Alwajeez Tech is a trusted technology provider offering ZATCA-compliant e-invoicing solutions designed to help businesses seamlessly transition into the Integration Phase (Phase Two) of E-invoicing. Their robust, user-friendly, and secure invoicing system ensures compliance with ZATCA’s regulations while enhancing operational efficiency for businesses of all sizes.

🔹 Why Choose Alwajeez Tech for E-Invoicing Compliance?

✔ Full Compliance with ZATCA’s E-Invoicing (Fatoora) Requirements – Ensures businesses generate, store, and integrate e-invoices per ZATCA’s mandatory format.

✔ Seamless Integration with Fatoora – API-based connectivity for real-time invoice submission.

✔ Secure & Scalable System – Uses encryption, digital signatures, and cloud-based storage to protect financial data.

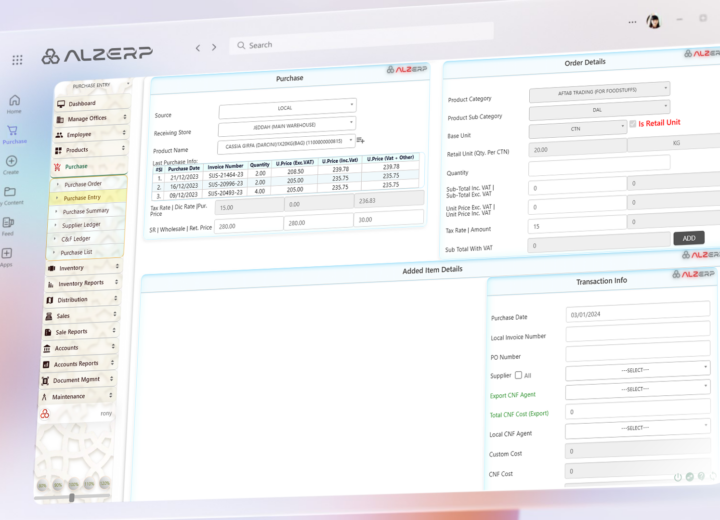

✔ Customizable Solutions – Whether you use ERP, POS, or standalone invoicing software, Alwajeez Tech provides tailored solutions.

✔ Expert Support & Training – Dedicated team to guide businesses through implementation, testing, and troubleshooting.

The Last Wave of the Integration Phase of E-Invoicing by ZATCA

- ZATCA has identified the criteria for taxpayers selected in Wave 20 of the Integration Phase of E-invoicing.

- Targeted taxpayers are those whose VAT-subject revenues exceeded SAR 1.5 million in 2022 or 2023.

- Deadline for integration with the Fatoora platform: October 31, 2025.

- Integration Phase (Phase Two) requirements include:

- Connecting e-invoicing systems with ZATCA’s Fatoora platform.

- Issuing e-invoices in a specific format with additional mandatory fields.

- Complying with technical requirements beyond those in Phase One.

- ZATCA will notify taxpayers at least six months before their integration date.

- The initiative is part of Saudi Arabia’s digital transformation to enhance compliance and consumer protection.

📖 Key Concepts and Breakdown

1️⃣ What is the Integration Phase (Phase Two) of E-invoicing?

The Integration Phase builds on Phase One and requires businesses to:

✔ Integrate their invoicing systems with ZATCA’s Fatoora platform.

✔ Follow specific technical standards for invoice formats.

✔ Include additional invoice details, such as:

- Unique invoice identifiers

- QR codes

- Mandatory data fields

2️⃣ Who is Required to Comply in Wave 20?

✔ Businesses whose VAT-liable revenue exceeded SAR 1.5 million in 2022 or 2023.

✔ Businesses that receive official notification from ZATCA.

✔ Future waves will be notified at least six months before their integration date.

3️⃣ What is the Deadline for Compliance?

📅 October 31, 2025 is the final date for Wave 20 businesses to fully integrate with Fatoora.

4️⃣ What Was Phase One (Generation Phase)?

🚀 Launched on December 4, 2021, requiring:

- No more handwritten or manually created invoices (e.g., Word/Excel).

- Use of compatible e-invoicing software.

- Storing invoices with QR codes and structured data formats.

✅ Phase One prepared businesses for full integration in Phase Two.

5️⃣ What Are the Benefits of E-invoicing?

✔ Streamlines tax compliance by automating reporting.

✔ Enhances transparency in transactions.

✔ Reduces tax evasion risks and boosts government revenue.

✔ Improves business efficiency by automating invoicing processes.

✔ Ensures regulatory compliance with Saudi Arabia’s digital transformation goals.

💡 FAQs (Frequently Asked Questions)

1️⃣ What Happens If a Business Does Not Integrate by October 31, 2025?

❌ Non-compliance may result in penalties or legal action from ZATCA.

✔ Businesses should integrate before the deadline to avoid fines.

2️⃣ How Will Businesses Know If They Are Selected for Wave 20?

📢 ZATCA will officially notify selected businesses through:

✔ Official letters or emails.

✔ Announcements on ZATCA’s portal.

✔ Other communication channels like SMS notifications.

3️⃣ What Are the Technical Requirements for Integration?

📌 Businesses must:

✔ Have an e-invoicing system compatible with ZATCA’s Fatoora platform.

✔ Ensure invoices are in a structured electronic format.

✔ Include mandatory fields and a QR code on all invoices.

✔ Use secure encryption and digital signatures where required.

❗ Tip: Businesses should consult their e-invoicing providers for Fatoora compliance.

4️⃣ Can Small Businesses Be Exempt from E-Invoicing?

🔹 If a business does not meet the SAR 1.5 million VAT revenue threshold, they may not be included in Wave 20.

🔹 However, future waves will gradually include more businesses, so compliance is eventually mandatory for all VAT-registered entities.

5️⃣ Will There Be Additional Waves After Wave 20?

✔ Yes, ZATCA is implementing Phase Two gradually in multiple waves.

✔ Each wave is notified at least six months before their compliance deadline.

📢 Next Steps for Businesses

✔ Check if your VAT revenue exceeded SAR 1.5 million in 2022 or 2023.

✔ Look for ZATCA’s official notification confirming your inclusion in Wave 20.

✔ Upgrade your invoicing system for Fatoora compliance.

✔ Contact ZATCA or an e-invoicing provider for integration support.

📌 Digital Strategy for Ensuring Compliance with ZATCA’s E-Invoicing (Fatoora) Requirements

To comply with ZATCA’s E-invoicing Integration Phase (Phase Two), businesses must develop a structured digital transformation strategy. Below is a step-by-step roadmap to ensure compliance before the October 31, 2025 deadline for Wave 20.

🔹 Step 1: Assess Your Business Readiness

🔍 Evaluate Current Invoicing Processes

- Identify whether your business exceeded SAR 1.5M VAT-liable revenue in 2022 or 2023 (to confirm inclusion in Wave 20).

- Check if your current invoicing system supports e-invoicing features.

- Ensure your invoices follow ZATCA’s format, including QR codes and mandatory fields.

📌 Action:

✅ Conduct an internal audit to determine gaps in your current invoicing process.

✅ If you’re still using manual invoices (e.g., Excel, Word, paper), transition to an approved e-invoicing solution ASAP.

🔹 Step 2: Select a ZATCA-Compliant E-Invoicing System

🔹 Your e-invoicing system must:

✔ Be compatible with Fatoora (ZATCA’s platform).

✔ Support structured e-invoice formats (XML, PDF/A-3 with embedded XML).

✔ Generate and store invoices with QR codes, unique invoice identifiers, and mandatory tax details.

✔ Ensure data security with encryption and digital signatures (if required).

📌 Action:

✅ Contact your current ERP/POS/e-invoicing provider to confirm compliance.

✅ If you don’t have an e-invoicing solution, choose a ZATCA-approved provider or upgrade your existing system.

🔹 Step 3: Integrate Your E-Invoicing System with Fatoora

🔗 Technical Integration Steps:

1️⃣ Ensure software compatibility: Verify that your e-invoicing system can integrate with ZATCA’s Fatoora platform.

2️⃣ Develop APIs for automatic invoice submission: If using an in-house invoicing system, your IT team should build API connections.

3️⃣ Test your integration with a pilot run before full implementation.

📌 Action:

✅ Coordinate with IT teams or software vendors to ensure Fatoora integration.

✅ Test invoice submissions through the Fatoora system to confirm compliance.

🔹 Step 4: Train Your Finance & Accounting Teams

📢 Key Training Areas:

- How to generate ZATCA-compliant e-invoices.

- How to handle real-time invoice submission to ZATCA.

- How to resolve errors or rejections from Fatoora.

- How to ensure tax compliance in daily operations.

📌 Action:

✅ Organize training workshops for finance, accounting, and IT teams.

✅ Provide step-by-step guides for invoice generation and submission.

🔹 Step 5: Ensure Ongoing Compliance & Future Readiness

🔄 Stay Updated on Future Regulations

- ZATCA continues to expand e-invoicing requirements in phases.

- Future waves may introduce new features, such as AI-powered fraud detection or real-time invoice approvals.

📌 Action:

✅ Subscribe to ZATCA’s updates via its website, email alerts, and social media (@Zatca_Care).

✅ Set up monthly compliance checks to ensure your invoicing system remains aligned with ZATCA’s rules.

🎯 Timeline & Implementation Plan

| Phase | Task | Deadline |

|---|---|---|

| Step 1 | Internal audit & compliance check | Q1 2024 |

| Step 2 | Select & upgrade to a ZATCA-compliant system | Q2 2024 |

| Step 3 | Begin technical integration with Fatoora | Q3 2024 |

| Step 4 | Train teams & test e-invoice generation | Q4 2024 |

| Step 5 | Full transition & compliance monitoring | Q1 2025 |

📚 Training Plan for Companies Seeking ZATCA E-Invoicing Compliance

To ensure companies understand, implement, and comply with ZATCA’s e-invoicing regulations, the following structured training plan is recommended:

📅 Training Plan: “Mastering ZATCA E-Invoicing Compliance”

🕒 Duration: 4-6 weeks

🎯 Audience: Finance, Accounting, IT, and Compliance Teams

📍 Delivery Format: Online/On-site workshops, training videos, and hands-on technical demos

🔹 Week 1: E-Invoicing Fundamentals & Regulatory Overview

📌 Topics Covered:

✅ Overview of ZATCA’s E-invoicing Mandate (Fatoora, Phase One & Two)

✅ Types of e-invoices (Standard vs. Simplified) & required fields

✅ ZATCA compliance rules, penalties, and deadlines

🎯 Objective: Ensure teams understand legal and technical e-invoicing requirements.

🔹 Week 2: Choosing & Integrating a ZATCA-Compliant E-Invoicing System

📌 Topics Covered:

✅ How to evaluate and select an e-invoicing provider (e.g., Alwajeez Tech)

✅ Key features of a ZATCA-compliant invoicing system

✅ Technical steps to integrate with the Fatoora platform

🎯 Objective: Help businesses make informed decisions and initiate system integration.

🔹 Week 3: Generating & Submitting E-Invoices to ZATCA

📌 Topics Covered:

✅ Step-by-step guide to issuing e-invoices with QR codes

✅ Understanding invoice data validation & rejection reasons

✅ Hands-on session: Submitting test invoices to Fatoora

🎯 Objective: Train staff on how to generate, validate, and submit e-invoices correctly.

🔹 Week 4: Security, Troubleshooting & Continuous Compliance

📌 Topics Covered:

✅ Best practices for data security, storage, and backup

✅ How to resolve invoice errors and integration issues

✅ ZATCA audit preparation & compliance monitoring

🎯 Objective: Ensure businesses maintain long-term compliance and security.

📌 Additional Support:

🔹 Live Q&A Sessions for addressing company-specific challenges.

🔹 1:1 Consultation for technical setup and integration troubleshooting.

🔹 Training Certification upon course completion.

Businesses preparing for ZATCA’s Phase Two of E-invoicing should consider Alwajeez Tech as a trusted partner for compliance, seamless integration, and ongoing technical support.