In the ALZERP Cloud ERP software, the Detailed Balance Sheet Report, formally also known as the Statement of Financial Position, is a crucial financial statement that offers an in-depth view of a company’s financial health. This report provides detailed insights into the company’s assets, liabilities, and shareholders’ equity at a specific point in time. It serves as an essential tool for stakeholders to assess the financial stability and performance of the organization.

ALZERP’s Detailed Balance Sheet Report provides a comprehensive breakdown of a company’s financial position at a specific point in time. This report is essential for in-depth financial analysis, decision-making, and regulatory compliance.

Key Features of the Detailed Balance Sheet Report #

- Comprehensive Coverage: Displays all individual accounts, offering granular financial insights.

- Date-Specific: Reflects the financial position at a user-defined date.

- Account Hierarchy: Reflects the chart of accounts structure for accurate reporting.

- Multiple Formats: Available in PDF, Excel, or Word for flexible reporting needs.

Types of Balance Sheet Reports in ALZERP #

ALZERP offers two primary types of balance sheet reports:

- Summarized Statement of Financial Position: Provides a high-level summary of balances for all control account heads.

- Detailed Statement of Financial Position: Offers a comprehensive breakdown of balances for all individual account heads, allowing for a more detailed analysis.

This article focuses on the Detailed Balance Sheet Report, which is instrumental for in-depth financial analysis and decision-making.

Accessing the Detailed Balance Sheet Report in ALZERP #

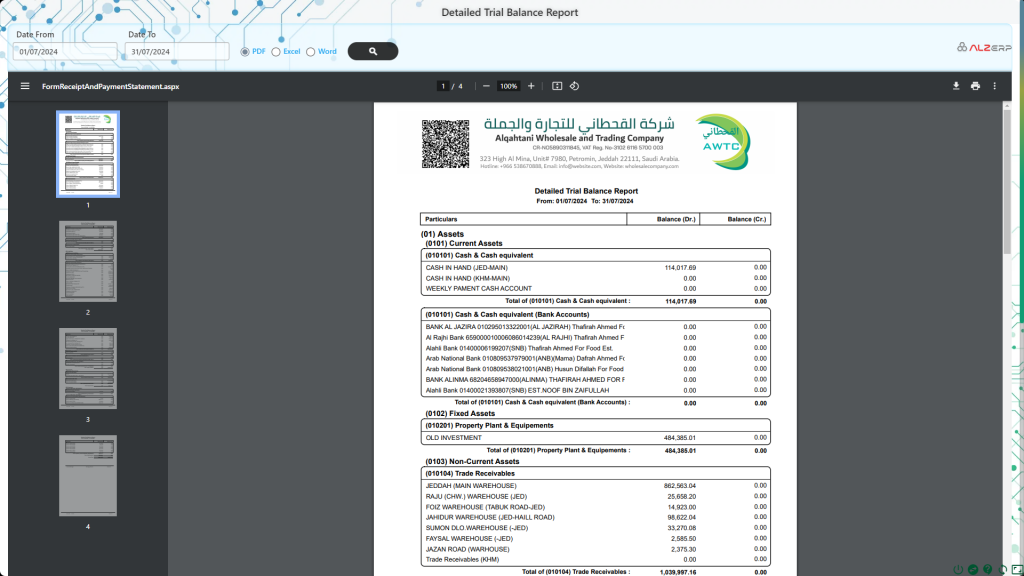

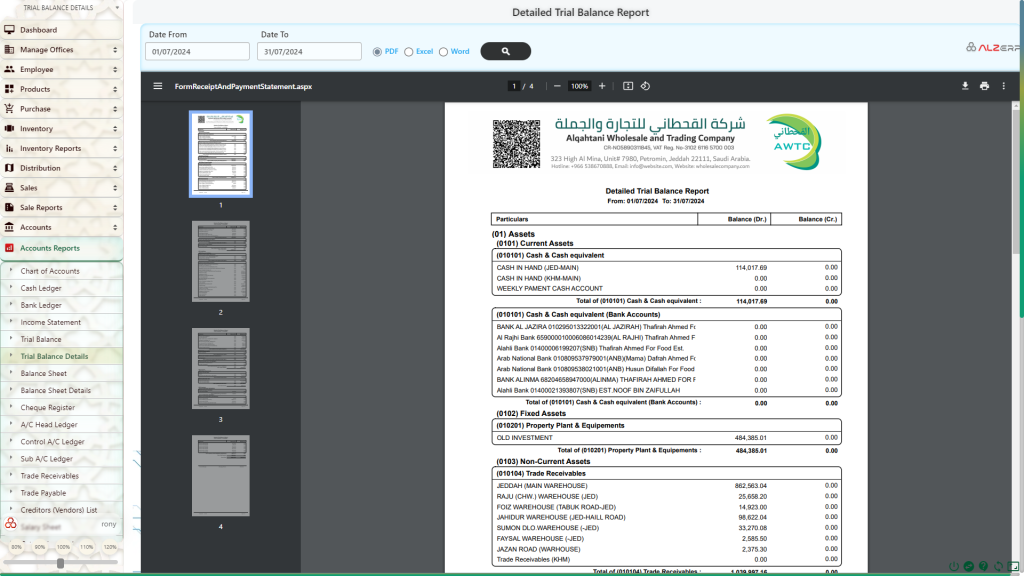

To generate the Detailed Statement of Financial Position in ALZERP, follow these steps:

- As on Date: Specify the date for which you want to view the balance sheet. This allows you to capture the financial position of the company as of that particular date.

- Output Format: ALZERP provides flexibility in choosing the report format. You can select PDF, Excel, or Word depending on your reporting needs.

- Generate the Report: After selecting the desired options, click the button with the magnifying glass icon to generate the report. The system will produce a detailed balance sheet in the chosen format.

- Printable Report: The PDF format provides a beautifully formatted report, complete with your company’s letterhead, making it easy to share via email, WhatsApp, or print for physical use.

Understanding the Detailed Balance Sheet Report in ALZERP #

The Detailed Balance Sheet Report in ALZERP is structured to give a comprehensive view of the company’s financial position. It is categorized into three main components: assets, liabilities, and shareholders’ equity. Each component is further broken down to provide detailed insights into the company’s financial resources and obligations.

1. Assets #

- Current Assets: These are assets expected to be converted into cash or used up within one year. They include:

- Cash and Equivalents: The most liquid assets, ready for immediate use.

- Accounts Receivable: Amounts owed to the company by customers for sales on credit.

- Inventory: The value of goods available for sale.

- Non-Current Assets: These are long-term investments and assets not expected to be converted into cash within a year. They include:

- Property, Plant, and Equipment (PP&E): Tangible assets used in operations, such as buildings, machinery, and land.

- Intangible Assets: Non-physical assets like patents, trademarks, and goodwill.

- Total Assets: The sum of current and non-current assets, representing everything the company owns.

2. Liabilities #

- Current Liabilities: These are obligations the company must settle within one year, including:

- Accounts Payable: Amounts the company owes to suppliers for purchases made on credit.

- Current Portion of Long-Term Debt: The part of long-term loans due within the current year.

- Non-Current Liabilities: These are long-term obligations not due within the next 12 months, such as:

- Bonds Payable: The amortized value of bonds issued by the company.

- Long-Term Debt: Loans and other debts that mature beyond one year.

- Total Liabilities: The sum of current and non-current liabilities, representing everything the company owes.

3. Shareholders’ Equity #

- Share Capital: The funds invested by shareholders when the company was formed, as well as any additional investments made.

- Retained Earnings: Profits that have been accumulated over time after paying out dividends. This represents the earnings that have been reinvested in the business.

- Total Shareholders’ Equity: This reflects the net worth of the company, calculated as the difference between total assets and total liabilities.

Components of the Detailed Balance Sheet Report #

The Detailed Balance Sheet typically includes:

- Assets:

- Current Assets: Cash, accounts receivable, inventory, and other short-term assets.

- Non-Current Assets: Property, plant, equipment, intangible assets, and long-term investments.

- Liabilities:

- Current Liabilities: Accounts payable, short-term loans, and accrued expenses.

- Non-Current Liabilities: Long-term debt, deferred taxes, and other long-term obligations.

- Shareholders’ Equity:

- Share Capital: Investment made by shareholders.

- Retained Earnings: Accumulated profits not distributed as dividends.

- Other Equity: Additional components of equity, such as reserves.

How to Generate the Detailed Balance Sheet Report #

To generate a Detailed Balance Sheet Report in ALZERP:

- Access the Report: Navigate to the Balance Sheet module within ALZERP.

- Select Date: Specify the desired date for the report.

- Choose Output Format: Select PDF, Excel, or Word for the report format.

- Generate Report: Click the generate button to produce the report.

Benefits of Using the Detailed Balance Sheet Report #

- In-depth Financial Analysis: Provides a granular view of financial health.

- Decision Making: Supports strategic planning and resource allocation.

- Regulatory Compliance: Meets financial reporting requirements.

- Audit Support: Provides detailed data for auditors.

Key Features and Benefits of the Detailed Balance Sheet Report #

The Detailed Balance Sheet Report in ALZERP is designed to provide users with a thorough understanding of a company’s financial standing. Here are some of its key features and benefits:

- Date-Specific Reporting: The report reflects the financial position of the company as of a specific date, allowing for precise financial analysis.

- Comprehensive Detail: Unlike the summarized version, this report offers a detailed breakdown of all account heads, providing deeper insights into each aspect of the company’s finances.

- Flexible Output Formats: The ability to generate the report in PDF, Excel, or Word formats ensures that users can choose the most convenient format for their needs.

- Facilitates In-Depth Financial Analysis: The detailed report is ideal for users who need to conduct a thorough financial analysis, monitor performance, or evaluate creditworthiness.

How to Use the Detailed Balance Sheet Report in Financial Decision-Making #

The Detailed Balance Sheet Report is an essential tool for various financial assessments:

- Quick Financial Assessment: Provides a rapid, detailed overview of the company’s financial position, making it easier to identify areas of strength and weakness.

- Performance Monitoring: By comparing balance sheets over different periods, users can track changes in assets, liabilities, and equity, allowing for effective performance monitoring.

- Creditworthiness Evaluation: A detailed understanding of liabilities and assets helps in assessing the company’s ability to meet its financial obligations, crucial for lenders and investors.

- Investment Decisions: Investors can analyze the detailed financial health of the company before making investment decisions, ensuring they have a complete understanding of the risks and rewards.

- Comparison Analysis: The report can be used to compare the company’s financial position against industry benchmarks or its past performance, helping to identify trends and areas for improvement.

#

The Detailed Balance Sheet Report in ALZERP Cloud ERP software is an indispensable resource for anyone involved in financial management and analysis. By providing a comprehensive breakdown of a company’s financial position, it allows for informed decision-making, accurate performance tracking, and a clear understanding of financial health. Whether you’re assessing liquidity, evaluating leverage, or planning investments, this report is essential for making sound financial decisions.

By utilizing ALZERP’s Detailed Balance Sheet Report, businesses can gain a deeper understanding of their financial position, identify trends, and make informed decisions.

Sign up for your free lifetime account of Cloud ERP Software and start transforming your business today!

– Create an account now –