offers detailed insights into expense history, enabling businesses to ensure compliance with ZATKA regulations and make informed financial decisions.

Key Features of the VAT Expense Report #

- Comprehensive Reporting: View a detailed history of all VAT-paid expenses within a specified date range.

- Advanced Filtering: Filter reports by company, branch, expenser, vendor, and expense date for targeted analysis.

- Customizable Output: Generate reports in PDF format with your company’s letterhead for professional presentation.

- ZATKA Compliance: Ensure compliance with ZATKA regulations by accurately tracking VAT-related expenses.

Detailed Analysis of VAT Expenses #

ALZERP’s VAT Expense Report feature is designed to give businesses a comprehensive overview of all VAT-paid expenses made within a specified period. This feature is particularly beneficial for tracking B2B expenses that are eligible for VAT returns. By offering detailed history analysis reports, ALZERP enables businesses to monitor and analyze their VAT expenses effectively, ensuring that all returnable amounts are accounted for.

Businesses can generate VAT Expense History Reports that cover specific date ranges, branches, and vendors, as well as the individual responsible for the expenses. This level of detail allows businesses to gain insights into their spending patterns, identify areas for cost optimization, and ensure that they remain compliant with ZATCA’s regulations.

Flexible VAT Expense History Search #

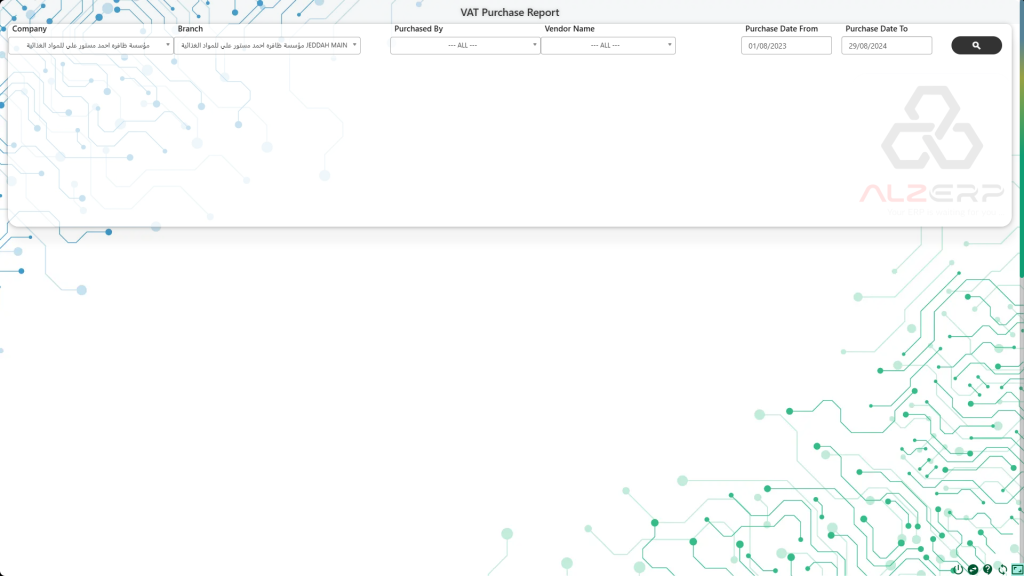

The VAT Expense History Searching Form in ALZERP offers a highly customizable interface that allows businesses to retrieve expense data based on various criteria:

- Company Branch: Filter expenses by the specific branch within the organization where the expense was incurred.

- Expensed By: Identify the individual or department responsible for the expenses, enabling accountability and better tracking.

- Vendor Name: Narrow down the search to expenses made with a particular vendor, which is useful for vendor analysis and management.

- Expense Date Range: Specify a start and end date to focus on expenses made within a particular period.

These search capabilities enable businesses to quickly locate specific expenses, facilitating efficient management and reporting of VAT-related transactions.

Professionally Designed VAT Expense Reports #

After conducting a search, ALZERP automatically generates a VAT Expense History Report that is professionally formatted with the company’s letterhead. This report is not only visually appealing but also ensures that all necessary information is clearly presented for official use.

The report is outputted as a PDF file, making it easy to share via email, WhatsApp, or print for submission to relevant authorities. The professional design of the report enhances its credibility, ensuring that businesses can confidently present their expense history to ZATCA or other stakeholders.

Compliance and Audit Preparedness #

ALZERP’s VAT Expense Report feature is fully compliant with ZATCA’s stringent regulations, making it an indispensable tool for businesses aiming to maintain accurate records of their VAT-paid expenses. In the event of an audit or inquiry from tax authorities, businesses can swiftly generate and submit these reports, thereby ensuring compliance and avoiding potential fines or penalties.

The ability to generate these reports on demand, with all relevant expense history included, provides businesses with peace of mind knowing that they are always prepared for any compliance checks or audits.

How to Generate the VAT Expense Report #

- Access the Report: Navigate to the VAT Expense Report module within ALZERP.

- Apply Filters: Select the desired criteria for your report, such as date range, company, branch, expenser, and vendor.

- Generate Report: Click the “Generate Report” button to produce the report in PDF format.

Components of the VAT Expense Report #

- Expense Date: The date of the expense.

- Expense For: The purpose or category of the expense.

- Vendor Name: The name of the vendor from whom the expense was incurred.

- Invoice Number: The unique identifier for the expense invoice.

- Item Amount: The total expense amount before VAT.

- VAT Amount: The amount of VAT paid on the expense.

- Total Amount: The total amount including VAT.

- Description: Additional details or notes about the expense.

Key Benefits of ALZERP’s VAT Expense Report Feature #

- ZATCA-Compliant Software: ALZERP ensures that all VAT-related reports are in full compliance with ZATCA’s regulatory standards.

- VAT Management: The software streamlines the management and reporting of VAT-paid expenses, ensuring that all returnable amounts are accurately tracked.

- Zakat and Tax Automation: ALZERP automates the preparation of VAT and Zakat-related reports, reducing the administrative burden on businesses.

- Real-Time VAT Reporting: Businesses can generate up-to-date VAT expense reports at any time, ensuring they have a clear view of their financial position.

- Secure Document Management: All expense documents are securely stored and can be retrieved easily, ensuring that businesses are always audit-ready.

- Audit Preparedness: ALZERP’s reporting feature ensures that businesses are fully prepared to respond to any inquiries from ZATCA, with all necessary documents and reports readily available.

- Customizable Reports: Reports can be tailored to specific business needs, whether by branch, vendor, purchaser, or date range.

- Professional Presentation: Reports are automatically formatted with the company’s letterhead, making them ready for official submission or presentation.

- Integration with Other Tax Management Tools: ALZERP’s VAT Expense Report feature integrates seamlessly with other tax management tools, including those for Zakat calculation, tax filing, and compliance management.

- Enhanced Financial Transparency: By providing detailed and accurate expense reports, ALZERP enhances the overall financial transparency of the business, which is crucial for both internal and external stakeholders.

Summary of the ALZERP VAT Expense Report #

- Enhanced Compliance: Ensure compliance with ZATKA regulations by accurately tracking VAT-related expenses.

- Improved Efficiency: Streamline VAT reporting and analysis processes.

- Data-Driven Decision Making: Gain valuable insights into expense trends and identify areas for optimization.

- Simplified Auditing: Easily access expense data for audits and verification.

ALZERP’s VAT Expense Report is an essential tool for businesses in Saudi Arabia seeking to optimize their financial operations and ensure compliance with ZATKA regulations. By utilizing this report, businesses can make informed decisions, improve efficiency, and mitigate risks associated with VAT-related matters.

Conclusion #

Managing VAT-paid expenses is a critical component of financial management for businesses in Saudi Arabia. ALZERP Cloud ERP Software provides a comprehensive solution for tracking, reporting, and managing these expenses, ensuring that businesses remain compliant with ZATCA’s regulations.

With its powerful VAT Expense Report feature, ALZERP allows businesses to generate detailed, professionally formatted reports that are essential for tax filing, audit preparedness, and financial transparency. By leveraging ALZERP’s capabilities, businesses can enhance their financial management processes, ensuring accuracy, compliance, and readiness in all VAT-related matters.