In the intricate world of import and export, managing Letter of Credit (LC) payments is a vital task, especially for companies operating under stringent tax regulations. ALZERP Cloud ERP Software offers a dedicated LC Payment Entry tool designed specifically for VAT and tax management. This tool is essential for businesses that need to maintain accurate records of their LC payments while ensuring full compliance with Zakat, Tax, and Customs Authority (ZATCA) regulations in Saudi Arabia.

ALZERP understands the complexities of LC payments and their impact on VAT and tax management in Saudi Arabia. Our dedicated LC Payment Entry feature simplifies the process, ensuring compliance with ZATCA regulations while maintaining accurate financial records.

Key Features of LC Payment Entry in ALZERP #

- Separate Tracking: LC payments are tracked separately from core accounting transactions to accurately account for VAT and tax implications.

- Detailed Recording: Capture essential payment information, including date, type, bank details, vendor information, and payment notes.

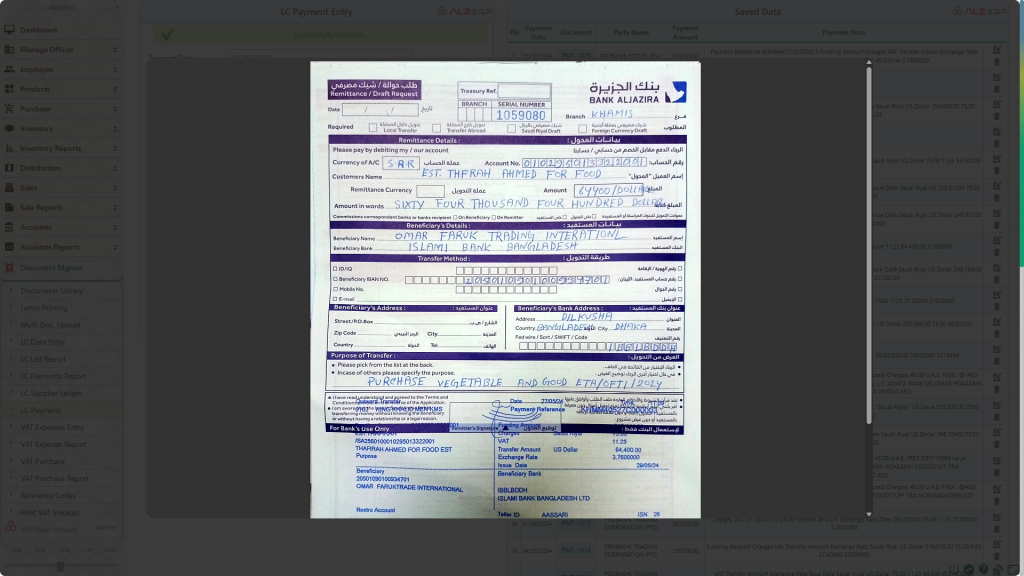

- Document Uploads: Attach supporting documents, such as bank receipts, for verification and audit purposes.

- Currency Conversion: Automatically convert currencies based on the specified exchange rate.

- ZATCA Compliance: Ensure compliance with ZATCA regulations by accurately recording LC payments and associated VAT amounts.

Importance of Separate LC Payment Management for VAT and Tax Compliance #

In ALZERP, the LC Payment Entry feature under VAT and Tax Management operates independently from the core accounting system. This separation is crucial because it allows businesses to manage LC payments specifically for tax purposes without affecting their overall financial accounts. The primary reason for this distinct process is the difference between the actual vendor LC amount and the customs-declared LC amount. By keeping these records separate, businesses can maintain a clear distinction between financial transactions and tax management, ensuring both accuracy and compliance.

The LC Payment Entry tool is a significant part of ALZERP’s tax management system, as it provides a structured way to record and manage LC payments. This feature is particularly useful for companies that need to provide detailed payment data during tax audits or when complying with ZATCA’s stringent reporting requirements.

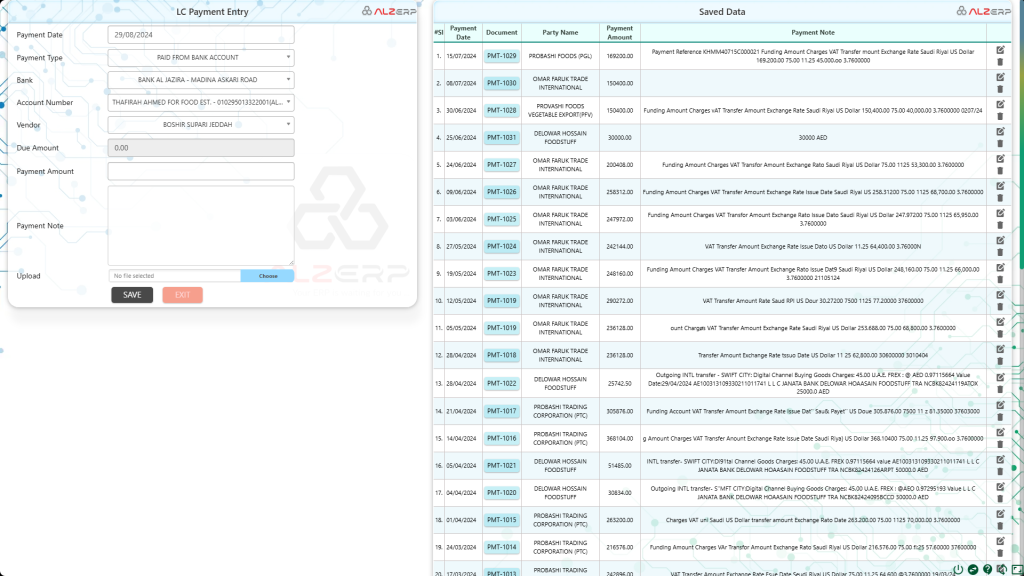

Detailed LC Payment Entry Form #

The LC Payment Entry form in ALZERP is designed to capture every detail related to LC payments. Here’s a breakdown of the essential components of this form:

- Payment Date: This field records the date on which the LC payment was made, which is crucial for tracking and reporting purposes.

- Payment Type: This section allows users to specify the type of payment, such as Telegraphic Transfer (TT), transfer from a bank account, or direct deposit. This flexibility ensures that all types of LC payments are accurately documented.

- Bank Name and Account Number: Users can select the bank and account number from which the payment was made, ensuring that the correct financial records are associated with each transaction.

- Vendor: This field records the name of the beneficiary company, which is essential for tracking payments to specific vendors and ensuring compliance with contractual obligations.

- Due Amount and Payment Amount: The due amount field tracks the previous credited amount, while the payment amount field records the deposit amount in local currency. This ensures that all financial data is accurately captured and reported.

- Payment Note: This section allows users to add detailed remarks, such as the USD amount, receiver currency, and received amount. These notes provide additional context to the payment, making it easier to understand the transaction details.

- Document Upload: Users can upload receipt files received from the bank, ensuring that all relevant documentation is stored and easily accessible for future reference or audits.

Efficient Management of LC Payment Records #

One of the key advantages of ALZERP’s LC Payment Entry tool is its ability to manage LC payment records separately from the core accounting system. While the bookkeeping module in ALZERP affects actual financial transactions, the LC Payment Entry under VAT and tax management focuses solely on tax-related records. This approach allows businesses to maintain accurate and compliant financial records without disrupting their core accounting processes.

Moreover, the tool allows businesses to store and manage all relevant payment data, including deposit dates, USD amounts, local currency amounts, and beneficiary bank information. By keeping these records well-organized and easily accessible, businesses can quickly respond to any inquiries from tax authorities or during audits.

Ready for Tax Audits and Compliance Checks #

ALZERP’s LC Payment Entry tool ensures that businesses are fully prepared for tax audits or compliance checks. All payment records and associated documents can be retrieved and printed for submission to tax authorities. This capability is particularly valuable in ensuring that businesses can demonstrate their compliance with ZATCA’s requirements and avoid potential penalties.

By using ALZERP’s LC Payment Entry feature, businesses can efficiently manage their VAT and tax obligations related to LC payments, ensuring that all transactions are accurately recorded and fully compliant with Saudi tax regulations.

Key Benefits of ALZERP’s LC Payment Entry for VAT and Tax Management #

- ZATCA-Compliant Software: ALZERP ensures that all LC payment transactions are managed in full compliance with ZATCA’s regulations.

- Accurate VAT Management: The software provides detailed tracking and reporting of VAT on LC payments, ensuring that businesses can accurately report their VAT obligations.

- Zakat Calculation Software: ALZERP supports comprehensive zakat calculation, including all relevant data from LC payments.

- Tax Management System: The LC Payment Entry tool is part of ALZERP’s broader tax management system, which streamlines tax reporting and compliance.

- ZATCA e-Invoicing Solution: ALZERP’s integration with ZATCA’s e-invoicing system ensures that all invoices related to LC payments are compliant with Saudi regulations.

- Real-Time VAT Reporting: Businesses can generate real-time reports on VAT and LC payments, ensuring they always have up-to-date financial data.

- Automated Tax Compliance: ALZERP automates various aspects of tax compliance, reducing the administrative burden on businesses.

- Secure Document Management: All LC-related payment documents are securely stored within the system, ensuring they are readily available for audits or compliance checks.

- Seamless Integration: The LC Payment Entry tool integrates with other modules within ALZERP, providing a comprehensive solution for tax and VAT management.

- Audit Preparedness: ALZERP’s robust reporting and document management features ensure that businesses are always ready for tax audits or inquiries.

Summary of Using ALZERP for LC Payment Entry #

- Simplified Process: Streamline LC payment management and reduce manual errors.

- Enhanced Accuracy: Ensure accurate VAT and tax calculations for LC payments.

- Improved Compliance: Maintain compliance with ZATCA regulations.

- Centralized Records: Store all LC payment data in one place for easy access and reference.

- Time-Saving: Automate routine tasks and reduce the time spent on LC payment management.

ALZERP provides a comprehensive solution for LC payment entry, helping businesses in Saudi Arabia streamline their financial operations and ensure compliance with VAT and tax regulations.

Conclusion #

Managing LC payments is a complex but essential aspect of VAT and tax management for importers and wholesale distributors. ALZERP Cloud ERP Software offers a specialized LC Payment Entry tool that simplifies this process, ensuring that all LC-related transactions are accurately recorded and compliant with ZATCA regulations. By leveraging this tool, businesses can maintain precise financial records, streamline their VAT and tax reporting, and be fully prepared for any tax audits or compliance checks.

With ALZERP, businesses can confidently manage their LC payments, knowing that they have a reliable, ZATCA-approved solution that supports their compliance and financial management needs.