ALZERP: Fully Compliant Software for ZATCA E-Invoicing Requirements

Business operations in Saudi Arabia needs to compliant with regulatory requirements. One of the most significant recent developments is the introduction of ZATCA (Zakat, Tax and Customs Authority) E-Invoicing, also known as FATOORAH. This initiative aims to modernize the invoicing process by transitioning to structured electronic invoices. ALZERP Cloud ERP Software is at the forefront of this transformation, providing a robust software for ZATCA E-Invoicing requirements.

Understanding ZATCA E-Invoicing

ZATCA’s E-Invoicing initiative aims to digitize the invoicing process, making it easier, faster, and more transparent. It involves generating invoices, credit notes, and debit notes in a structured format through integrated electronic solutions. ALZERP Software for ZATCA integrations ensures a seamless exchange of these documents between buyers and sellers.

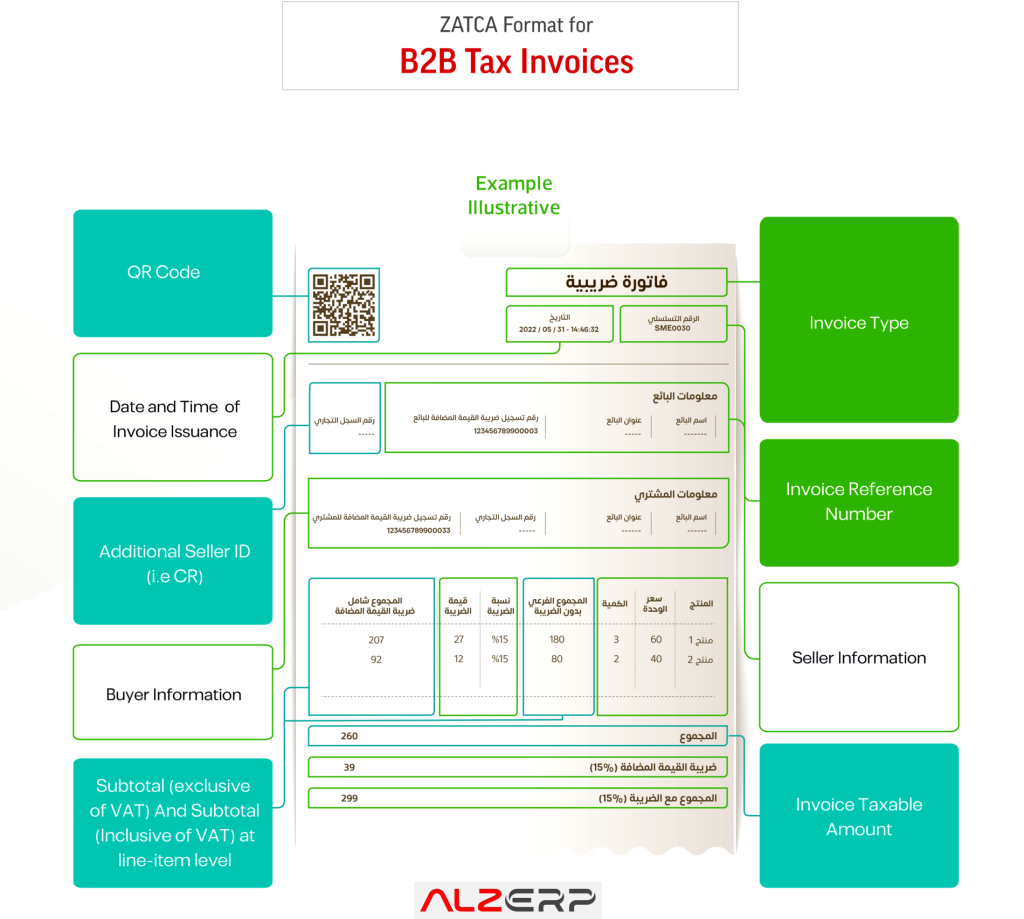

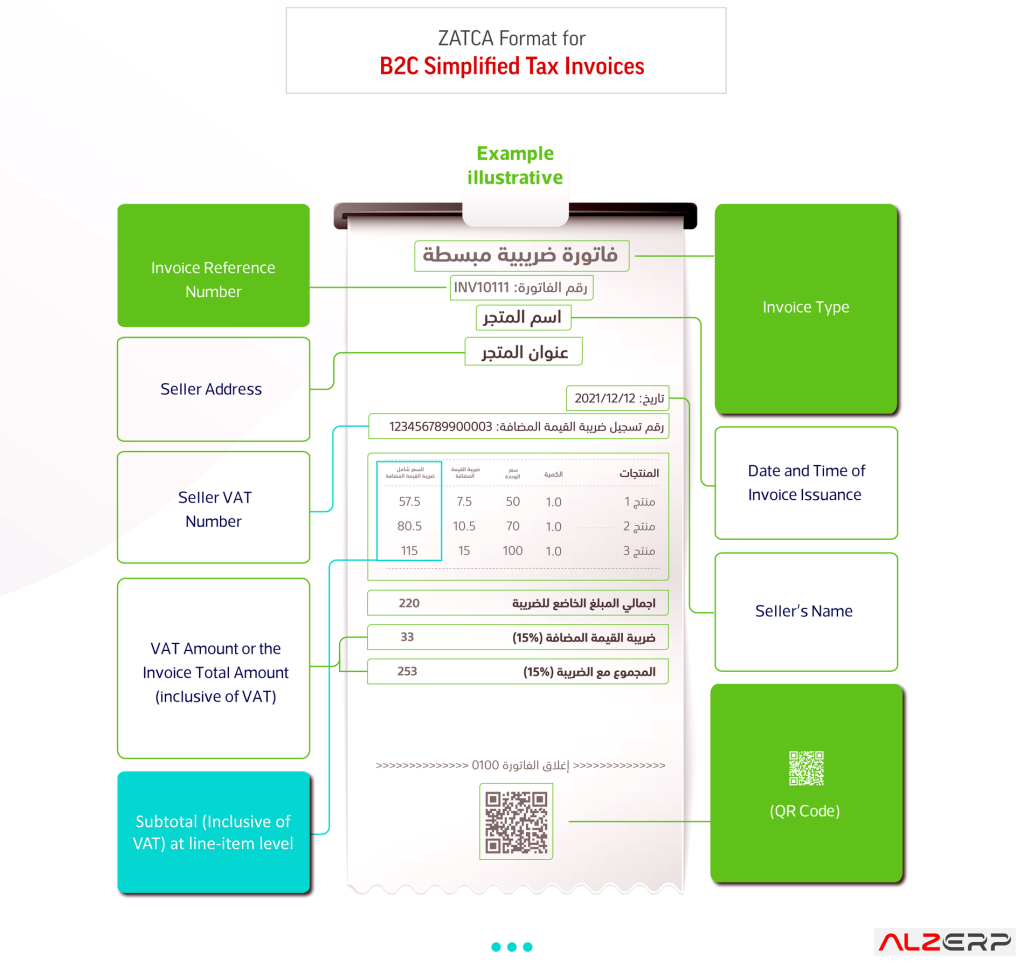

There are two main types of invoices under ZATCA regulations:

- Tax Invoice: Typically issued by a business to another business (B2B), containing all the required tax elements.

- Simplified Tax Invoice: Generally issued by a business to a consumer (B2C), containing the essential elements for simplified tax invoicing.

To comply with these requirements, businesses need a reliable software solution that can handle both the generation and integration of electronic invoices.

How Software for ZATCA Works?

ALZERP Cloud ERP Software is specifically designed to meet the stringent requirements set by ZATCA for E-Invoicing. Here’s how ALZERP ensures full compliance:

- Structured Electronic Invoices: ALZERP generates invoices in a structured electronic format, ensuring that all necessary elements are included. Whether it’s a B2B Tax Invoice or a B2C Simplified Tax Invoice, ALZERP formats the invoice to meet ZATCA’s standards, making it easier for businesses to comply with local regulations.

- Phase 1 Compliance (Generation Phase): As of December 4th, 2021, all taxpayers in Saudi Arabia, except non-resident taxpayers, are required to generate and store tax invoices electronically. ALZERP fully supports this mandate by enabling businesses to create and store compliant electronic invoices with ease. The software also includes additional fields as required by ZATCA, depending on the type of transaction, ensuring that all invoices are compliant from the start.

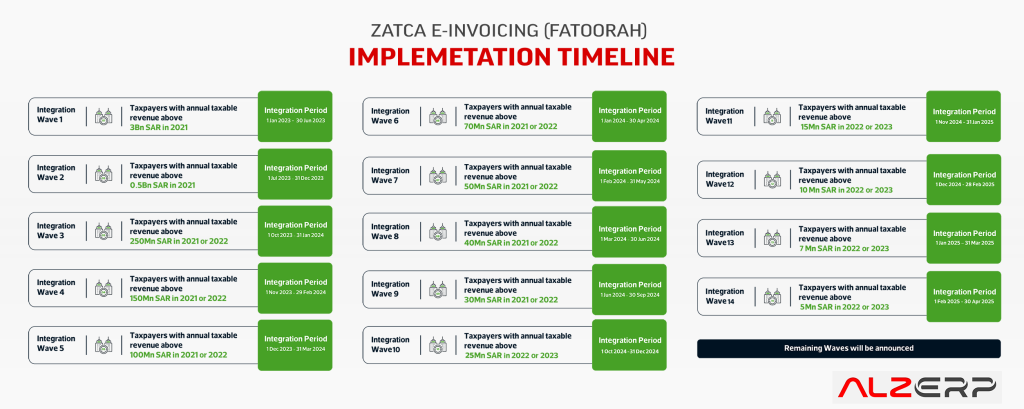

- Phase 2 Compliance (Integration Phase): Starting January 1st, 2023, ZATCA began rolling out the Integration Phase, requiring businesses to integrate their electronic invoicing systems with software for ZATCA’s systems. ALZERP is equipped to handle this integration seamlessly. The software ensures that all invoices generated are in the required format and are submitted to ZATCA’s systems for real-time validation and reporting. This integration is crucial for businesses to maintain compliance and avoid penalties.

- Comprehensive Roll-Out Phase Support: ZATCA has implemented a phased roll-out of the Integration Phase, targeting different taxpayer groups based on their annual taxable revenue. ALZERP is one of the best software for ZATCA prepared to support businesses in all phases, from those with annual revenue above 3 Billion SAR in Wave 1 to smaller businesses with revenue between 5 Million and 7 Million SAR in later waves. No matter the size of your business or which wave you belong to, ALZERP ensures that your invoicing processes remain compliant throughout the transition.

- Real-Time Reporting and Validation: ALZERP’s integration with ZATCA’s systems allows for real-time reporting and validation of invoices. This feature is critical for businesses to stay on top of their compliance obligations and to ensure that all invoices are accurately recorded and reported.

- User-Friendly Interface and Functionality: One of the standout features of ALZERP is its user-friendly interface, which makes it easy for businesses to generate and manage electronic invoices. The software is designed to streamline the invoicing process, reducing the burden on businesses and allowing them to focus on their core operations while maintaining compliance with ZATCA regulations.

- Security, Ongoing Updates and Support: ALZERP is committed to staying ahead of regulatory changes. As ZATCA continues to evolve its E-Invoicing requirements, ALZERP will provide security updates and support to ensure that your business remains compliant. The software is continuously updated to reflect the latest regulations, ensuring that your invoicing processes are always in line with ZATCA’s standards.

Why Choose ALZERP for ZATCA Compliance?

In the dynamic business environment of Saudi Arabia, having a reliable ERP solution for ZATCA that ensures compliance with local regulations is essential.

ALZERP Cloud ERP Software is more than just an invoicing tool; it’s a comprehensive solution that integrates with your business operations, providing a seamless and compliant invoicing process.

By choosing ALZERP, businesses can:

- Ensure Full Compliance: Meet all ZATCA E-Invoicing requirements with confidence.

- Streamline Operations: Simplify the invoicing process, reducing manual effort and errors.

- Stay Ahead of Regulatory Changes: Benefit from ongoing updates and support as regulations evolve.

- Enhance Efficiency: Utilize a user-friendly interface that makes invoicing easy and efficient.

As Saudi Arabia progresses towards complete digitization of invoicing through ZATCA’s E-Invoicing initiative, businesses need to adapt to remain compliant. ALZERP Cloud ERP Software offers the perfect solution to create electronic invoices in full compliance with ZATCA’s requirements.

With ALZERP, businesses can eliminate the complexities of E-Invoicing with ease. Ensuring that they remain compliant and focused on growth in a rapidly changing business landscape.