The Employee Monthly Salary Process feature in ALZERP Cloud ERP software allows businesses to efficiently calculate and prepare monthly salary sheets based on attendance and salary information. This feature ensures accurate salary computation, taking into account attendance data and any additional notes for deductions or additions.

The Employee Monthly Salary Process feature in ALZERP is designed to calculate and generate salary payments for employees based on their attendance, salary information, and other relevant factors. This module is the core of payroll processing within the ERP system.

Key Features #

- Month and Year Selection: Specify the month and year for which salaries are being processed.

- Employee List: Displays a list of employees along with their ID, name, designation, and basic salary.

- Payable Amount: Calculates the net amount payable to each employee based on attendance, deductions, and other factors.

- Notes: Allows for adding comments or explanations for salary adjustments.

- Salary Generation Date: Records the date when the salary process was initiated.

- Submit/Post Data: Finalizes the salary calculation and prepares data for payroll processing or payment generation.

Form Contents: #

- Month Name:

- Purpose: Select the month for which the salary is being processed.

- Options: January to December

- Year Name:

- Purpose: Select the year for which the salary is being processed.

- Show Employee List:

- Purpose: Display the list of employees whose salaries will be processed for the selected month and year.

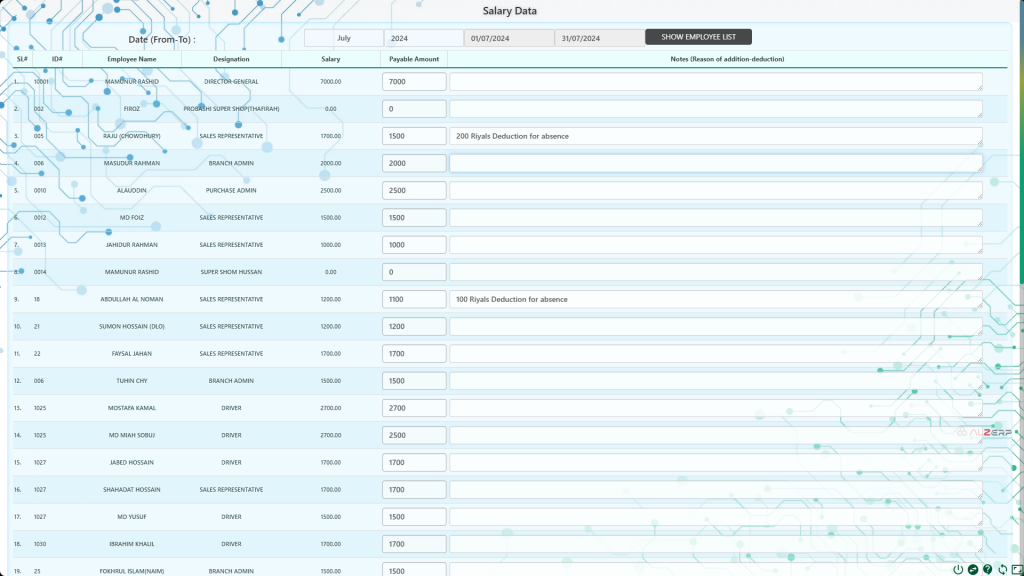

Salary Process Editable Data Table: #

This table lists the employees along with their salary details. The data in this table can be edited before finalizing the salary sheet. It includes the following columns:

- SL#:

- Serial number of the entry.

- ID#:

- Unique identifier for each employee.

- Employee Name:

- Name of the employee.

- Example: HARUN AR RASHID

- Designation:

- Designation of the employee.

- Example: PURCHASE ADMIN

- Salary:

- The base salary amount for the employee.

- Example: 7000.00

- Payable Amount:

- The actual amount to be paid to the employee after considering any additions or deductions.

- Example: (Editable)

- Notes (Reason of addition-deduction):

- Any notes explaining reasons for additions or deductions from the salary.

- Example: (Editable)

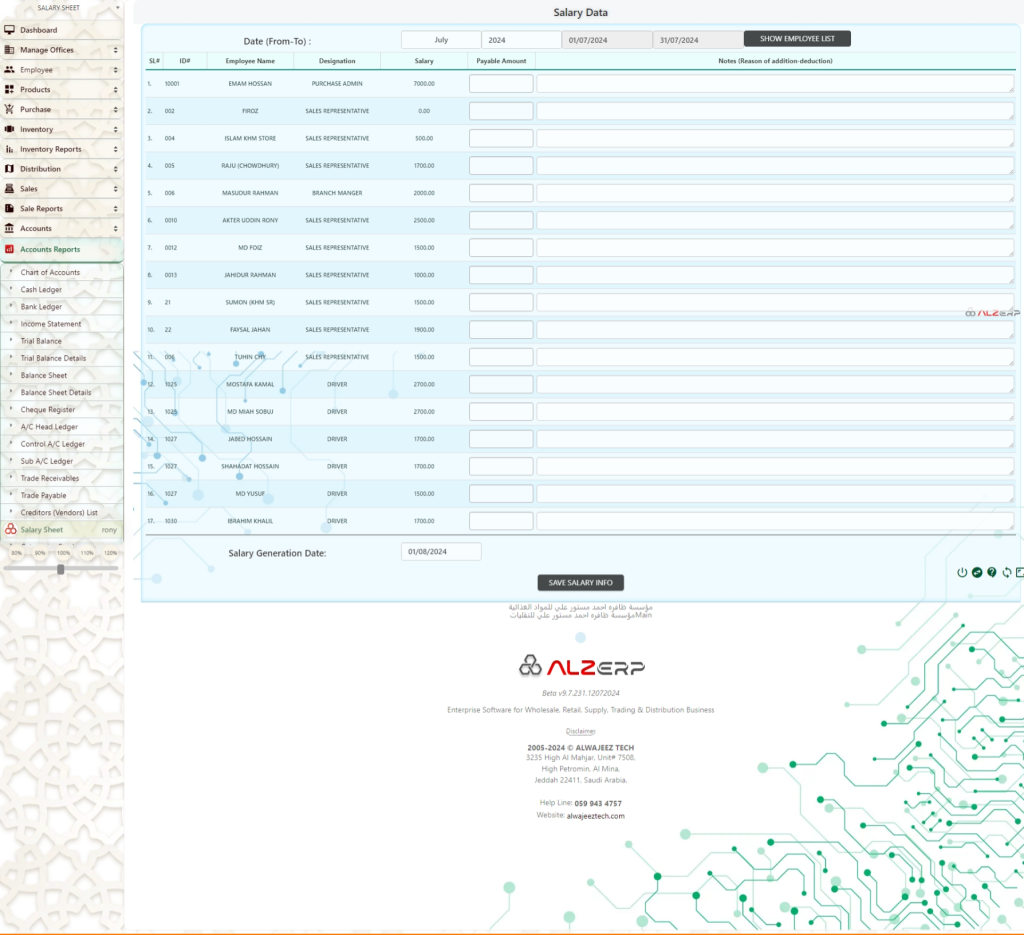

Salary Generation Date: #

- Purpose: The date on which the salary data is generated.

- Example: 01/08/2024

Submit/Post Data: #

- Purpose: Finalize and submit the salary data for processing and payment.

Benefits of the Employee Monthly Salary Process Feature: #

- Accurate Salary Calculation:

- Ensures precise computation of salaries based on attendance records and any adjustments, reducing errors and discrepancies.

- Efficient Payroll Management:

- Streamlines the payroll process, saving time and improving efficiency in salary preparation.

- Enhanced Transparency:

- Provides a clear breakdown of salary components, including base salary, adjustments, and final payable amounts.

- Customizable Adjustments:

- Allows for easy input of additions or deductions with notes explaining the reasons, ensuring transparency and accountability.

- Comprehensive Reporting:

- Facilitates the generation of detailed payroll reports, aiding in financial planning and analysis.

- Integration with Attendance Data:

- Seamlessly integrates attendance data to ensure that salary calculations are based on actual working days.

How it Works #

- Data Input: Select the month and year for which salaries are to be processed.

- Employee Data: The system retrieves employee information, including basic salary and attendance data.

- Salary Calculation: The system calculates the payable amount for each employee based on attendance, deductions, bonuses, and other factors.

- Data Review: Review the calculated salaries and make any necessary adjustments.

- Salary Generation: Submit the processed salary data for further processing, such as generating payslips or transferring funds.

Benefits #

- Accurate Salary Calculation: Ensures correct salary payments based on attendance, deductions, and other factors.

- Time Efficiency: Streamlines the payroll process by automating calculations.

- Improved Compliance: Helps maintain compliance with labor laws and tax regulations.

- Data-Driven Decision Making: Provides salary data for analysis and reporting.

Potential Additional Features #

While the provided information outlines core functionalities, ALZERP offer additional features such as:

- Deduction Management: Define and apply various deductions (e.g., taxes, loans, insurance) to employee salaries.

- Bonus and Incentives: Include additional payments or bonuses in salary calculations.

- Overtime Calculation: Integrate overtime hours from attendance data and calculate overtime pay.

- Payslip Generation: Automatically generate payslips for employees.

- Salary Advance: Manage salary advances and deductions.

- Payroll Export: Export salary data to a payroll system or generate payment files.

By effectively managing employee salaries, ALZERP can contribute to accurate and timely payroll processing, improving employee satisfaction and financial management.