In Saudi Arabia and most of the Islamic Finance based countries, businesses are required by the Zakat, Tax, and Customs Authority (ZATCA) to submit their Zakat amounts every financial year. To ensure compliance with these requirements, ALZERP Cloud ERP Software provides a robust Business Zakat calculation feature. This tool is designed to accurately calculate, moderate, and finalize the Zakat amounts for businesses, using comprehensive financial data from either the balance sheet or net profit, whichever yields the higher amount.

ALZERP Cloud ERP offers a Business Zakat Calculation Report that streamlines the process of determining and finalizing Zakat amounts for businesses operating in Saudi Arabia. This integrated feature ensures compliance with ZATCA regulations and provides a user-friendly interface for efficient Zakat management.

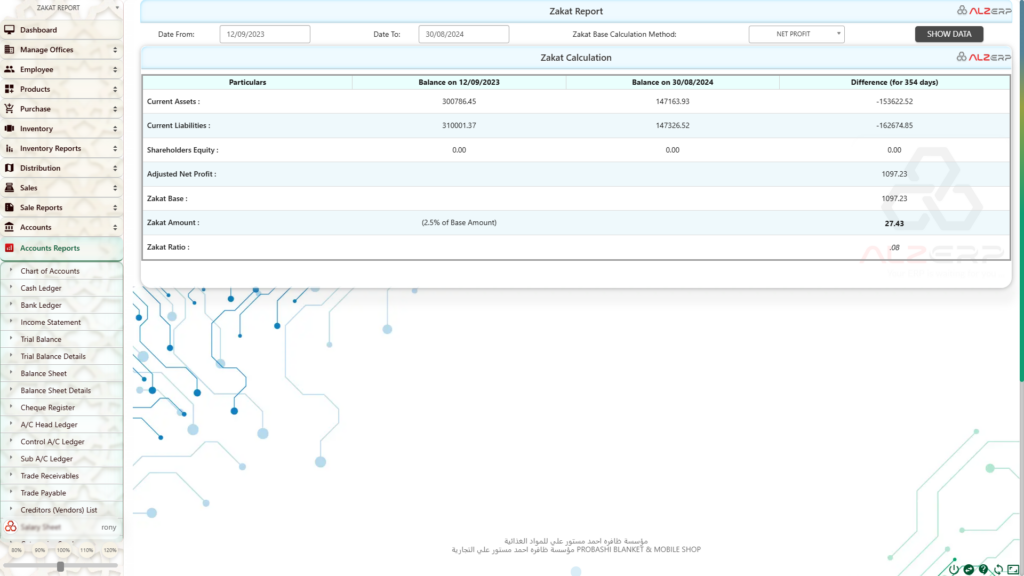

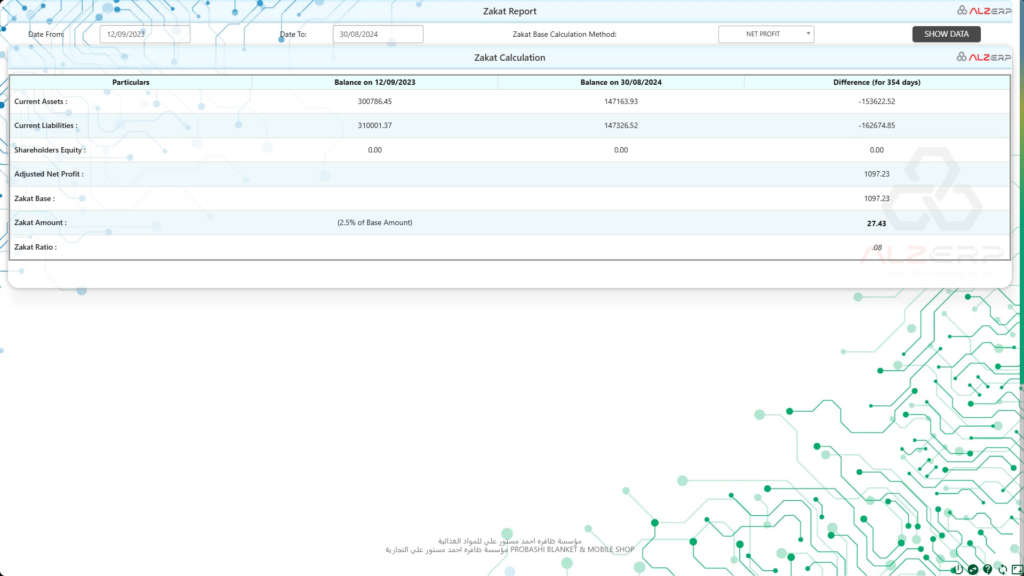

Key Components of the Zakat Calculation Report:

- Date Range: Specifies the financial year for which Zakat is being calculated.

- Zakat Base Calculation Method: Allows users to select either the Balance Sheet or Net Profit as the basis for Zakat calculation.

- Zakat Calculation Form:

- Displays a detailed breakdown of current assets, current liabilities, shareholders equity, adjusted net profit, Zakat base, Zakat amount, and Zakat ratio.

- Calculates Zakat based on the selected method.

- Zakat History: Provides a summary of previous Zakat submissions to ZATCA.

Overview of Zakat Calculation in ALZERP #

Zakat, a form of almsgiving in Islamic finance, is a mandatory process for businesses operating in Saudi Arabia. The ALZERP Cloud ERP Software streamlines this process by automating the calculation based on the company’s financial data, ensuring accuracy and compliance with ZATCA regulations.

Key Features of the Zakat Calculation Report in ALZERP:

- Data Range Specification:

- Users can specify the date range for the Zakat calculation. For instance, a business can define a period starting from 12/09/2023 to 30/08/2024, ensuring that the Zakat calculation covers the entire financial year.

- Zakat Base Calculation Method:

- ALZERP offers flexibility in calculating the Zakat base using either the Balance Sheet or Net Profit method. This dual approach ensures that businesses can choose the calculation method that yields a higher Zakat amount, aligning with compliance requirements.

Detailed Zakat Calculation Process #

1. Zakat Calculation Using the Balance Sheet:

The Zakat calculation from the balance sheet involves analyzing the company’s current assets, current liabilities, and shareholders’ equity over the specified financial period. The difference in these values over time is used to determine the Zakat base.

- Particulars and Balances:

- The system tracks the balances of current assets, current liabilities, and shareholders’ equity at the beginning and end of the financial period.

- For example:

- Current Assets: SAR 300,786.45 on 12/09/2023 and SAR 147,163.93 on 30/08/2024, with a difference of SAR -153,622.52 over 354 days.

- Current Liabilities: SAR 310,001.37 on 12/09/2023 and SAR 147,326.52 on 30/08/2024, showing a decrease of SAR -162,674.85.

- Adjusted Net Profit: The system calculates the adjusted net profit, which in this example is SAR 1,097.23. This figure is critical in determining the Zakat base.

- Zakat Base and Amount:

- The Zakat base, calculated from the adjusted net profit, is SAR 1,097.23.

- The Zakat amount is then determined as 2.5% of the Zakat base, resulting in SAR 27.43.

- The Zakat ratio provides a perspective on the business’s financial health and its Zakat obligation, calculated here as 0.08.

2. Zakat Calculation Using Net Profit:

Similar to the balance sheet method, the net profit method also considers the changes in current assets, liabilities, and net profit to determine the Zakat base.

- The figures for current assets, current liabilities, and adjusted net profit remain the same as in the balance sheet method, ensuring consistency in financial reporting and compliance.

- Zakat Base and Amount:

- The Zakat base is calculated based on the net profit, leading to the same Zakat amount of SAR 27.43, reinforcing the reliability of ALZERP’s dual-method approach.

Zakat History #

ALZERP maintains a comprehensive record of previous Zakat submissions to ZATCA. This historical data provides businesses with an overview of their compliance status and facilitates easier auditing and reporting.

Benefits of Using ALZERP for Zakat Calculation #

- ZATCA Compliant Software: ALZERP is designed to meet all ZATCA requirements, ensuring that Zakat calculations are accurate and compliant with Saudi tax regulations.

- Efficient VAT Management: In addition to Zakat, ALZERP manages VAT reporting and compliance, providing an all-in-one solution for tax management.

- Zakat Calculation Software: The built-in Zakat calculator simplifies the complex process of determining Zakat obligations, reducing errors and ensuring timely submissions.

- Automated Tax Compliance: The software automates the tax compliance process, from calculation to submission, minimizing manual intervention and the risk of errors.

- Zakat and Tax Automation: ALZERP integrates Zakat and tax processes, automating calculations, reporting, and compliance tasks.

- Real-Time VAT Reporting KSA: The system offers real-time reporting, allowing businesses to stay up-to-date with their tax liabilities.

- Saudi Tax Compliance Software: Tailored specifically for the Saudi market, ALZERP ensures businesses meet all local tax and Zakat obligations.

- Tax Optimization Tool: By providing insights into Zakat and tax liabilities, ALZERP helps businesses optimize their financial strategies.

- VAT Fraud Detection: The system includes features to detect and prevent VAT fraud, ensuring the integrity of financial transactions.

Summary of ALZERP Zakat Calculation Report:

- Accuracy: Ensures accurate Zakat calculations based on the selected method.

- Compliance: Adheres to ZATCA regulations regarding Zakat calculation and reporting.

- Efficiency: Streamlines the Zakat calculation process, saving time and effort.

- Clarity: Provides a clear and detailed breakdown of Zakat components.

- Historical Records: Maintains a record of previous Zakat calculations for reference and analysis.

Additional Features:

- Integration with Other Modules: Seamlessly integrates with other modules within ALZERP, such as accounting and financial reporting, for a comprehensive view of business operations.

- Customization: Allows for customization of the Zakat Calculation Report to meet specific business requirements.

- Reporting: Generates various reports related to Zakat, such as Zakat summaries and analysis.

ALZERP’s Zakat Calculation Report is a valuable tool for businesses in Saudi Arabia. It simplifies the process of determining Zakat obligations, ensures compliance with ZATCA regulations, and provides accurate calculations. By leveraging this feature, businesses can efficiently manage their Zakat responsibilities and maintain financial integrity.

Conclusion #

The Zakat Calculation Report in ALZERP Cloud ERP Software is a vital tool for businesses in Saudi Arabia, ensuring compliance with ZATCA regulations. By offering dual calculation methods, real-time reporting, and automated compliance, ALZERP simplifies the Zakat submission process, helping businesses maintain accuracy and efficiency in their financial operations. Whether using the balance sheet or net profit method, ALZERP ensures that businesses can confidently meet their Zakat obligations, reinforcing their commitment to both religious and legal responsibilities.

Sign up for your free lifetime account of Cloud ERP Software and start transforming your business today!

– Create an account now –

Business Zakat Calculation in ALZERP Cloud ERP Softwarehttps://t.co/dSdFFH1L9f #zatca #VATManagement #SaudiTax #ZakatSoftware #TaxCompliance #ERPZATCA #eInvoicing #VATreporting #ZakatCalculator #TaxAutomation #SaudiSME #RealTimeVAT #TaxAudit #ZATCAintegration #taxplanning pic.twitter.com/sHzZHNWA1T

— Alwajeez Technology (@AlwajeezTech) August 31, 2024

Post by @alz_erpView on Threads