Managing and reconciling financial transactions related to Letters of Credit (LC) is a crucial task for businesses engaged in international trade, especially under the rigorous tax regulations in Saudi Arabia. ALZERP Cloud ERP Software offers a specialized tool to address this need—the LC Vendors Ledger Report. This feature is designed to help businesses maintain accurate and compliant records of their LC transactions, specifically focusing on VAT and tax management.

ALZERP’s LC Vendor Ledger Report provides a detailed overview of your transactions with specific LC suppliers, ensuring accurate VAT and tax management. This report is essential for reconciling LC purchases and payments, identifying discrepancies, and maintaining compliance with ZATCA regulations.

Key Features of the LC Vendor Ledger Report #

- Supplier-Specific Analysis: View a detailed ledger of transactions for individual LC suppliers.

- Purchase and Payment Tracking: Track LC purchases, payments, and outstanding balances.

- Date Range Filtering: Analyze data within specific timeframes to identify trends and irregularities.

- Report Customization: Choose between detailed or summary reports to suit your specific needs.

- Professional Formatting: Generate reports in a visually appealing PDF format for easy sharing and printing.

The Importance of the LC Vendors Ledger Report #

The LC Vendors Ledger Report under VAT and Tax management in ALZERP is distinct from the traditional financial ledger. While the core financial ledger in ALZERP’s Financial Statements module captures all financial transactions impacting the overall financial health of the business, the LC Vendors Ledger focuses solely on transactions related to LC purchases and payments. This distinction is critical because it allows businesses to separately manage and report LC transactions for tax purposes without affecting their main financial accounts.

The primary purpose of the LC Vendors Ledger Report is to ensure that there is a balance between the LC purchases and the corresponding payments. This report allows businesses to verify that the payments made against each LC purchase match the expected amounts, ensuring accuracy and compliance with tax regulations.

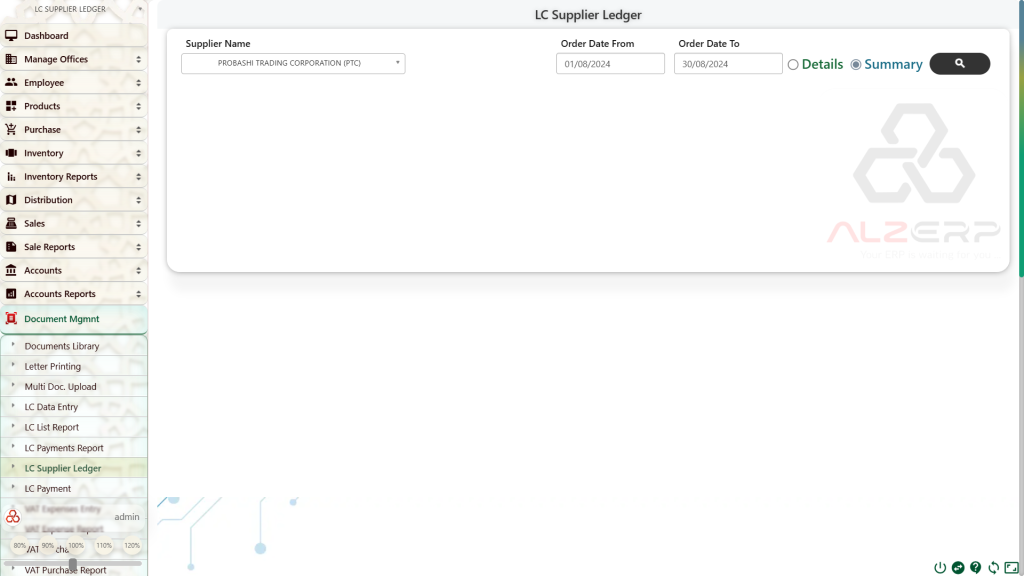

How to Generate the LC Vendor Ledger Report #

- Access the Report: Navigate to the LC Vendor Ledger Report module within ALZERP.

- Select Supplier: Choose the specific supplier you want to analyze.

- Set Date Range: Specify the desired date range for the report.

- Choose Report Type: Select either a detailed or summary report format.

- Generate Report: Click the “Generate Report” button to produce the report in PDF format.

Detail Features of the LC Vendors Ledger Report in ALZERP #

The LC Vendors Ledger Report in ALZERP is designed with several features that make it an essential tool for businesses managing LC transactions:

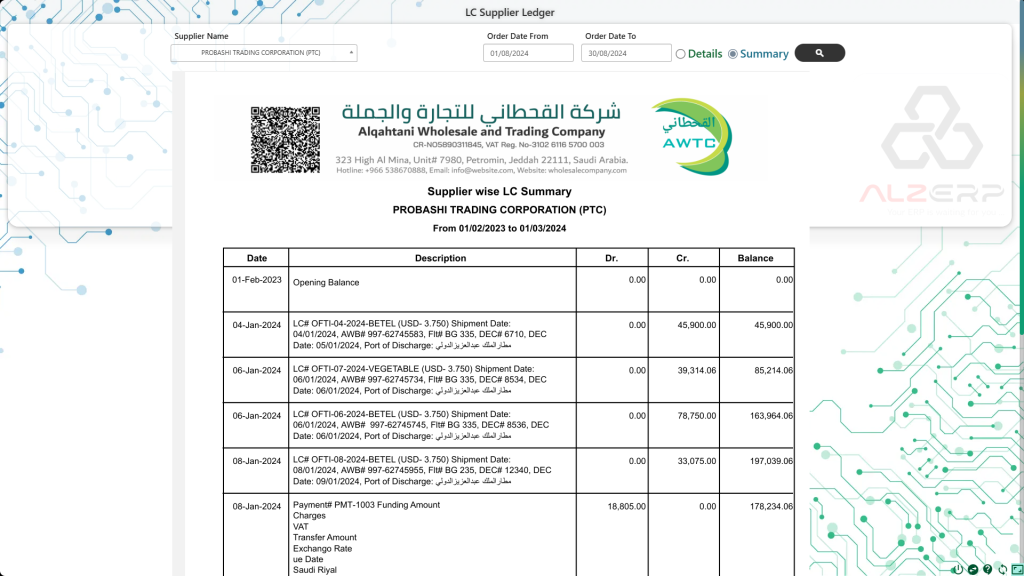

- Supplier-Wise LC Summary: The report provides a detailed summary of LC transactions for each supplier. This includes both purchases made under LC agreements and payments made against those purchases. By offering a supplier-specific view, businesses can easily monitor their transactions with each vendor and ensure compliance with tax regulations.

- Detailed and Summary Reports: Users can choose between generating a detailed or summary report. The detailed report provides a comprehensive view of each transaction, while the summary report gives an overview of the overall financial position regarding LC transactions.

- Date-Range Flexibility: The report can be generated for any specified date range, allowing businesses to focus on specific periods, whether for routine checks or in response to inquiries from tax authorities.

- Professional PDF Format: The generated report is beautifully formatted and can be exported as a PDF. This professional document can be easily shared, emailed, or printed for submission to tax authorities or for internal use.

- Transaction Data Columns: The report includes essential columns such as Date, Description, Debit (Dr.), Credit (Cr.), and Balance, providing a clear and detailed view of each transaction.

How the LC Vendors Ledger Report Supports VAT and Tax Compliance #

ALZERP’s LC Vendors Ledger Report is not just a financial tool; it is an integral part of the VAT and tax management system. It supports businesses in several key areas of tax compliance:

- ZATCA Compliant Software: The LC Vendors Ledger Report is fully compliant with the Zakat, Tax, and Customs Authority (ZATCA) regulations in Saudi Arabia, ensuring that businesses meet their tax obligations.

- Accurate VAT Management: By maintaining a separate ledger for LC transactions, the report ensures that all VAT-related transactions are accurately recorded and reported.

- Zakat Calculation Software: The report assists in the calculation of zakat by providing accurate records of all LC-related transactions, which are essential for determining the correct zakat amount.

- Tax Management System: As part of ALZERP’s broader tax management system, the LC Vendors Ledger Report helps businesses manage their tax liabilities effectively, reducing the risk of errors or omissions.

- Real-Time VAT Reporting: Businesses can generate real-time reports on LC transactions, ensuring they always have up-to-date information for VAT reporting.

- Audit Preparedness: The report’s detailed and organized format ensures that businesses are always ready for audits, whether conducted by ZATCA or internal auditors.

Components of the LC Vendor Ledger Report #

- Date: The date of the transaction.

- Description: A brief description of the transaction.

- Debit: The amount debited to the supplier’s account.

- Credit: The amount credited to the supplier’s account.

- Balance: The running balance of the supplier’s account.

The Role of ALZERP in Saudi Business Tax Management #

ALZERP Cloud ERP Software is designed to meet the specific needs of businesses operating under Saudi Arabia’s stringent tax regulations. The LC Vendors Ledger Report is just one of the many tools within ALZERP that support comprehensive tax management. Here are some of the key benefits:

- Automated Tax Compliance: ALZERP automates various aspects of tax compliance, including VAT reporting and zakat calculation, reducing the administrative burden on businesses.

- Saudi VAT Reconciliation Software: The software includes features that help businesses reconcile VAT transactions, ensuring that all records are accurate and compliant with Saudi tax laws.

- ZATCA Integration Software: ALZERP integrates seamlessly with ZATCA’s e-invoicing system, ensuring that all invoices related to LC transactions are compliant and properly reported.

- Tax Analytics for Saudi Businesses: The software provides advanced analytics tools that help businesses analyze their tax data, identify potential issues, and optimize their tax strategies.

- Zakat and VAT Calculator: The integrated calculator within ALZERP helps businesses accurately calculate their zakat and VAT liabilities based on their LC transactions.

Summary of the LC Vendor Ledger Report #

- Enhanced Compliance: Ensure compliance with ZATCA regulations by accurately tracking LC transactions.

- Improved Efficiency: Streamline the process of reconciling LC purchases and payments.

- Data-Driven Decision Making: Gain valuable insights into your relationships with LC suppliers.

- Simplified Auditing: Easily access LC transaction data for audits and verification.

ALZERP’s LC Vendor Ledger Report is an essential tool for businesses in Saudi Arabia seeking to optimize their financial operations and ensure compliance with ZATKA regulations. By utilizing this report, you can gain valuable insights into your LC transactions, identify discrepancies, and make informed decisions.

Conclusion #

The LC Vendors Ledger Report in ALZERP Cloud ERP Software is an essential tool for businesses managing LC transactions under Saudi Arabia’s rigorous tax regulations. By providing a detailed and accurate record of all LC purchases and payments, this report ensures that businesses remain compliant with ZATCA’s requirements, manage their VAT obligations effectively, and are always prepared for tax audits.

With ALZERP, businesses can confidently navigate the complexities of VAT and tax management, knowing that they have a reliable, ZATCA-approved solution that supports their financial and compliance needs.