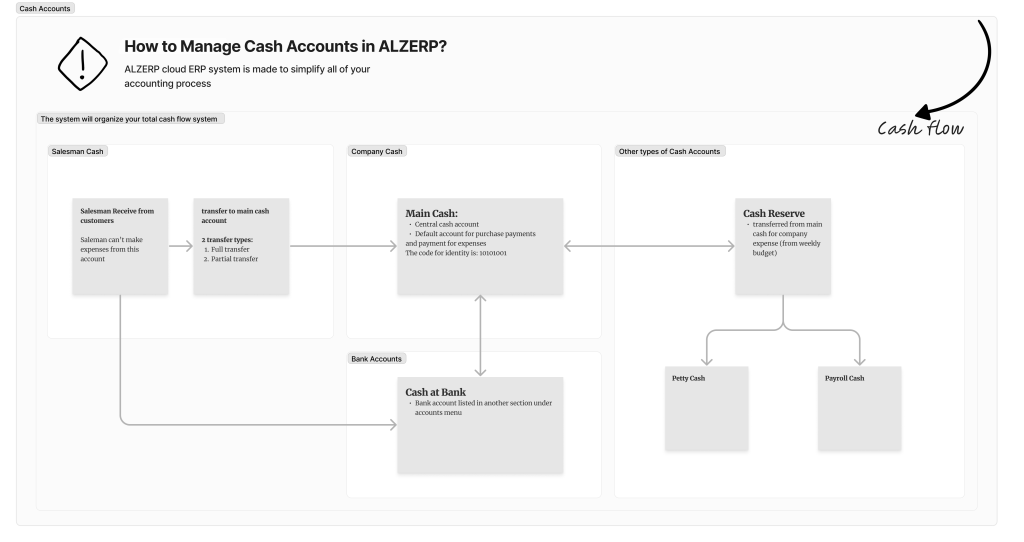

ALZERP’s Cash Transfer Form is a critical component of the software designed to streamline and secure the movement of cash within an organization. Primarily used to transfer cash from individual sales representatives’ accounts to the main company account, this feature plays a pivotal role in financial management and control.

By mandating that sales representatives transfer their cash holdings at regular intervals (daily, weekly, or monthly), the system ensures that cash is accounted for, reduces the risk of loss or misuse, and maintains accurate financial records.

Key functionalities of the Cash Transfer System:

Integration with Other Modules: Seamlessly interacts with other financial modules within ALZERP for holistic financial management.

Clear and Efficient Interface: The form presents a user-friendly layout for easy data input and navigation.

Account Selection: Allows users to specify the source (salesperson’s account) and destination (main company account) for the cash transfer.

Amount Transfer: Facilitates the input of the exact cash amount being transferred.

Transaction Recording: Automatically records the transfer details, including date, time, and involved accounts.

Audit Trail: Maintains a comprehensive history of all cash transfers for reference and compliance purposes.

The Cash Transfer Form in ALZERP Cloud ERP software is designed to facilitate and manage the movement of cash between different accounts within an organization, particularly from individual salesman cash accounts to a company branch account. This form ensures that cash handling is secure, tracked, and systematically recorded, providing a clear audit trail of all transactions.

Cash Transfer Form Features: #

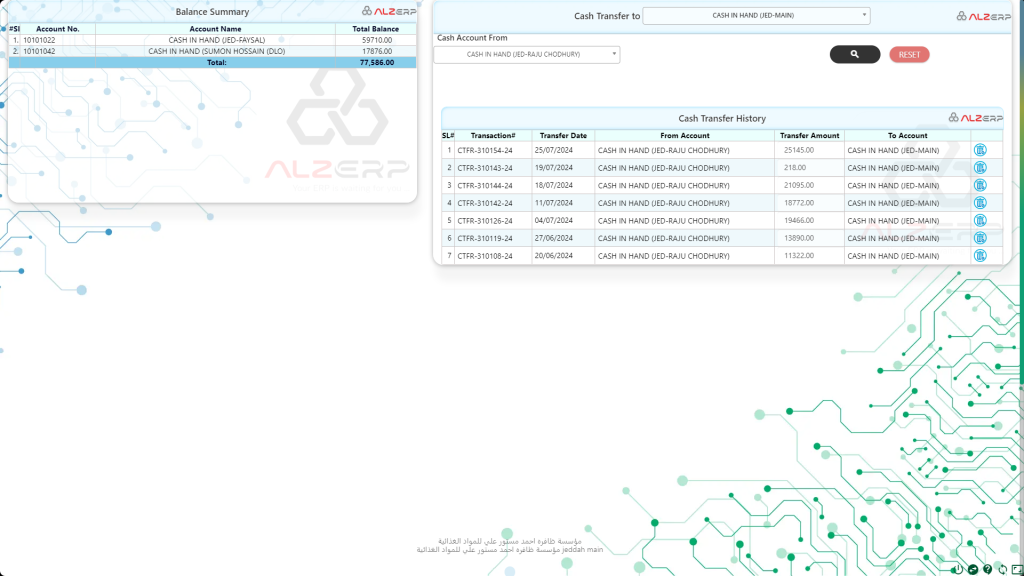

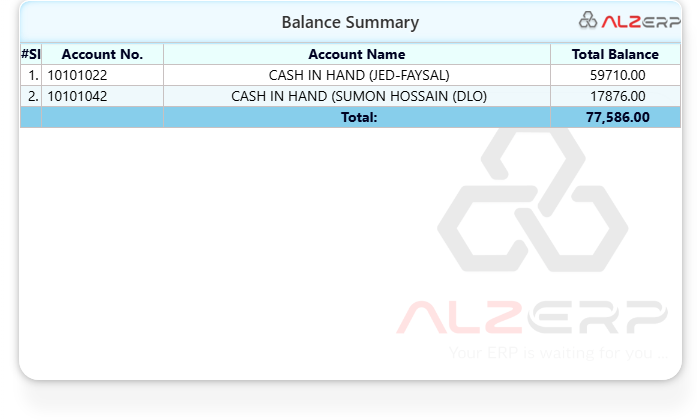

1. All Cash Accounts Balance Summary: #

- Overview: Located on the left side of the form, this section provides a snapshot of the current balances across all cash accounts within the system. It’s essential for users to quickly assess available funds before initiating a transfer.

- Columns Displayed:

- #Sl: A serial number for easy reference.

- Account No.: The unique identifier for each cash account.

- Account Name: The descriptive name of the cash account, such as

CASH IN HAND (JED-FAYSAL)orCASH IN HAND (SUMON HOSSAIN (DLO). - Total Balance: The current balance in each cash account, e.g.,

59,710.00or17,876.00.

- Total: The cumulative total of all cash balances, giving a comprehensive view of the organization’s liquidity.

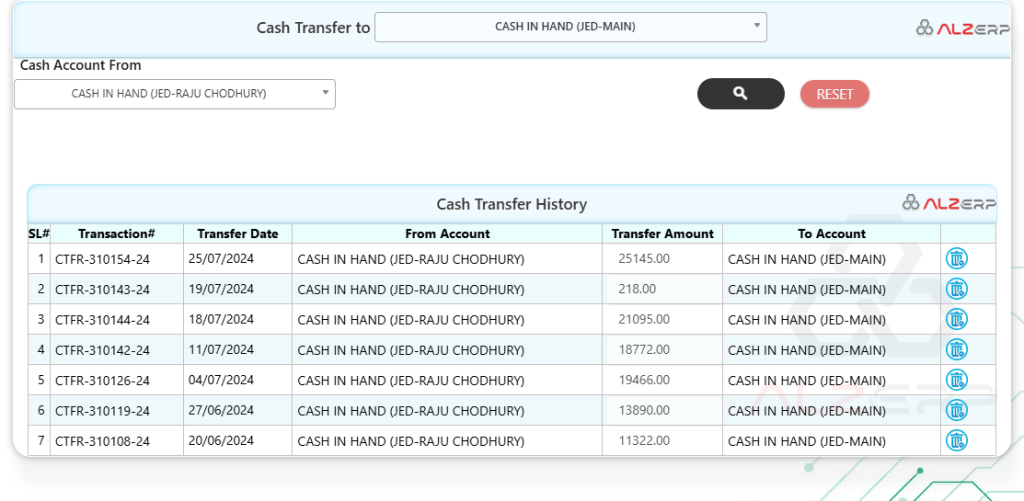

2. Transactions Section: #

- Cash Account From:

- Purpose: This dropdown list allows the user to select the source cash account from which funds will be transferred. Typically, this will be a salesman’s cash account.

- Example:

CASH IN HAND (Salesman Raju).

- Cash Receiver Account:

- Purpose: This dropdown list allows the user to select the destination cash account where the funds will be transferred. Typically, this will be the main company or branch cash account.

- Example:

CASH IN HAND (Main Cash).

The transaction process involves selecting the appropriate accounts for transferring funds. The system ensures that all cash movements are accurately tracked and recorded.

3. Cash Transfer History: #

- Purpose: This section records and displays all past cash transfer transactions, allowing users to review previous movements of funds between accounts.

- Columns Displayed:

- SL#: A serial number for reference.

- Transaction#: A unique identifier for each cash transfer transaction, useful for tracking and auditing purposes.

- Transfer Date: The date when the transfer occurred.

- From Account: The source account from which cash was transferred.

- Transfer Amount: The amount of cash that was transferred.

- To Account: The destination account where the cash was deposited.

- Delete Functionality: The form includes an option to delete transactions if necessary, allowing for corrections or adjustments. However, this would typically be restricted to users with appropriate permissions to maintain the integrity of financial records.

How it Works: #

- Cash Account Selection: Select the cash account from which the money will be transferred (source account) and the account to which the money will be transferred (destination account).

- Transfer Amount: Enter the amount of cash to be transferred.

- Transaction Recording: The system records the cash transfer, updating the balances of both accounts.

- Transaction History: The cash transfer is saved for future reference.

Benefits: #

- Enhanced Cash Control: Provides a centralized platform for managing cash flow.

- Reduced Risk: Minimizes the risk of cash loss or theft.

- Improved Financial Accuracy: Ensures accurate and up-to-date financial records.

- Streamlined Reconciliation: Facilitates the reconciliation process between sales and accounting departments.

- Compliance Adherence: Supports compliance with financial regulations and internal controls.

- Error Correction: The ability to delete transactions, with proper authorization, allows for the correction of mistakes, ensuring that financial records remain accurate.

- Efficient Cash Management: The form simplifies the process of transferring funds between accounts, ensuring that all cash movements are tracked and controlled.

- Real-Time Balance Overview: The balance summary provides an up-to-date view of all cash accounts, helping users make informed decisions before transferring funds.

- Secure Transactions: By recording each transfer with unique transaction IDs and detailed history logs, the system ensures that all cash movements are secure and auditable.

- Audit Trail: The history section maintains a detailed log of all transactions, which is essential for financial audits and internal reviews.

Additional Features: #

- Transfer Approval: Implement an approval process for large cash transfers.

- Transfer Reasons: Allow for specifying reasons for cash transfers.

- Batch Transfers: Enable multiple cash transfers in a single transaction.

- Integration with Accounting: Update accounting records with cash transfer information.

The Cash Transfer Form in ALZERP Cloud ERP is a critical tool for managing cash flow within an organization. It ensures that all cash transfers are executed securely, tracked accurately, and recorded systematically, providing transparency and control over financial operations. By effectively managing cash transfers, ALZERP helps businesses maintain accurate cash balances, improve financial control, and streamline cash management processes. By utilizing ALZERP’s Cash Transfer Form, businesses can establish robust cash management practices, mitigate risks, and improve overall financial performance.

Sign up for your free lifetime account of Cloud ERP Software and start transforming your business today!

– Create an account now –