In the accounting module of ALZERP Cloud ERP software, the Summarized Trial Balance Report is a powerful tool that offers a high-level overview of a company’s financial standing at a specific point in time. This report is an essential part of the accounting process, helping businesses ensure that their bookkeeping is mathematically accurate and in balance.

What Is a Trial Balance? #

A trial balance is a financial report that compiles the closing balances of all ledger accounts in the general ledger. It is a worksheet with two main columns: one for debits and one for credits. The primary purpose of a trial balance is to verify that the total debits equal the total credits, ensuring that the entries in a company’s bookkeeping system are mathematically correct.

The trial balance is a crucial step in the accounting cycle, typically prepared at the end of an accounting period. It serves as the first step in the process of closing the books and preparing financial statements such as the balance sheet and income statement.

Types of Trial Balance in ALZERP #

ALZERP Cloud ERP offers two types of trial balance reports to meet the varying needs of businesses:

- Summarized Trial Balance: This report shows the balances of the Control Account Heads, providing a high-level summary of a company’s financial status. It is particularly useful for getting a quick overview of the company’s finances without delving into the detailed accounts.

- Detailed Trial Balance: This report displays the balances of all the 4th level Account Heads, offering a more granular view of the company’s financial transactions. It is ideal for detailed analysis and for preparing comprehensive financial statements.

How a Trial Balance Works #

In double-entry accounting systems, every business transaction affects at least two ledger accounts, and the trial balance ensures that the sum of all debits equals the sum of all credits. This balancing act is crucial because it confirms that there are no mathematical errors in the ledger. However, it is important to note that while a balanced trial balance indicates mathematical accuracy, it does not guarantee that all transactions have been recorded correctly or in the appropriate accounts.

Special Features of the Summarized Trial Balance Report in ALZERP #

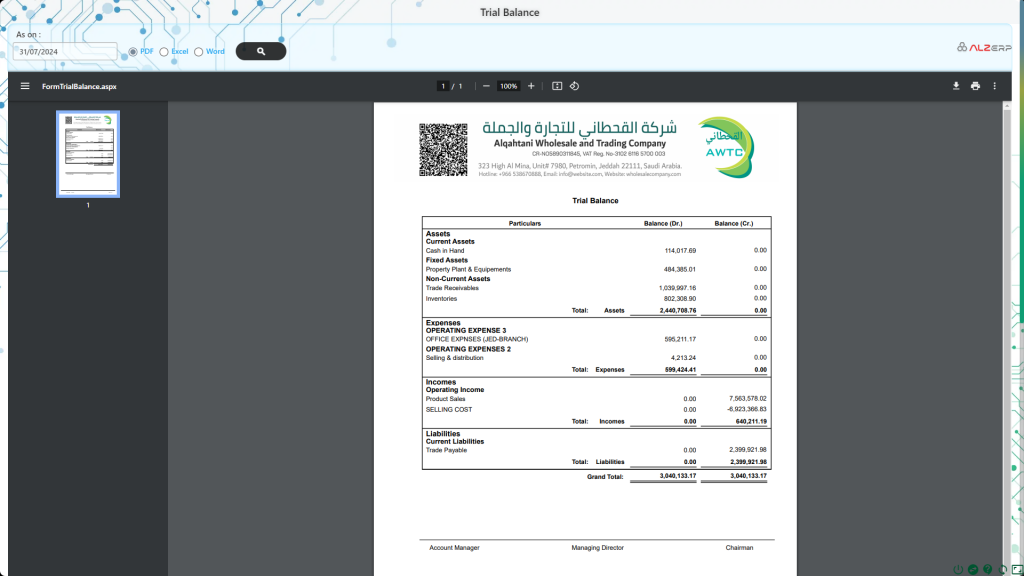

The Summarized Trial Balance Report in ALZERP is designed with user convenience in mind, offering several features that enhance its utility:

- Search Form: Users can specify a transaction date range to generate the report for a specific period. This allows for targeted analysis of financial data.

- Output Types: The report can be exported in multiple formats, including PDF, Excel, and Word, catering to different reporting needs and preferences.

- Printable Report: The PDF version of the report is beautifully formatted with the company’s letterhead, making it ready for professional presentation, whether for emailing, sharing via WhatsApp, or printing.

To generate the Summarized Trial Balance Report, users simply select the desired transaction date range, choose their preferred output type, and click the button with the magnifying glass icon to open the report.

Importance of the Summarized Trial Balance #

The Summarized Trial Balance Report is a vital tool for businesses as it provides a snapshot of the company’s financial health at a glance. By summarizing the balances of the Control Account Heads, this report helps in identifying any discrepancies early on, enabling corrective actions before they escalate. It is also a valuable document for auditors as it serves as a preliminary check on the accuracy of the company’s financial records.

Conclusion #

The Summarized Trial Balance Report in ALZERP Cloud ERP software is an indispensable feature for businesses aiming to maintain accurate and reliable financial records. By providing a concise overview of account balances, it helps in detecting mathematical errors and ensuring the integrity of the company’s financial data. With its user-friendly interface and flexible output options, ALZERP makes it easy to generate, share, and review this critical financial report.

Sign up for your free lifetime account of Cloud ERP Software and start transforming your business today!

– Create an account now –