Efficient Management of VAT-Paid Purchases in ALZERP Cloud ERP Software

ALZERP is a leading cloud-based ERP software designed to streamline business operations and ensure compliance with Saudi Arabian tax regulations. Its Other Purchases (VAT Paid) feature offers a robust solution for efficiently managing and tracking VAT-related purchases.

In the complex landscape of tax compliance in Saudi Arabia, managing VAT-paid purchases is a crucial task for businesses. ALZERP Cloud ERP Software offers a comprehensive solution to streamline the process of recording, tracking, and reporting VAT-paid purchases, ensuring compliance with the Zakat, Tax, and Customs Authority (ZATCA) regulations.

Key Features of Other Purchases (VAT Paid) in ALZERP #

- Centralized Tracking: Maintain a comprehensive record of all VAT-paid purchases within a single platform.

- ZATKA Compliance: Ensure compliance with ZATKA regulations by accurately recording and reporting VAT-related data.

- Vendor Management: Manage vendor information and track purchase history.

- Document Uploads: Attach supporting tax invoices to each purchase entry for verification.

- VAT Calculation: Automatically calculate VAT amounts based on purchase values.

- Purchase History: Access a detailed history of all VAT-paid purchases for auditing and reporting purposes.

Streamlining VAT-Paid Purchase Entry #

ALZERP’s VAT-Paid Purchases feature is designed to simplify the entry of B2B purchases that are eligible for VAT returns. This includes a wide range of business expenses such as fuel or oil for vehicles, furniture, maintenance purchases, and any other items that include VAT.

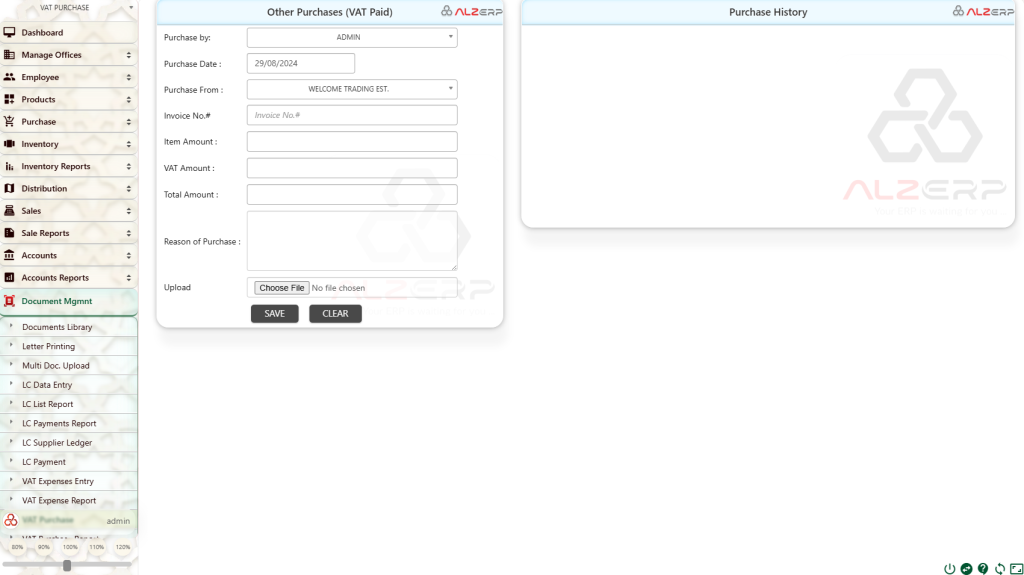

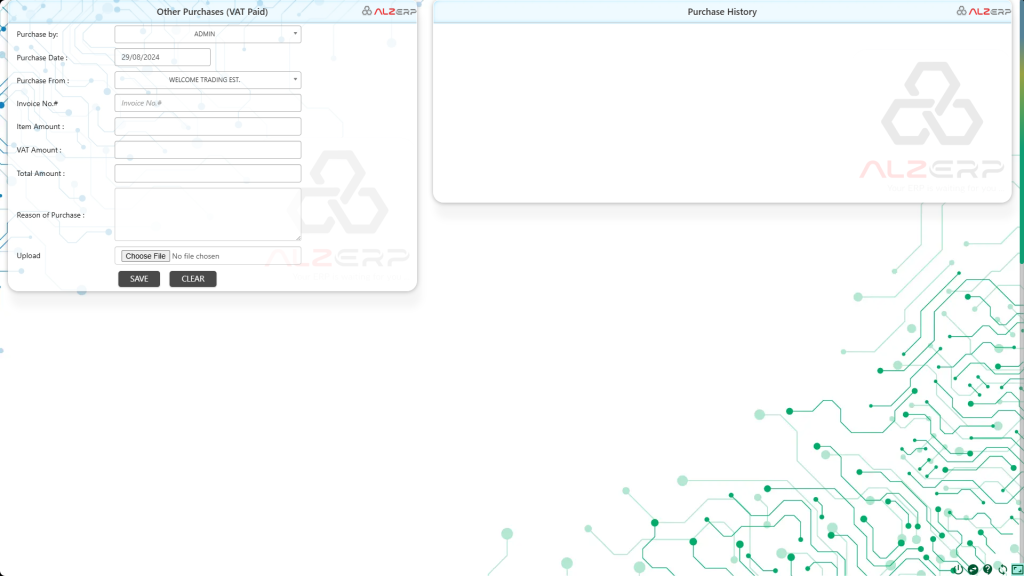

The VAT Purchases Entry Form in ALZERP provides a user-friendly interface for recording all relevant details:

- Purchase by: The name of the individual or department responsible for the purchase.

- Purchase Date: The date when the purchase was made.

- Purchase For: The purpose of the purchase, with an option to create a new category if the existing ones do not suffice.

- Purchase From: The vendor or supplier from whom the purchase was made.

- Invoice No.: The invoice number associated with the purchase.

- Item Amount: The total amount of the purchased item(s) before VAT.

- VAT Amount: The VAT charged on the purchase.

- Total Amount: The total amount including VAT.

- Reason of Purchase: A brief explanation or purpose of the purchase.

- Upload: An option to upload scanned images or PDF files of the tax invoice, providing proof of VAT payment.

Secure and Accessible Documentation #

One of the key features of ALZERP is its robust document management capability. Businesses can securely upload and store digital copies of tax invoices directly in the system. These documents serve as proof of VAT payments and are essential for compliance with ZATCA regulations. The ability to upload these files ensures that all documentation is centralized, easily retrievable, and ready for any potential audit by tax authorities.

Comprehensive Purchase History and Reporting #

The VAT Purchases Entry Form is integrated with a detailed Purchase History module. This feature allows users to view and manage a complete record of all VAT-paid purchases. The history includes:

- Date of Purchase: The specific date when the transaction occurred.

- Invoice Number: The unique identifier for each transaction.

- Item Amount: The amount spent on the item before VAT.

- VAT Amount: The VAT component of the purchase.

- Total Amount: The total expenditure, including VAT.

- Description: Additional details or notes about the purchase.

This historical data is not just for record-keeping; it provides valuable insights for financial reporting and tax filing purposes. Users can easily edit or delete records if necessary, ensuring that all information remains accurate and up-to-date.

Merging and Downloading Purchase Files #

ALZERP goes beyond simple data entry by offering the ability to merge multiple purchase files into a single document. This feature is particularly useful for businesses during tax season or when responding to audit requests from ZATCA. The ability to compile all relevant purchase documents into a single, downloadable file simplifies the audit process and ensures that businesses are always prepared.

How to Use the Other Purchases (VAT Paid) Feature #

- Access the Module: Navigate to the Other Purchases (VAT Paid) module within ALZERP.

- Create New Entry: Input purchase details, including date, vendor, invoice number, item amount, VAT amount, and total amount.

- Upload Invoice: Attach a scanned copy of the tax invoice as proof of VAT payment.

- Save and Review: Save the purchase entry and review the purchase history for a comprehensive overview.

Key Benefits of ALZERP for VAT-Paid Purchase Management #

- ZATCA-Compliant Software: ALZERP ensures that all VAT-paid purchases are recorded and reported in line with ZATCA’s stringent regulations.

- VAT Management: The software provides a streamlined approach to managing VAT-related purchases, from entry to reporting.

- Zakat and Tax Automation: ALZERP automates many aspects of tax management, reducing the risk of errors and ensuring timely compliance.

- Real-Time VAT Reporting: Businesses can monitor their VAT-paid purchases in real-time, ensuring accurate and up-to-date financial records.

- Secure Document Management: ALZERP’s secure document storage guarantees that all tax invoices and related documents are safely stored and easily accessible.

- VAT Return Automation: The software simplifies the process of preparing and submitting VAT returns, making tax compliance less time-consuming.

- Audit Preparedness: ALZERP enables businesses to quickly compile and present all necessary documentation during a tax audit, ensuring smooth compliance.

Summary of ALZERP for Other Purchases (VAT Paid) #

- Enhanced Compliance: Ensure accurate VAT reporting and avoid penalties.

- Improved Efficiency: Streamline purchase tracking and management.

- Centralized Data: Maintain a centralized repository of VAT-related documents.

- Data-Driven Decision Making: Analyze purchase data to identify trends and optimize spending.

- Simplified Auditing: Easily access purchase records for audits and verification.

ALZERP provides a user-friendly and efficient solution for managing other purchases (VAT Paid) in Saudi Arabia. By utilizing this feature, businesses can streamline their financial processes, ensure compliance with ZATKA regulations, and make informed decisions.

Conclusion #

Managing VAT-paid purchases is a critical component of tax compliance in Saudi Arabia, and ALZERP Cloud ERP Software provides an effective solution to handle this task. By offering a seamless interface for entering, tracking, and reporting VAT-paid purchases, along with robust document management capabilities, ALZERP ensures that businesses remain compliant with ZATCA regulations while optimizing their financial operations.

With ALZERP, businesses can confidently manage their VAT-paid purchases, ensuring that they are always prepared for tax filing and audits, ultimately contributing to better financial management and compliance.