The Income Statement Report, also referred to as the Profit and Loss (P&L) Report or the Statement of Comprehensive Income, is a crucial component of financial reporting within the ALZERP Cloud ERP software. This report offers a detailed account of a company’s financial performance over a specified period, outlining its revenue, expenses, gains, and losses. Within ALZERP, the Income Statement Report is available in two formats: Summarized Statement of Comprehensive Income and Detailed Statement of Comprehensive Income.

ALZERP’s Income Statement Report, provides a comprehensive overview of a company’s financial performance over a specific period. This report is essential for evaluating profitability, making informed business decisions, and complying with financial reporting standards.

Key Features of the Income Statement Report #

- Date Range Flexibility: Generate reports for specific periods (e.g., monthly, quarterly, annually).

- Report Types: Choose between Summarized and Detailed views for different levels of analysis.

- Account Hierarchy: Reflects the chart of accounts structure for accurate reporting.

- Revenue and Expense Breakdown: Displays detailed information about income and expenses.

- Profitability Metrics: Calculates key performance indicators (KPIs) such as gross profit, operating profit, and net profit.

Types of Income Statements in ALZERP #

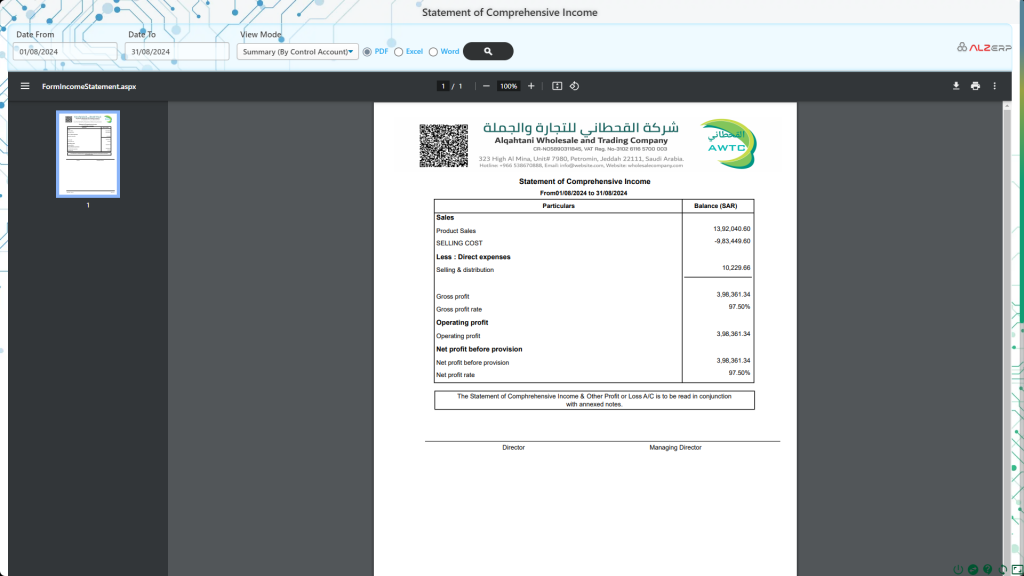

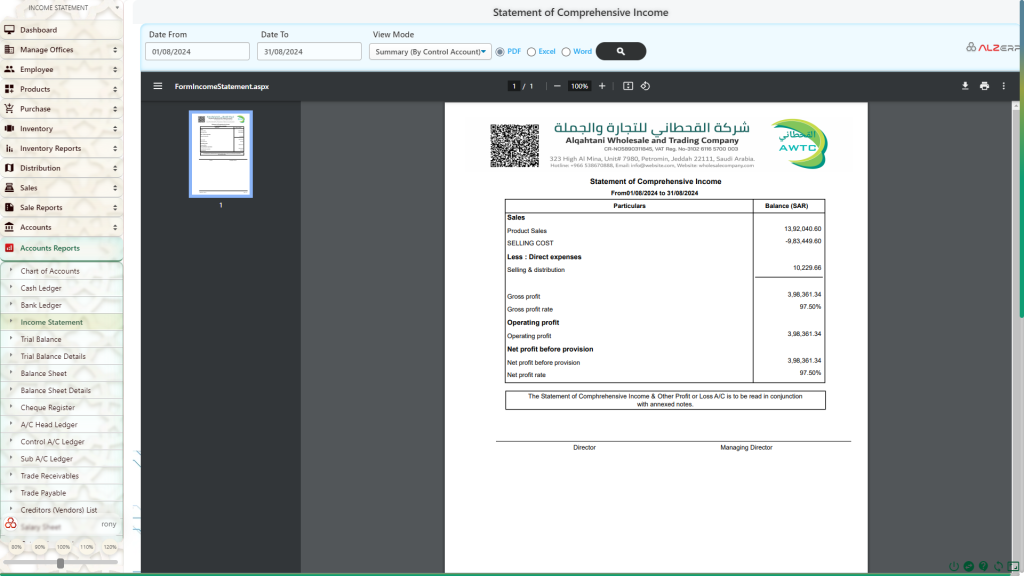

- Summarized Statement of Comprehensive Income:

- This format provides a high-level overview, summarizing the balances of the Control Account Heads.

- It is ideal for quick insights into overall financial performance without delving into granular details.

- Detailed Statement of Comprehensive Income:

- This report breaks down financial data to the 4th level Account Heads.

- It offers a comprehensive view, enabling in-depth analysis of each financial transaction.

Navigating the Search Form to Generate Income Statements #

The search form in ALZERP allows users to customize their report parameters, ensuring the output meets specific requirements. Here’s how to use the search form:

- Transaction Date From/To: Define the period for which the report should be generated.

- View Mode: Choose between ‘Summarized’ or ‘Detailed’ based on the depth of information needed.

- Output Format: Select your preferred output format—PDF, Excel, or Word.

Once you have set your preferences, clicking the button with the magnifying glass icon will generate the report. The PDF format offers a beautifully formatted document complete with the company’s letterhead, which can be easily shared via email, WhatsApp, or printed for hard copies.

What is an Income Statement? #

An income statement is a financial report that provides a summary of a company’s financial performance over a specific accounting period. It details the revenue, expenses, gains, and losses that a company incurs, starting with revenue and ending with net income. This statement is also known as the profit and loss (P&L) statement or the statement of revenue and expense.

The income statement is one of the three critical financial statements used by businesses, the others being the balance sheet and the cash flow statement. Each of these statements provides different insights into a company’s financial health. While the balance sheet offers a snapshot of financials at a particular point in time, the income statement focuses on performance over a period.

Comprehensive Income #

Comprehensive income reflects the variation in a company’s net assets from non-owner sources during a specific period. It includes net income and unrealized gains or losses, such as those from hedge/derivative financial instruments or foreign currency transactions. This concept extends beyond the traditional income statement to provide a fuller picture of a company’s financial performance.

Key aspects of comprehensive income include:

- Adjustments in the prices of securities held for sale.

- Changes in foreign currency exchange rates.

- Adjustments to pension liabilities.

These elements of comprehensive income are often detailed in the footnotes of financial statements or presented in a separate statement.

Structure and Components of an Income Statement #

An income statement in ALZERP can be presented in a single-step or multi-step format, depending on the complexity of the business operations and regulatory requirements.

- Operating Revenue: Revenue from the company’s core business activities, such as the sale of products or services.

- Non-Operating Revenue: Earnings from secondary activities, like interest income or rental income.

- Gains: Net money made from activities like selling long-term assets.

- Primary-Activity Expenses: Costs incurred in the primary operations, including employee wages, utilities, and R&D expenses.

- Secondary-Activity Expenses: Costs related to non-core activities, such as interest on loans.

- Losses: Expenses due to loss-making sales or one-time costs like lawsuit settlements.

Income Statement Calculation and Example #

The net income on an income statement is calculated as:

Net Income = (Revenue + Gains) – (Expenses + Losses)

For example, a sports merchandise company could report:

- Revenue: $30,800 (including sales and training services)

- Expenses: $10,650 (procurement costs, rent, wages)

- Gains: $2,000 (sale of an old van)

- Losses: $800 (settling a consumer dispute)

This would result in a net income of $21,350 for the quarter.

Single-Step vs. Multi-Step Income Statements #

- Single-Step Income Statement: Simplified format with a straightforward calculation summing up revenue and gains and subtracting expenses and losses.

- Multi-Step Income Statement: More complex, used by larger corporations. It reports profitability at multiple levels—gross, operating, pretax, and after-tax—providing a detailed analysis of financial performance.

Practical Use of Income Statements #

Income statements serve various purposes for different stakeholders:

- Investors: Assess profitability and compare business performance across sectors.

- Management: Analyze core and non-core revenue streams, expenses, and make informed decisions about expansion, cost-cutting, or capital investments.

- Creditors: Evaluate a company’s ability to generate cash flows and manage debt, based on year-on-year and quarter-on-quarter performance comparisons.

Conclusion #

The Income Statement Report in ALZERP Cloud ERP Software is a powerful tool for businesses to monitor and evaluate their financial performance. Whether using the summarized or detailed format, this report offers essential insights that can guide strategic decisions and ensure the company’s financial health.

Sign up for your free lifetime account of Cloud ERP Software and start transforming your business today!

– Create an account now –