In the complex landscape of international trade and taxation, managing compliance with VAT and tax authorities is a critical concern for businesses, especially those involved in importing goods through Letters of Credit (LC). The ALZERP Cloud ERP Software offers a powerful solution to address this need through its LC History Report under VAT & Tax management. This feature enables businesses to generate detailed reports of their LC transactions, ensuring that they remain compliant with regulatory requirements.

ALZERP’s LC History Report provides a detailed overview of all your LC transactions, making it an essential tool for ensuring compliance with ZATKA regulations and managing your import operations effectively.

Key Features of the LC History Report #

- Comprehensive Data: View all LC transactions, including purchase details, payment information, customs data, and more.

- Advanced Filtering: Filter reports by various criteria, such as date range, port of discharge, exporter, and LC number.

- Customizable Output: Generate reports in PDF format with your company’s letterhead for professional presentation.

- ZATKA Compliance: Ensure compliance with ZATKA regulations by tracking all LC-related activities.

The Importance of the LC History Report #

The LC History Report in ALZERP is specifically designed to help businesses manage and document their LC transactions in a way that meets the stringent requirements of VAT and tax authorities. This report provides a comprehensive view of all LC purchase activities, making it an essential tool for businesses that need to submit accurate and detailed records for tax compliance.

The primary purpose of the LC History Report is to provide a complete overview of all LC-related transactions, including purchase details, customs declarations, shipment information, and associated costs. By consolidating this information into a single report, businesses can quickly and easily prepare the necessary documentation for submission to VAT and tax authorities, ensuring that they meet all compliance requirements.

Details of the LC History Report in ALZERP #

ALZERP’s LC History Report is equipped with a range of features that make it an indispensable tool for managing VAT and tax compliance:

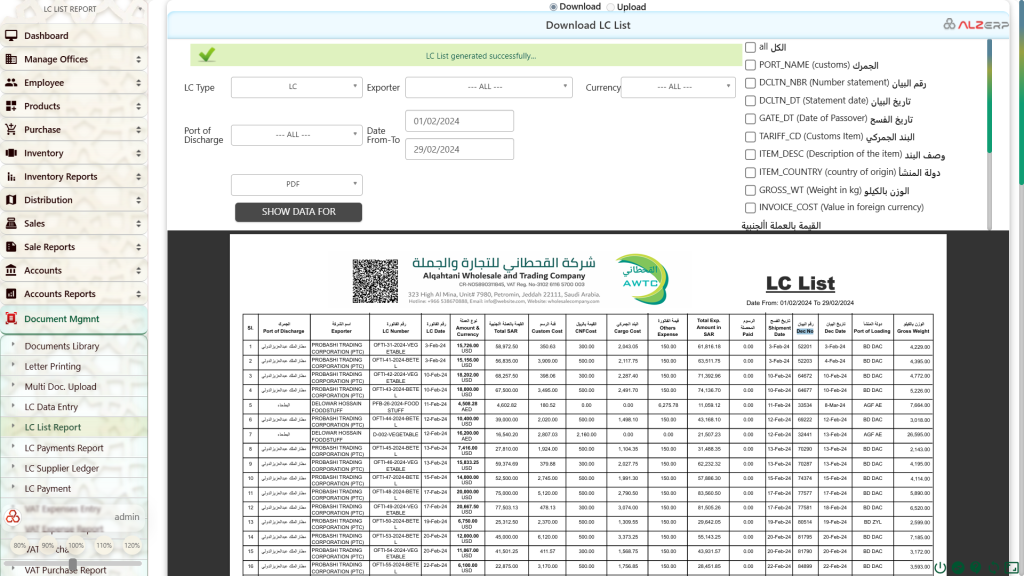

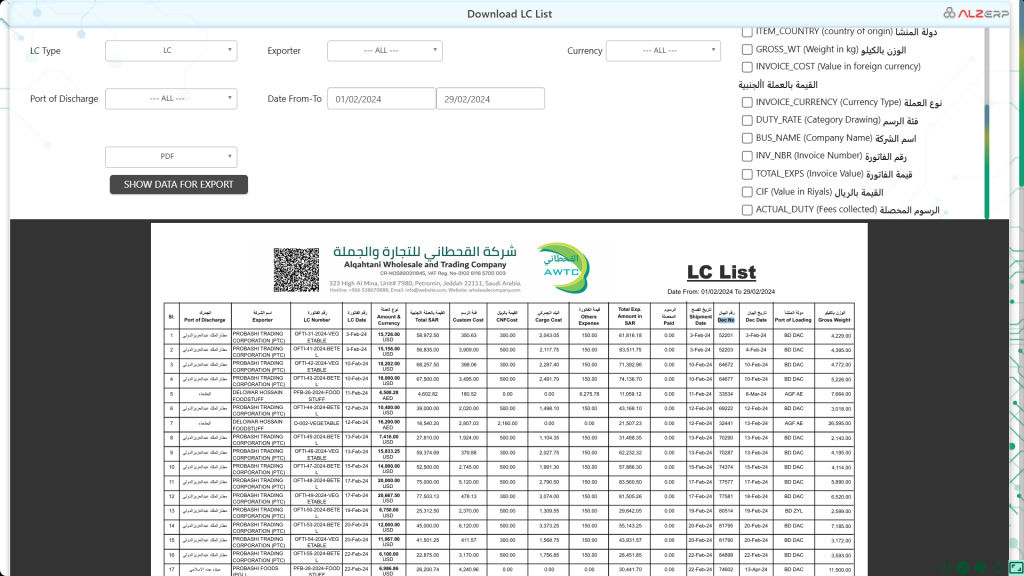

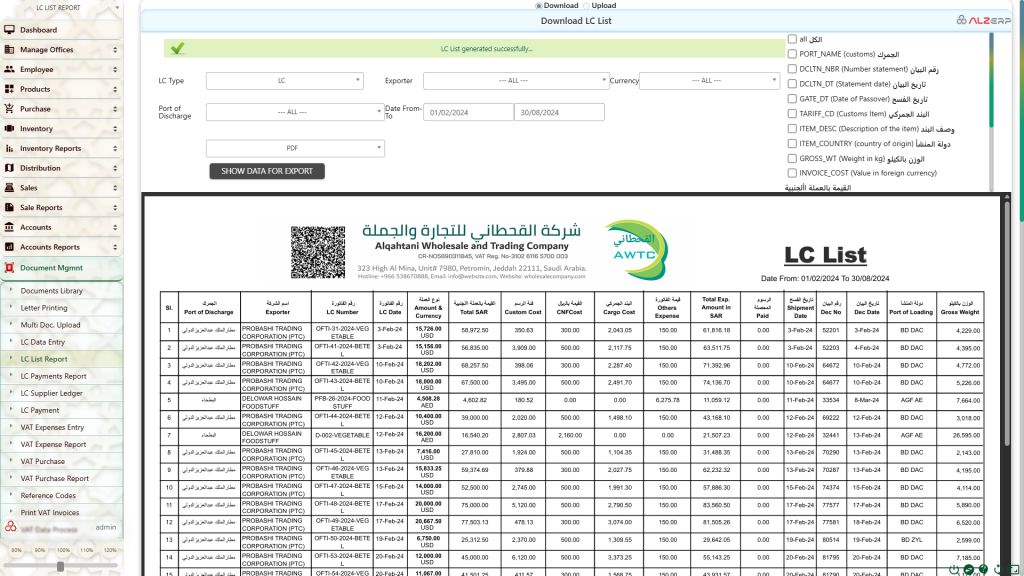

- Comprehensive Data Filtering: Users can generate reports based on specific date ranges or by selecting from various dropdown filters. This flexibility allows businesses to tailor the report to their specific needs, whether for routine reporting or for responding to specific inquiries from tax authorities.

- Detailed Report Data Columns: The LC History Report includes a wide array of data columns, providing a detailed view of each LC transaction. Key columns include:

- Port of Discharge

- Exporter Name

- LC Number and Date

- Amount and Currency

- Total SAR Value

- Customs Costs, CNF Costs, Cargo Costs, and Other Expenses

- Shipment and Declaration Details

- Gross Weight

- Port and Customs Information: The report allows users to include specific details about the port of discharge, customs declaration numbers, tariff codes, and other customs-related data. This is particularly important for ensuring that all import transactions are accurately documented and compliant with customs regulations.

- Professional PDF Reports: Once generated, the LC History Report is beautifully formatted into a professional PDF document. This report can be easily shared, emailed, or printed, making it ideal for submission to VAT and tax authorities or for internal auditing purposes.

- Historical LC Data: The report provides a historical record of all LC transactions, allowing businesses to review past transactions, track compliance over time, and prepare for future audits or tax filings.

How to Generate the LC History Report #

- Access the Report: Navigate to the LC History Report module within ALZERP.

- Apply Filters: Select the desired criteria for your report, such as date range, port of discharge, and other relevant fields.

- Generate Report: Click the “Generate Report” button to produce the report in PDF format.

Components of the LC History Report #

- Port of Discharge: The port where the goods were unloaded.

- Exporter: The name of the exporting company.

- LC Number: The unique identifier for the LC.

- LC Date: The date the LC was issued.

- Amount & Currency: The total amount of the LC in the original currency.

- Total SAR: The equivalent amount in Saudi Riyals.

- Custom Cost: The amount paid for customs duties.

- CNF Cost: The cost of clearing and forwarding agents.

- Cargo Cost: The cost of transportation.

- Others Expense: Any additional expenses incurred.

- Total Amount: The total cost of the LC, including all charges.

- Paid: Indicates whether the LC has been paid in full.

- Shipment Date: The date the goods were shipped.

- Dec No: The customs declaration number.

- Dec Date: The date of the customs declaration.

- Port of Loading: The port from which the goods were shipped.

- Gross Weight: The total weight of the goods.

How the LC History Report Supports VAT and Tax Compliance #

ALZERP’s LC History Report is an integral part of its broader VAT and tax management system. It plays a crucial role in ensuring that businesses remain compliant with Saudi Arabia’s tax regulations, particularly those enforced by the Zakat, Tax, and Customs Authority (ZATCA). Here’s how the report supports compliance:

- ZATCA Compliant Software: The LC History Report is fully compliant with ZATCA regulations, ensuring that all LC-related transactions are documented and reported according to the latest legal requirements.

- Accurate VAT Management: By providing a detailed record of all LC transactions, the report helps businesses accurately calculate and report their VAT obligations.

- Zakat Calculation Software: The report assists in calculating zakat by providing comprehensive data on all import transactions, which are crucial for determining the correct zakat amount.

- Automated Tax Compliance: The LC History Report is part of ALZERP’s automated tax compliance system, which helps businesses streamline their tax reporting processes and reduce the risk of errors or omissions.

- Real-Time VAT Reporting: Businesses can generate real-time reports on their LC transactions, ensuring that they always have up-to-date information for VAT reporting purposes.

- Audit Preparedness: The detailed and organized nature of the LC History Report ensures that businesses are always prepared for audits, whether conducted by ZATCA or internal auditors.

The Role of ALZERP in Saudi Business Tax Management #

ALZERP Cloud ERP Software is designed to help businesses navigate the complexities of VAT and tax compliance in Saudi Arabia. The LC History Report is just one of many tools that ALZERP offers to support comprehensive tax management. Here are some key benefits:

- Saudi VAT Reconciliation Software: ALZERP provides advanced reconciliation tools that help businesses ensure their VAT records are accurate and compliant.

- ZATCA Integration Software: ALZERP integrates seamlessly with ZATCA’s e-invoicing system, ensuring that all LC-related invoices are compliant and properly reported.

- Tax Analytics for Saudi Businesses: The software includes powerful analytics tools that help businesses analyze their tax data, identify potential issues, and optimize their tax strategies.

- Zakat and VAT Calculator: The integrated calculator within ALZERP helps businesses accurately calculate their zakat and VAT liabilities based on their LC transactions.

Summary of the LC History Report #

- Enhanced Compliance: Ensure compliance with ZATKA regulations by tracking all LC-related activities.

- Improved Efficiency: Streamline the process of managing and reporting LC transactions.

- Data-Driven Decision Making: Gain valuable insights into your import operations and identify areas for improvement.

- Simplified Auditing: Easily access LC transaction data for audits and verification.

ALZERP’s LC History Report is an essential tool for businesses in Saudi Arabia seeking to optimize their import operations and ensure compliance with ZATKA regulations. By utilizing this report, you can gain valuable insights into your LC transactions, identify trends, and make informed decisions.

Conclusion #

The LC History Report in ALZERP Cloud ERP Software is an essential tool for businesses involved in international trade, particularly those that need to comply with Saudi Arabia’s rigorous tax regulations. By providing a detailed and accurate record of all LC transactions, this report ensures that businesses can meet their VAT and tax obligations, prepare for audits, and maintain compliance with ZATCA’s requirements.

With ALZERP, businesses can confidently manage their VAT and tax responsibilities, knowing they have a reliable, ZATCA-approved solution that supports their financial and compliance needs.