In ALZERP Cloud ERP software, the balance sheet, also known as the Statement of Financial Position, is a critical financial report that provides a snapshot of a company’s financial health at a specific point in time. It summarizes what the company owns (assets), what it owes (liabilities), and the amount invested by shareholders (equity). This report is fundamental for financial modeling, accounting, and assessing a company’s overall financial condition.

The Summarized Balance Sheet Report in ALZERP, also known as the Statement of Financial Position, provides a concise overview of a company’s financial health at a specific date. This report is essential for understanding a company’s assets, liabilities, and shareholders’ equity, which are the fundamental building blocks of its financial stability.

Key Features of the Summarized Balance Sheet Report #

- Date-Specific: Reflects the financial position at a user-defined date.

- Condensed View: Presents key balances for control account heads, offering a high-level summary.

- Easy to Understand: Ideal for quick analysis and financial health assessment.

- Multiple Formats: Available in PDF, Excel, or Word for flexible reporting needs.

Types of Balance Sheet Reports in ALZERP #

ALZERP offers two distinct types of balance sheet reports within its accounting module:

- Summarized Statement of Financial Position: This report aggregates the balances of all control account heads, providing a high-level overview of the company’s financial status.

- Detailed Statement of Financial Position: This report goes deeper, breaking down the balances of individual account heads, offering a more granular view of the company’s finances.

Accessing the Summarized Balance Sheet Report in ALZERP #

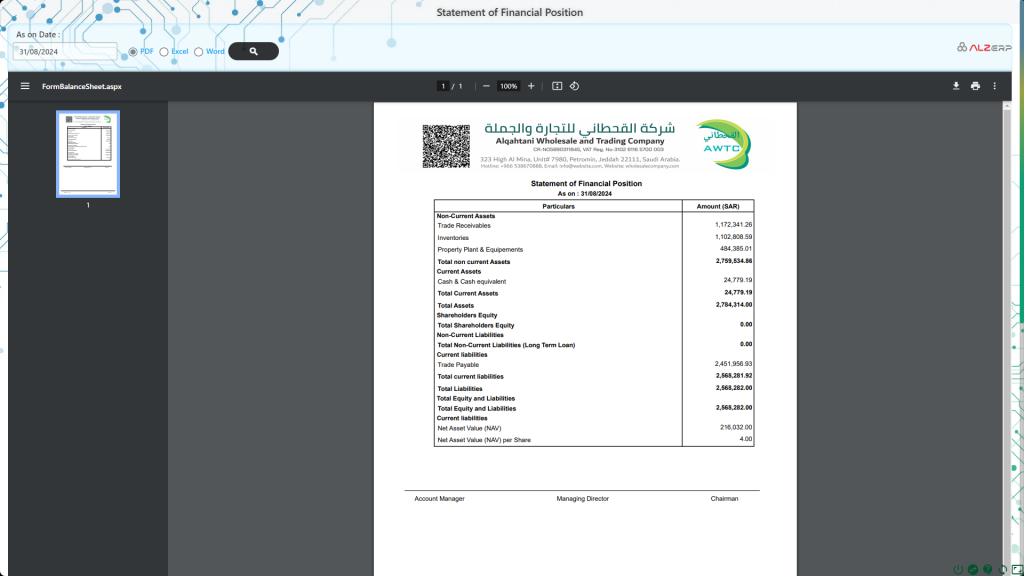

To generate the Summarized Statement of Financial Position in ALZERP, follow these steps:

- As on Date: Choose the specific date for which you want to view the balance position. This date determines the snapshot of the company’s financial status at that moment.

- Output Format: Select the format in which you want to view the report. ALZERP provides options for PDF, Excel, or Word formats, allowing for flexibility depending on your needs.

- Generate the Report: Click the button with the magnifying glass icon to generate the report. The system will present the summarized balance sheet in the selected format.

- Printable Report: If you choose the PDF format, ALZERP provides a beautifully formatted report, complete with your company’s letterhead. This PDF can be easily shared via email, WhatsApp, or printed for physical distribution.

Understanding the Balance Sheet Structure #

The balance sheet in ALZERP, like in traditional accounting, is structured to adhere to the fundamental equation: Assets = Liabilities + Equity. This structure ensures that every financial aspect of the company is accounted for and balanced.

1. Assets #

- Current Assets: These include the most liquid assets, such as cash and equivalents, accounts receivable, and inventory. Current assets are expected to be converted into cash or used up within one year.

- Non-Current Assets: These are long-term investments and tangible assets like Property, Plant, and Equipment (PP&E), as well as intangible assets such as patents and goodwill. Non-current assets are not expected to be liquidated within a year.

2. Liabilities #

- Current Liabilities: These are the company’s short-term financial obligations, including accounts payable, current debt, and the current portion of long-term debt. These liabilities are due within one year.

- Non-Current Liabilities: Long-term obligations, such as bonds payable and long-term debt, which are not due within the next 12 months, fall under this category.

3. Shareholders’ Equity #

- Share Capital: This represents the funds invested by shareholders when the company was formed or through subsequent investments.

- Retained Earnings: These are the cumulative net earnings that the company has retained, rather than distributing as dividends to shareholders.

Importance of the Balance Sheet #

The balance sheet is vital for several reasons:

- Liquidity Assessment: By comparing current assets to current liabilities, the balance sheet helps determine if the company can meet its short-term obligations.

- Leverage Evaluation: The balance sheet reveals how much debt a company has relative to its equity, indicating the level of financial risk.

- Efficiency Measurement: By analyzing how effectively the company uses its assets, the balance sheet can reveal the efficiency of operations.

- Return on Investment: Metrics like Return on Equity (ROE) and Return on Assets (ROA) can be calculated using balance sheet data to assess the profitability of investments.

How to Generate the Report #

- Access the Report: Navigate to the “Balance Sheet” or “Statement of Financial Position” section within ALZERP’s accounting module.

- Select Date: Specify the desired date for the report (e.g., end of month, quarter, or year).

- Choose Output Format: Select your preferred format (PDF, Excel, or Word) for download or printing.

- Generate Report: Click the designated button to generate the report based on your selections.

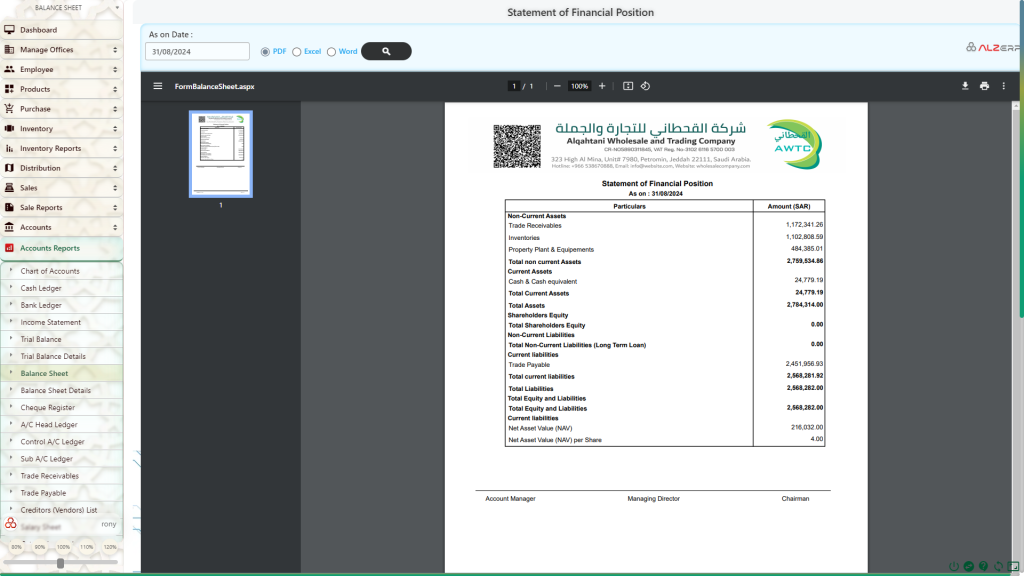

Components of the Summarized Balance Sheet Report #

The report typically includes:

- Assets:

- Total Current Assets: Cash, receivables, and other short-term resources.

- Total Non-Current Assets: Long-term investments, property, equipment, and intangible assets.

- Total Assets: The sum of current and non-current assets.

- Liabilities:

- Total Current Liabilities: Short-term debts payable to suppliers and creditors.

- Total Non-Current Liabilities: Long-term debts such as loans and bonds.

- Total Liabilities: The sum of current and non-current liabilities.

- Shareholders’ Equity:

- Share Capital: The amount invested by shareholders in the company.

- Retained Earnings: Profits accumulated over time, less any dividends paid out.

- Total Shareholders’ Equity: The company’s net worth, representing ownership claims.

Benefits of Using the Summarized Balance Sheet Report #

- Quick Financial Assessment: Gain a rapid understanding of a company’s financial position.

- Performance Monitoring: Track changes in assets, liabilities, and equity over time.

- Creditworthiness Evaluation: Assess a company’s ability to meet its financial obligations.

- Investment Decisions: Analyze a company’s financial health before making investment choices.

- Comparison Analysis: Compare a company’s financial position against industry benchmarks or past performance.

By utilizing the Summarized Balance Sheet Report effectively, businesses can make informed decisions about resource allocation, financial strategies, and overall financial well-being.

Using the Balance Sheet in Financial Analysis #

The balance sheet is not only a standalone report but also works in conjunction with other financial statements like the income statement and cash flow statement. For instance, changes in balance sheet accounts are used to calculate cash flow, helping analysts understand the cash movements within the company.

Financial ratios derived from the balance sheet, such as the Current Ratio, Debt-to-Equity Ratio, and Asset Turnover Ratio, provide deeper insights into the company’s financial performance, liquidity, leverage, and efficiency.

Conclusion #

The Summarized Balance Sheet Report in ALZERP Cloud ERP software is a powerful tool that provides a high-level view of a company’s financial position. Whether you’re assessing liquidity, leverage, or return on investment, this report is essential for making informed financial decisions. By offering flexibility in report formats and easy access to critical financial data, ALZERP ensures that businesses can maintain a clear and accurate picture of their financial health.

Sign up for your free lifetime account of Cloud ERP Software and start transforming your business today!

– Create an account now –