The Cash Transfer to Bank Account in ALZERP facilitates the transfer of cash from company cash accounts to designated bank accounts. This feature is essential for managing cash flow, reconciling bank statements, and maintaining accurate financial records.

Key Features:

- Account Selection: Choose the source cash account and the target bank account for the transfer.

- Transfer Amount: Specify the amount of cash to be transferred.

- Transfer Type: Indicate the type of transfer (e.g., weekly, partial, full).

- Transaction Recording: Records the cash transfer with details of accounts, date, and amount.

- Cash and Bank Balance Updates: Automatically updates the balances of both cash and bank accounts.

- Transaction History: Maintains a record of all cash transfers to bank accounts for reference and reporting.

The Cash Transfer to Bank Account in ALZERP Cloud ERP software allows users to transfer funds from any cash account within the organization to a designated bank account. This form is part of a permission-based system that controls various types of cash movements, ensuring secure and authorized transactions. The system supports three distinct types of cash transfers:

- Weekly Cash Transfer

- Partial Cash Transfer

- Cash Transfer from Cash Accounts to Bank Accounts

Cash Transfer to Bank Form Features: #

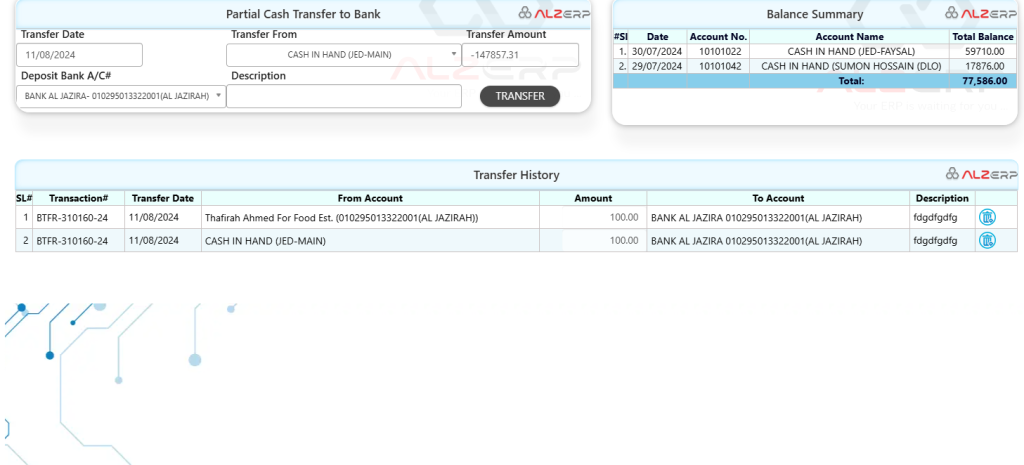

1. Transactions Section: #

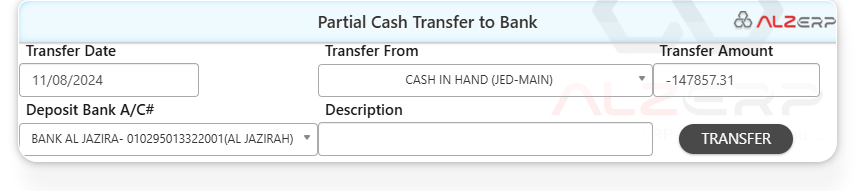

- Partial Cash Account From:

- Purpose: This dropdown allows users to select the cash account from which funds will be transferred. The selected account could be any of the cash accounts within the organization, such as the main cash account or any other specific cash account.

- Example:

CASH IN HAND (Main Cash).

- Cash Receiver Account:

- Purpose: This dropdown lets users choose the bank account where the cash will be deposited. The available options include all bank accounts associated with the organization, ensuring flexibility in selecting the appropriate destination.

- Example:

ANB BANK (11223364548).

- Transfer Amount:

- Purpose: The user enters the specific amount of cash they want to transfer from the selected cash account to the chosen bank account. This ensures that only the desired amount is moved, allowing for precise control over cash flow.

- Example:

50,000.

This section is where the cash transfer process is initiated. Once the user selects the appropriate accounts and enters the transfer amount, the system processes the transaction and updates the balances accordingly.

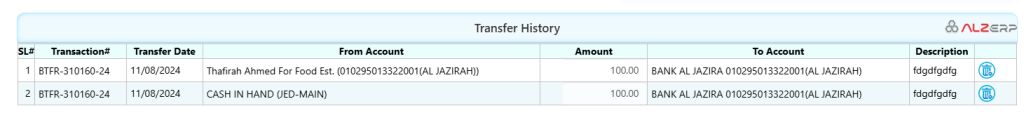

2. Cash Transfer History: #

- Purpose: This section records and displays a detailed history of all cash transfers made to bank accounts. It provides an audit trail for tracking financial transactions and ensuring transparency.

- Columns Displayed:

- SL#: A serial number for referencing each transaction.

- Transaction#: A unique identifier assigned to each transfer, useful for tracking and auditing purposes.

- Transfer Date: The date on which the transfer occurred.

- From Cash Account: The source cash account from which the funds were transferred.

- Amount: The amount of cash transferred.

- To Bank Account: The bank account that received the transferred funds.

- Description: Any additional notes or descriptions related to the transfer, providing context or details about the transaction.

This history log ensures that all cash-to-bank transfers are documented, providing a clear record for financial reviews and audits.

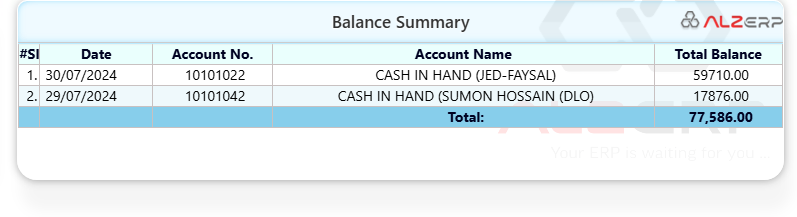

3. All Cash Accounts Balance Summary: #

- Overview: Displayed on the right side of the form, this section provides a real-time summary of the balances in all cash accounts within the organization. This summary helps users assess available funds before initiating a transfer to a bank account.

- Columns Displayed:

- #Sl: A serial number for each cash account listed.

- Account No.: The unique identifier for each cash account.

- Account Name: The name of the cash account, such as

CASH IN HAND (JED-FAYSAL)orCASH IN HAND (SUMON HOSSAIN (DLO). - Total Balance: The current balance of each cash account, giving a comprehensive view of the organization’s liquidity.

This balance summary is crucial for ensuring that sufficient funds are available in the selected cash account before a transfer is initiated.

Key Features and Benefits: #

- Controlled Cash Movement: The permission-based system ensures that only authorized personnel can perform cash transfers, reducing the risk of unauthorized or fraudulent transactions.

- Flexibility: Users can transfer any amount of cash from any internal cash account to any external bank account, allowing for tailored cash management based on the organization’s needs.

- Real-Time Account Balances: The balance summary provides an up-to-date view of cash availability, helping users make informed decisions when transferring funds.

- Comprehensive Transaction History: The detailed history log allows for easy tracking and auditing of all cash-to-bank transfers, ensuring transparency and accountability in financial operations.

The Cash Transfer to Bank Form in ALZERP Cloud ERP is an essential tool for managing cash flow effectively, allowing organizations to securely transfer funds from their cash accounts to bank accounts while maintaining a comprehensive record of all transactions. This ensures that financial operations are conducted smoothly and in compliance with internal controls.

Sign up for your free lifetime account of Cloud ERP Software and start transforming your business today!

– Create an account now –