What is Bank Book? #

The Bank Book is a specialized ledger that tracks all financial transactions made through a company’s bank accounts. This feature, also known as the Bank Accounts Ledger or Bank Statement, is a vital component of the ALZERP central bookkeeping system. It allows businesses to keep a detailed and organized record of every bank-related transaction, ensuring accurate and up-to-date financial reporting.

A bank book, or bank accounts ledger, is a digital record of all financial transactions occurring within a specific bank account. ALZERP Cloud ERP Software provides a robust Bank Book feature to manage these transactions effectively.

Understanding the Bank Book in ALZERP #

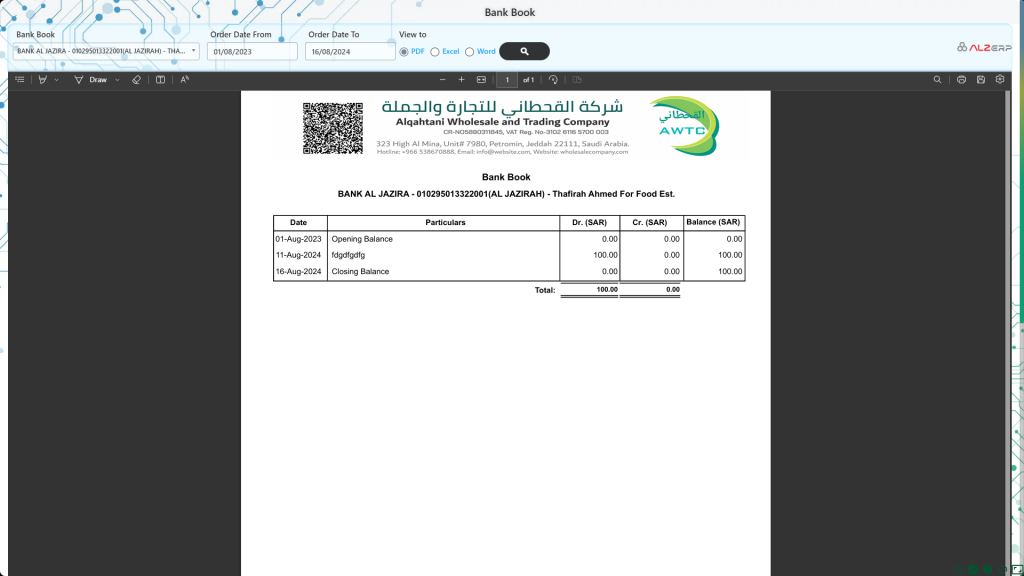

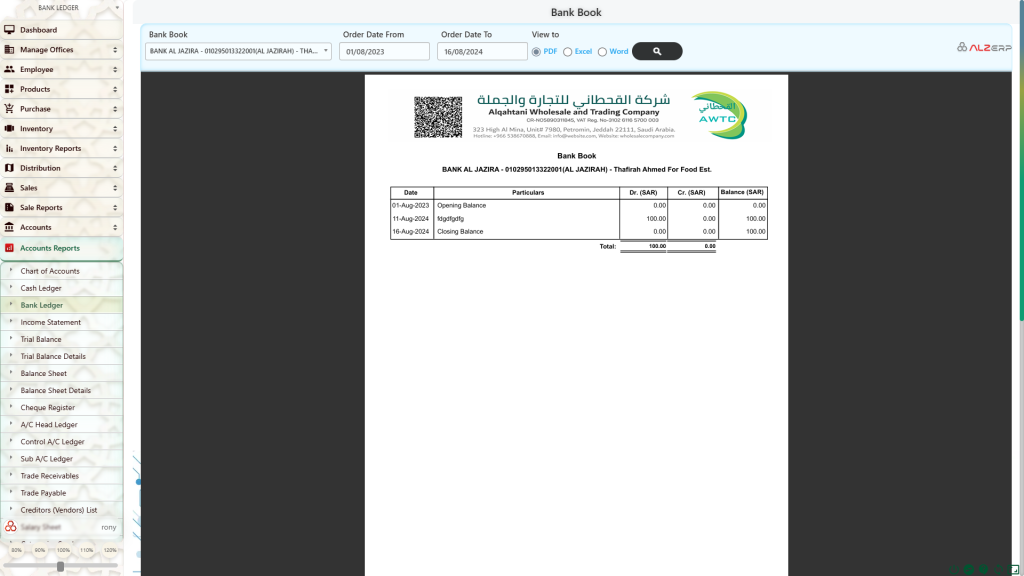

ALZERP’s Bank Book is a detailed report generated from the bank ledger database. It offers a clear overview of all bank transactions, including deposits, withdrawals, and balances, within a specified date range.

Key Features of ALZERP’s Bank Book:

- Centralized Record Keeping: All bank transactions are recorded in a single, centralized location for efficient management.

- Comprehensive Reporting: The Bank Book generates reports in various formats (PDF, Excel, Word) to suit different needs.

- Customizable Search: Users can filter transactions based on bank accounts, dates, and report formats.

- Clear and Concise Reports: The report includes essential columns such as date, particulars, bank deposits, bank withdrawals, and balance.

- Opening and Closing Balances: The report automatically calculates and displays the starting and ending balances for the selected period.

How ALZERP’s Bank Book Works #

ALZERP’s Bank Book is a dynamic tool that reflects the real-time status of your bank accounts. By recording every transaction, from deposits to withdrawals and checks, the system maintains an accurate and up-to-date financial record.

Key Benefits of Using ALZERP’s Bank Book:

- Improved Cash Flow Management: Monitor bank balances and cash flow trends to make informed financial decisions.

- Efficient Reconciliation: Easily reconcile bank statements by comparing the Bank Book with bank records.

- Enhanced Financial Control: Maintain accurate and up-to-date financial records for better oversight.

- Support for Decision Making: Use bank transaction data to analyze financial performance and identify trends.

Structure and Features of the Bank Book #

- Bank Ledger Overview:

- Bank Ledger: The Bank Ledger in ALZERP contains all the information about the bank accounts used for payments and receipts. This includes details such as the bank’s name, account number, IFSC code, and address.

- Multiple Cheque Books: The system supports multiple cheque books for a single bank ledger. Users can manage cheque ranges, and the software will alert them if a cheque number overlaps with an existing range.

- Transaction Recording:

- All Bank Transactions: Every transaction involving the bank accounts, whether it’s money coming in (deposits) or going out (withdrawals), is recorded in the Bank Ledger.

- Opening and Closing Balances: The report begins with an “Opening balance” which reflects the balance at the start of the selected date range. It ends with a “Closing balance,” showing the balance at the end of the selected period.

- Report Generation:

- Search and Filter Options: Users can generate the Bank Book report by selecting specific bank accounts, setting a transaction date range, and choosing the desired output format.

- Report Output Formats: The report can be exported in multiple formats including PDF, Excel, and Word. The PDF version is particularly useful as it can be beautifully formatted on the company’s letterhead, making it ideal for sharing via email, WhatsApp, or for printing.

- Columns in the Bank Book Report:

- Date: The date of each transaction.

- Particulars/Description: A brief description or reference for the transaction.

- Dr. (Bank In): Amounts deposited into the bank account.

- Cr. (Bank Out): Amounts withdrawn from the bank account.

- Balance: The running balance after each transaction.

- Bank Configuration and Connectivity:

- Bank Configuration: The ALZERP system provides various configuration options based on the selected bank, including the ability to set up cheque ranges and manage bank-specific settings.

- Internet Connectivity: For certain banks, the system requires TSS (Tally Server 9) and internet connectivity to display and manage the list of banks effectively.

Importance of the Bank Book in Financial Management #

The Bank Book is an essential tool for businesses to maintain a clear and accurate record of their bank transactions. By keeping detailed records, businesses can ensure:

- Accuracy in Financial Reporting: The Bank Book helps in cross-verifying the transactions recorded in the bank ledger with the actual bank statements.

- Efficient Cash Flow Management: With up-to-date balances, businesses can make informed decisions regarding cash flow and liquidity.

- Simplified Auditing Process: The organized structure of the Bank Book facilitates easier audits and reconciliations, ensuring compliance with regulatory standards.

In summary, the Bank Book feature in ALZERP Cloud ERP Software is a powerful tool that provides businesses with a comprehensive view of their bank transactions. By integrating it into the central bookkeeping system, ALZERP ensures that all financial activities are accurately captured, reported, and managed efficiently.

Sign up for your free lifetime account of Cloud ERP Software and start transforming your business today!

– Create an account now –