In today’s complex business environment, managing VAT and taxes efficiently is crucial for companies operating in Saudi Arabia. ALZERP Cloud ERP Software offers a cutting-edge solution with its LC Payment Entry tool, designed specifically for VAT and Tax Management. This ZATCA-compliant software streamlines the entire process, ensuring businesses stay compliant with Saudi tax regulations while optimizing their financial operations.

The Unique Approach of ALZERP’s LC Payment Entry

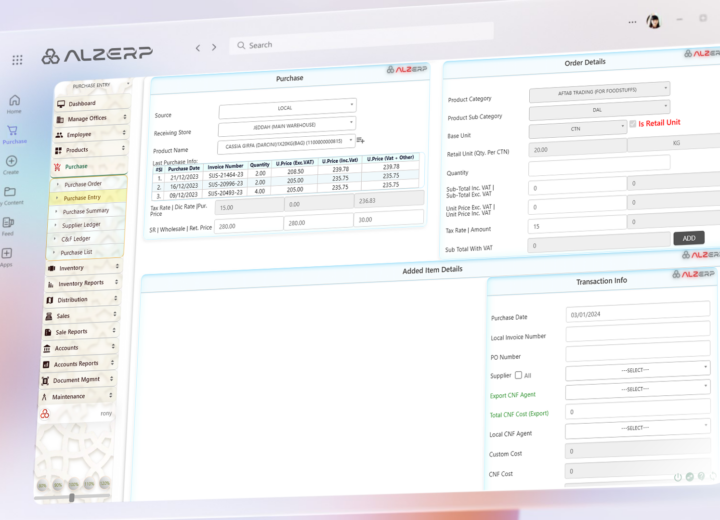

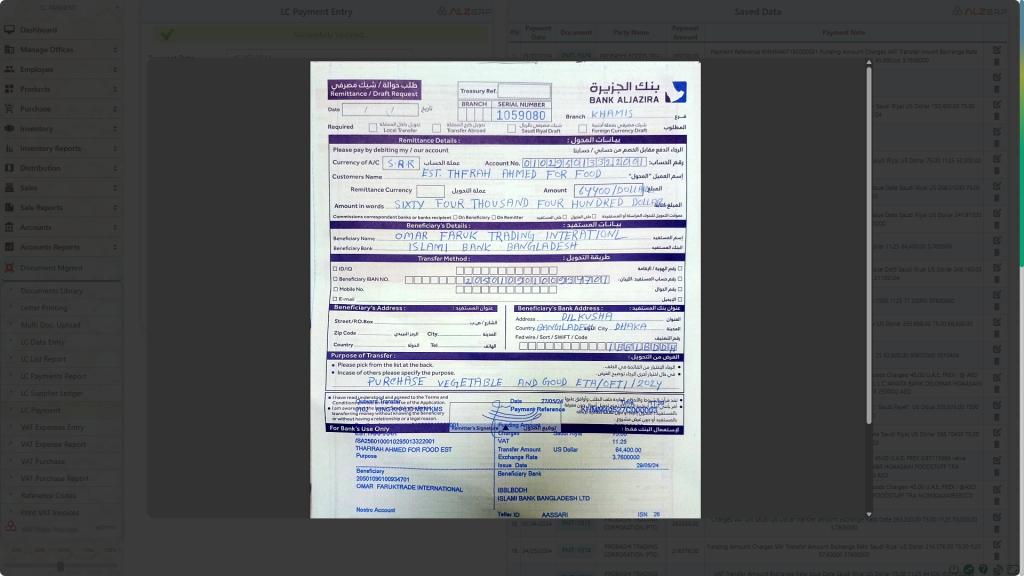

ALZERP’s LC Payment Entry stands out as a specialized tool within the VAT & Tax management module. Unlike traditional systems, this feature operates independently from the core accounting system, addressing a critical need in the market. The primary reason for this separate process is to manage the discrepancies between actual vendor LC amounts and custom-declared LC amounts, a common challenge in international trade.

Key Features of LC Payment Entry:

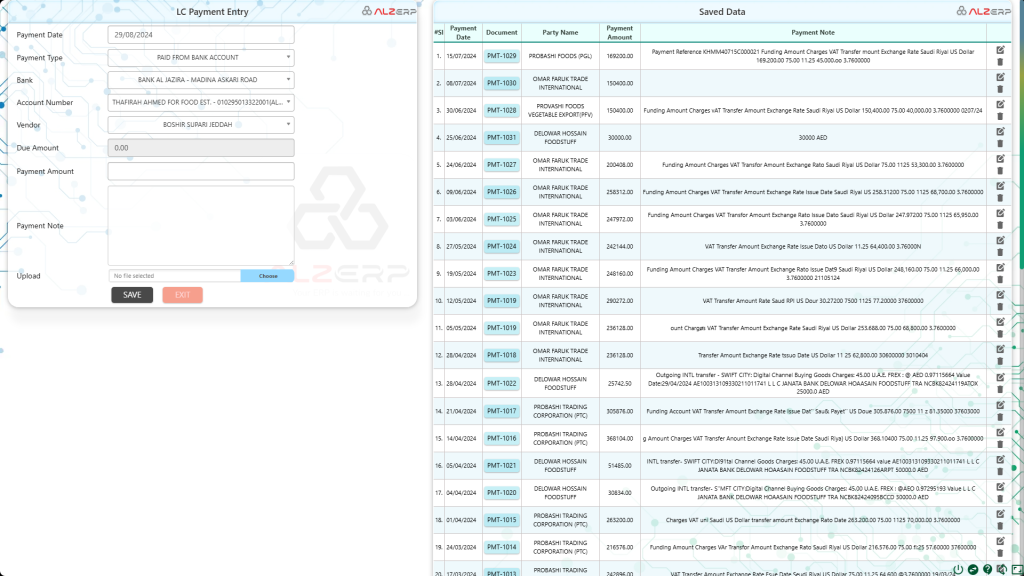

- Separate Record Keeping: While purchase payments under the Bookkeeping Module affect actual financial transactions for LC payments, the LC Payment Entry form maintains detailed records specifically for VAT Tax Management.

- Comprehensive Data Capture: The form meticulously records payment data, including:

- Deposit date

- USD amount

- Local currency amount

- Beneficiary bank information

- Document Management: Users can upload receipt files received from banks, ensuring a complete audit trail.

- User-Friendly Interface: The intuitive form includes fields such as:

- Payment Date

- Payment Type (TT, Transfer From Bank Account, Direct Deposit, etc.)

- Bank Name and Account Number

- Vendor (Beneficiary Company)

- Due Amount and Payment Amount

- Detailed Payment Notes

- Real-Time Data View: A comprehensive table displays saved data, including payment dates, document references, party names, payment amounts, and notes.

Enhancing VAT and Tax Management

ALZERP’s LC Payment Entry tool is part of a broader suite of ZATCA-approved ERP solutions designed to streamline VAT management and Zakat calculation. This integration offers several benefits:

- ZATCA Compliance: As a ZATCA-compliant software, ALZERP ensures that all transactions and reports meet the latest regulatory requirements.

- Automated Tax Compliance: The system automates various aspects of tax compliance, reducing the risk of errors and penalties.

- Real-Time VAT Reporting: Businesses can generate up-to-date VAT reports for KSA, facilitating timely and accurate submissions.

- Zakat Assessment and Calculation: The software includes tools for Zakat assessment and calculation, simplifying this crucial aspect of Saudi business operations.

- E-Invoicing Solution: ALZERP offers a ZATCA e-invoicing solution, ensuring that all invoices meet the required digital standards.

- Tax Analytics: Advanced analytics features provide insights into tax liabilities and opportunities for optimization.

- VAT Return Automation: The system automates VAT return processes, saving time and reducing the potential for errors.

Benefits for Saudi Businesses

Implementing ALZERP’s LC Payment Entry and associated tax management tools offers numerous advantages:

- Compliance Assurance: Stay compliant with ZATCA regulations and avoid penalties.

- Time Savings: Automate repetitive tasks in VAT reporting and Zakat calculations.

- Accuracy: Reduce human errors in tax calculations and submissions.

- Financial Visibility: Gain clear insights into tax liabilities and financial positions.

- Audit Readiness: Maintain comprehensive records for easy auditing.

- Cost Reduction: Minimize the need for external tax consultants.

- Strategic Planning: Use tax analytics for better financial planning and decision-making.

Conclusion

ALZERP Cloud ERP’s LC Payment Entry tool, coupled with its comprehensive VAT and tax management features, offers a robust solution for businesses navigating the complex tax landscape in Saudi Arabia. By providing a ZATCA-compliant, automated, and user-friendly platform, ALZERP empowers companies to manage their tax obligations efficiently, reduce risks, and focus on core business activities. As Saudi Arabia continues to evolve its tax regulations, having a reliable, adaptable, and compliant system like ALZERP is not just an advantage – it’s a necessity for sustainable business operations.