Managing VAT and tax documentation is a critical component of business operations, especially in regions with strict tax compliance requirements such as Saudi Arabia. ALZERP Cloud ERP Software addresses these needs with its robust VAT Invoice Printing feature, designed to simplify the process of managing and distributing invoices. This feature is crucial for businesses that need to send grouped invoices to customers or provide comprehensive invoice records to VAT/Tax authorities, ensuring compliance with ZATCA (Zakat, Tax, and Customs Authority) regulations.

Key Features of VAT Invoice Printing in ALZERP #

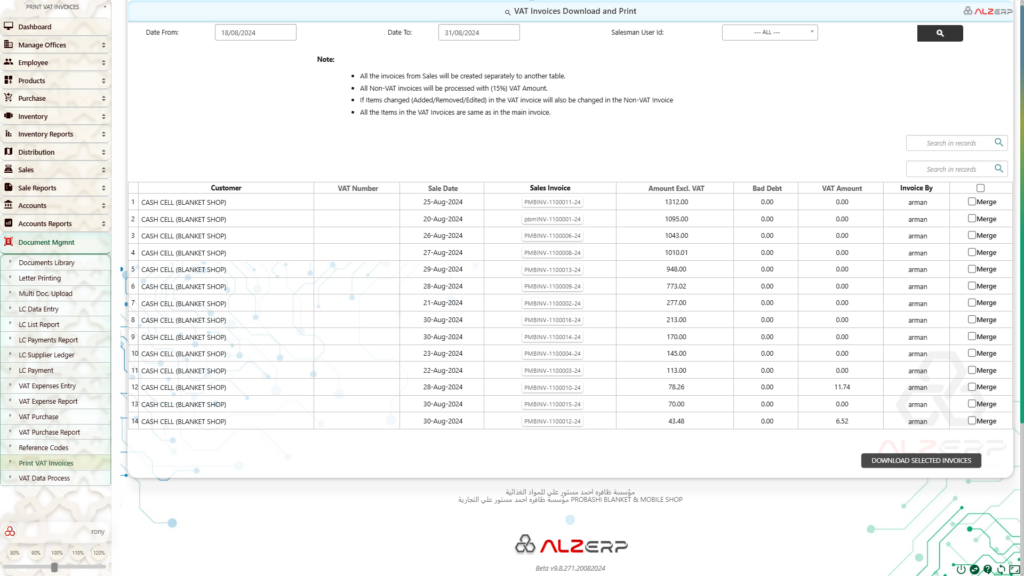

1. Merge and Download PDF Invoices: The Merge and Download PDF Invoices feature in ALZERP allows users to combine multiple invoices into a single PDF file. This functionality is ideal for businesses that need to provide consolidated invoice records for VAT reporting or Zakat assessments. It streamlines the invoicing process, saves time, and ensures accurate documentation.

2. Customizable Invoice Selection: Users can select multiple invoices based on various criteria such as date range, salesperson, and more. This flexibility allows businesses to filter and merge invoices according to their specific needs, whether for internal review or compliance with Saudi tax regulations. The selection process is facilitated through a user-friendly search form that includes options like:

- Date Range (Date From / Date To): Filter invoices within a specific time period, such as a month or quarter, to generate reports aligned with tax filing schedules.

- Entry By (Salesman User ID): Filter invoices by the salesperson or user who generated them, which is useful for tracking performance and managing team activities.

3. PDF Generation and Customization: Once the invoices are selected, ALZERP generates a combined PDF file containing the selected invoices. Users can customize the format of this PDF to include their company logo, contact information, and other relevant details, ensuring that the document reflects the company’s branding. This professional presentation enhances the credibility of the documents shared with customers and authorities.

4. Download and Sharing Options: After merging the invoices into a single PDF, users can easily download the file. The merged document can be shared electronically via email, WhatsApp, or other digital platforms, or printed for physical distribution. This versatility makes it easy to distribute invoices efficiently, whether for internal use or for submission to ZATCA as part of VAT compliance.

How the VAT Invoice Printing Feature Works #

- Invoice Selection: Users start by selecting the invoices they wish to merge using the search form. They can choose based on criteria such as customer name, VAT number, sale date, and the amount excluding VAT.

- PDF Generation: The selected invoices are then merged into a single PDF file. This file is organized and formatted according to the user’s specifications, ensuring that all necessary information is clearly presented.

- Customization: Users have the option to apply custom formatting to the PDF, including adding logos, adjusting layout, and including additional information as needed.

- Download and Sharing: The final PDF can be downloaded and saved for record-keeping, shared electronically with stakeholders, or printed. This ensures that businesses have flexible options for managing and distributing their VAT invoices.

Benefits of the Merge and Download PDF Invoices Feature #

- Efficiency: This feature enables businesses to quickly compile multiple invoices into a single document, reducing the time and effort required to manage and distribute individual invoices. This efficiency is particularly valuable during peak reporting periods.

- Professional Presentation: By consolidating invoices into a well-formatted PDF, businesses can present a clean and professional document to customers and tax authorities. This professionalism enhances the business’s image and supports compliance efforts.

- Compliance: The Merge and Download PDF Invoices feature supports compliance with ZATCA regulations by providing clear and organized VAT and tax-related details. This simplifies the process of audit preparation and ensures that businesses can meet their reporting obligations.

- Customization: The ability to filter invoices by date, salesperson, and other criteria allows businesses to generate customized reports that meet specific needs, such as tracking sales performance or preparing for tax audits.

ALZERP and Saudi Tax Compliance #

ALZERP Cloud ERP Software is designed to be ZATCA compliant, making it an ideal solution for businesses in Saudi Arabia looking to manage their VAT, Zakat, and tax obligations efficiently. The VAT Invoice Printing feature, along with other capabilities such as Zakat calculation, tax management, and real-time VAT reporting, positions ALZERP as a comprehensive tool for businesses to achieve full tax compliance. By automating and streamlining tax-related processes, ALZERP helps businesses avoid penalties, optimize tax planning, and ensure accurate reporting.

Conclusion #

The VAT Invoice Printing feature in ALZERP Cloud ERP Software offers businesses a powerful tool to manage and distribute their invoices effectively. By providing options to merge, customize, and download VAT invoices in a single PDF, ALZERP enhances the efficiency of tax management processes. This feature not only improves organizational efficiency but also ensures compliance with ZATCA regulations, supporting businesses in maintaining accurate and professional tax documentation.

For businesses in Saudi Arabia looking to streamline their VAT and tax management, ALZERP’s VAT Invoice Printing feature is an essential tool that delivers both efficiency and compliance.