ALZERP’s Cash Account Management module empowers wholesale and distribution businesses to define, manage, and track various cash accounts with ease. Here’s how it simplifies your financial operations:

Defining Diverse Cash Account Types:

- Flexibility: Create accounts tailored to your specific needs. Predefined options include:

- Branch Accounts: Track cash specific to individual branches.

- SR Accounts: Manage Saudi Riyal (SR) denominated accounts.

- Petty Cash: Allocate funds for minor expenses.

- Payroll Account: Dedicate funds for employee salaries.

- Sweep Account: Automate transfers of excess funds to another account.

- Cash Reserves: Monitor emergency or contingency cash funds.

- Customization: You’re not limited to these options. Create additional account types (e.g., Customer Deposits, Sales Tax Account) to suit your unique business model.

Enhanced Control and Security:

- Assigned Users: Designate a specific user (employee) with primary responsibility for managing each cash account, ensuring accountability.

- Opening Balances: Set the initial cash amount for each account, providing a clear starting point for tracking.

- Linked Accounting Heads: Connect cash accounts to relevant general ledger accounts within your accounting system, enabling seamless integration and accurate financial reporting.

Improved Cash Flow Visibility:

- Centralized View: Gain a comprehensive overview of all your cash accounts in a single location.

- Active/Inactive Accounts: Easily distinguish between currently used accounts and those no longer relevant.

- Detailed Information: Access account details like name, type, creation date, opening balance, and potentially the option to view transaction history within the table itself.

Benefits of Using ALZERP’s Cash Account Management:

- Simplified Reconciliation: Streamline the process of reconciling cash accounts with bank statements.

- Enhanced Security: Assign ownership and track activity for each cash account, minimizing the risk of unauthorized access or misuse of funds.

- Data-Driven Decision Making: Gain insights into cash flow patterns and make informed financial decisions based on real-time data.

ALZERP Cloud ERP: A Perfect Fit for Wholesale Businesses

By leveraging ALZERP’s Cash Account Management module, wholesale and distribution businesses can achieve:

- Improved financial control

- Increased transparency

- Enhanced operational efficiency

This translates to better cash flow management, streamlined financial processes, and ultimately, a stronger financial foundation for your business.

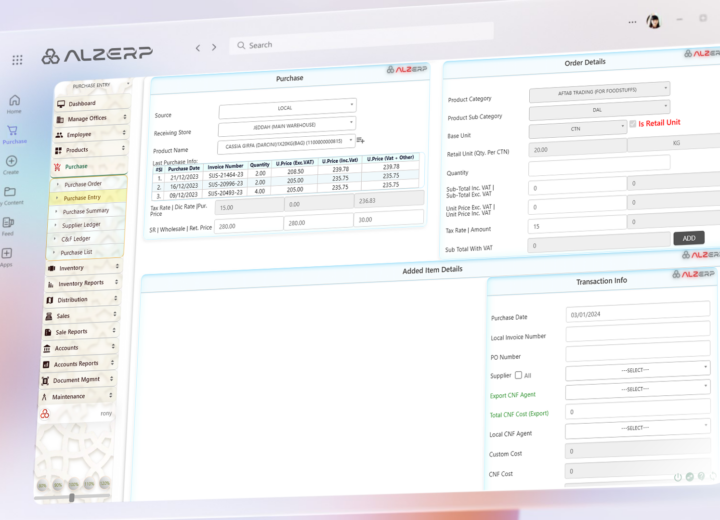

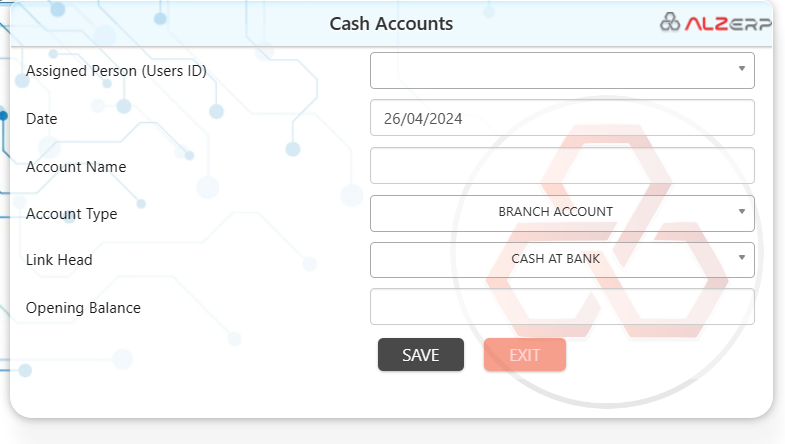

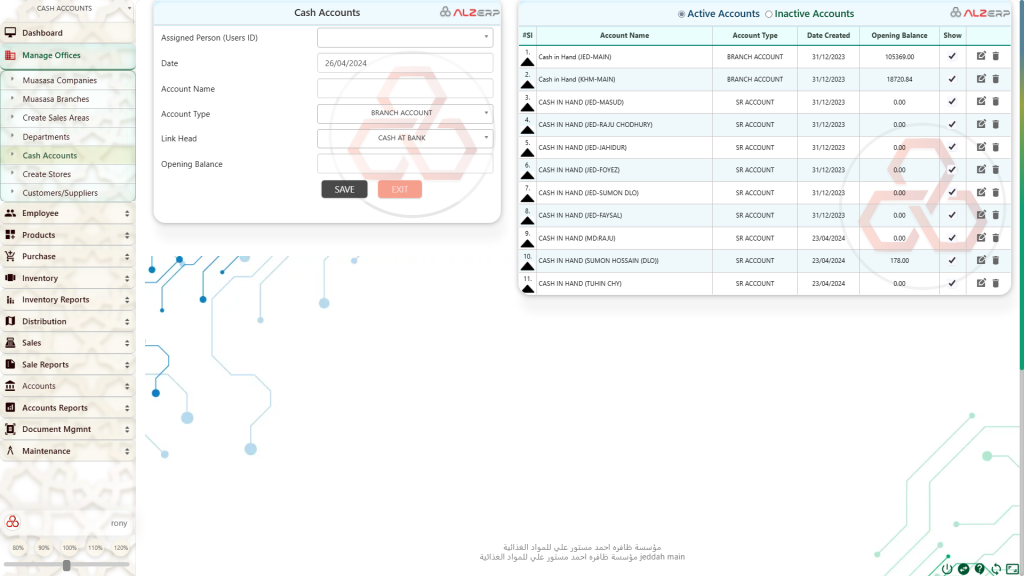

Multiple Cash Accounts Management module in ALZERP Cloud ERP software allows you to define and manage various types of cash accounts used by any wholesale and distribution business.

- Assigned Person (Users ID): This field lets you assign a specific user (employee) who has primary responsibility for managing the cash account.

- Assigned Date: Records the date the cash account was created in the system.

- Account Name: Enter a clear and descriptive name for the cash account (e.g., “Main Branch Cash Account”).

- Account Type (Multiple options): This allows you to categorize the cash account based on its purpose:

- BRANCH ACCOUNT: Tracks cash specific to a particular branch location.

- SR ACCOUNT: Likely refers to a Saudi Riyal (SR) denominated account.

- PETTY CASH: Manages a small cash fund for minor expenses.

- PAYROLL ACCOUNT: Tracks funds dedicated to employee payroll.

- SWEEP ACCOUNT: An account used to automatically transfer excess funds to another account.

- CASH RESERVES: Tracks emergency or contingency cash funds.

- Linked Accounting Head (Multiple options): This allows you to link the cash account to a specific general ledger account within your accounting system. These options might include:

- Cash at Bank: Represents cash deposited in a bank account.

- Cash in Hand: Tracks physical cash readily available at a location.

- Cash in SR Hand: Similar to Cash in Hand, but specifically for Saudi Riyal currency.

- Weekly Payment Cash Account: Tracks cash designated for weekly payments (potentially to suppliers or employees).

- Opening Balance: Enter the initial amount of cash available in this account when it’s created.

- Save Form Data: Saves the information you entered for the cash account.

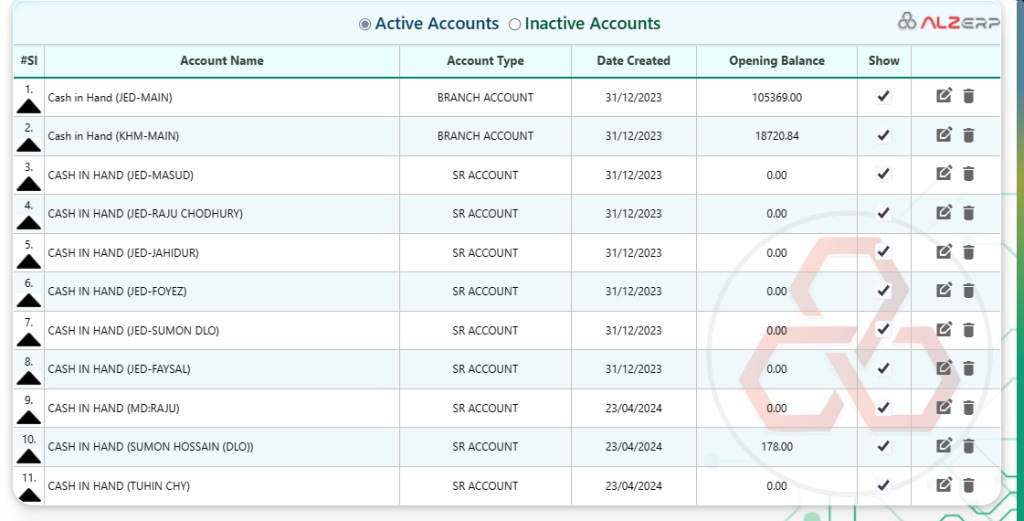

Data in Table Grid:

This section provides a centralized view and management of all your cash accounts:

- Active/Enabled Cash Accounts – Inactive/Disabled Cash Accounts: This likely displays your cash accounts categorized into two sections: active accounts currently in use and inactive accounts that may no longer be relevant.

- #Sl: Sequential number for easy reference.

- Account Name: The name you assigned to the cash account.

- Account Type: The category you selected (e.g., Branch Account).

- Date Created: The date the account was added to the system.

- Opening Balance: The initial amount recorded for the cash account.

- Show/Hide: This might allow you to expand or collapse detailed information for each cash account within the table view.

Benefits of Cash Account Management:

- Improved Cash Flow Visibility: Gain a clear overview of all your cash holdings across various accounts.

- Enhanced Control and Security: Assign ownership and track activity for each cash account.

- Simplified Reconciliation: Streamline the process of reconciling your cash accounts with bank statements.

The features related to Cash Accounts in an Enterprise Resource Planning (ERP) software tailored for wholesale businesses:

- Assigned Person (User ID):

- This field captures the unique identifier (ID) of the user or employee responsible for managing the cash account.

- It ensures accountability and facilitates tracking of transactions.

- Assigned Date:

- Represents the date when the cash account was assigned or created.

- Useful for auditing purposes and historical reference.

- Account Name:

- Specifies the name of the cash account.

- Each cash account typically corresponds to a specific purpose or function within the organization.

- Account Type:

- Offers multiple predefined options for categorizing the cash account:

- Branch Account: Associated with a specific branch or location.

- SR Account: May refer to a sales representative account.

- Petty Cash: Used for small, day-to-day expenses.

- Payroll Account: Handles employee salary payments.

- Sweep Account: Manages excess funds by automatically transferring them to interest-earning accounts.

- Cash Reserves: Reserved funds for emergencies or specific purposes.

- Offers multiple predefined options for categorizing the cash account:

- Linked Accounting Head:

- Provides further granularity by associating the cash account with specific accounting categories:

- Cash at Bank: Reflects funds held in bank accounts.

- Cash in Hand: Represents physical cash available on-site.

- Cash in SR Hand: May refer to cash held by sales representatives.

- Weekly Payment Cash Account: Used for weekly payment transactions.

- Provides further granularity by associating the cash account with specific accounting categories:

- Opening Balance:

- Indicates the initial amount in the cash account when it was established.

- Essential for accurate financial reporting and reconciliation.

- Save Form Data:

- Allows users to save the entered data for future reference or modification.

- Ensures data persistence and retrieval.

- Data in Table Grid:

- Displays a table grid with active/enabled and inactive/disabled cash accounts.

- Columns include:

- #Sl: Serial number or index.

- Account Name: Name of the cash account.

- Account Type: Type of cash account (e.g., Petty Cash, Payroll Account).

- Date Created: When the account was established.

- Opening Balance: Initial amount in the account.

- Show/Hide: Option to toggle visibility of specific accounts.

The Multiple Cash Accounts Management module in ALZERP Cloud ERP software offers a robust solution for defining and managing various types of cash accounts essential for wholesale and distribution businesses. Here’s how it enables efficient cash account management:

- Customization of Cash Accounts: ALZERP allows users to create and customize multiple cash accounts tailored to the specific needs of their wholesale and distribution business. Users can define each cash account with a unique name, account type, and linked accounting head, ensuring accurate tracking and categorization of cash transactions.

- Diverse Account Types: The module supports a wide range of account types commonly used in wholesale and distribution operations. Users can designate cash accounts as Branch Accounts, SR Accounts, Petty Cash, Payroll Accounts, Sweep Accounts, Cash Reserves, and more, reflecting the diverse financial needs and activities of the business.

- Linked Accounting Heads Integration: Each cash account in ALZERP can be seamlessly linked to the appropriate accounting head or ledger within the ERP software. This integration ensures that cash transactions recorded in the cash accounts are automatically reflected in the company’s financial statements, providing real-time visibility into cash flow and liquidity.

- User Assignment and Accountability: The module allows users to assign specific cash accounts to designated personnel within the organization. By associating each cash account with an assigned person and date, ALZERP ensures accountability and oversight, facilitating transparent cash management practices.

- Opening Balance Setup: Users can set up the opening balance for each cash account, capturing the initial amount of cash available in the account at the beginning of the accounting period. This feature streamlines the process of initializing cash accounts and ensures accurate financial reporting from the outset.

- Comprehensive Data Management: ALZERP’s Multiple Cash Accounts Management module presents cash account data in a user-friendly table grid format, allowing users to view and manage multiple accounts efficiently. The module supports the categorization of active and inactive cash accounts, providing flexibility and organization in cash account management.

- Secure Data Storage: All cash account data entered and managed within ALZERP is securely stored in the cloud-based ERP system. This ensures data integrity, confidentiality, and accessibility, allowing authorized users to retrieve and update cash account information anytime, anywhere.

Overall, the Multiple Cash Accounts Management module in ALZERP Cloud ERP software empowers wholesale and distribution businesses to effectively define, manage, and track various types of cash accounts, optimizing cash flow management and financial transparency. By effectively managing your cash accounts within the ERP software, wholesale businesses can gain better control over their finances, improve cash flow visibility, and ensure proper financial reporting

- Cash accounts refer to financial accounts used to track and manage cash transactions within the wholesale business. In the ERP software, users can create and manage multiple cash accounts to monitor cash inflows and outflows effectively.

- Assigned Person (User ID): This field captures the user ID or username of the individual responsible for managing the cash account. It helps track accountability and ensures proper oversight of cash transactions.

- Assigned Date: The assigned date indicates the date when the cash account was assigned to a specific user. It provides a reference point for tracking account ownership and changes over time.

- Account Name: Users can specify a descriptive name for each cash account, making it easy to identify and distinguish between different accounts.

- Account Type (Multiple Options): Users can categorize cash accounts into different types based on their purpose or function. Common account types include:

- Branch Account

- SR Account

- Petty Cash

- Payroll Account

- Sweep Account

- Cash Reserves

- Linked Accounting Head (Multiple Options): Users can link each cash account to a specific accounting head or ledger within the ERP software. This linkage ensures proper recording and integration of cash transactions into the company’s financial records. Common linked accounting heads may include:

- Cash at Bank

- Cash in Hand

- Cash in SR Hand

- Weekly Payment Cash Account

- Opening Balance: Users can input the opening balance for each cash account, representing the initial amount of cash available in the account at the beginning of the accounting period.

- Save Form Data: This option allows users to save the data entered into the form, ensuring that changes and updates are recorded and preserved within the ERP system.

- Data in Table Grid: The data for active/enabled cash accounts is displayed in a table grid format, allowing users to view and manage multiple accounts efficiently. The table includes the following columns:

- Account Name

- Account Type

- Date Created

- Opening Balance

- Show/Hide (option to display or hide inactive/disabled cash accounts)

These features collectively facilitate the effective management and tracking of cash accounts within the wholesale business, ensuring transparency, accuracy, and compliance with financial regulations.

To Subscribe your business in ALZ ERP: https://www.alzerp.com/signup

Service/Support Mobile Number & WhatsApp: +9660599434757, +966553977098

Service/Support Email: care@alzerp.com