In cloud accounting software, debits (DR) and credits (CR) are fundamental concepts in a double-entry bookkeeping system. They represent two sides of the same transaction and are essential for maintaining a balanced accounting equation.

In cloud accounting software, Credit (CR) and Debit (DR) represent fundamental concepts in double-entry bookkeeping. They are used to record financial transactions and ensure everything balances out. Here’s a breakdown:

Credit (CR):

- Generally increases asset accounts (cash, inventory, etc.)

- Decreases liability accounts (accounts payable, loans, etc.)

- Decreases equity accounts (capital, retained earnings, etc.)

Debit (DR):

- Generally increases liability accounts and equity accounts

- Decreases asset accounts

Imagine your accounting system as a seesaw:

- Transactions always affect both sides (debit and credit) to maintain balance.

- Credit (CR) entries go on the right side.

- Debit (DR) entries go on the left side.

Here are some real-life examples to illustrate how Credit (CR) and Debit (DR) work in cloud accounting software:

- You sell a product for $100 (increases income, an asset):

- Debit (DR) Cash Account: $100 (increases cash you receive)

- Credit (CR) Sales Account: $100 (increases revenue)

- You purchase office supplies for $50 (increases expense, decreases asset):

- Debit (DR) Office Supplies Expense Account: $50 (increases expense)

- Credit (CR) Cash Account: $50 (decreases cash you have)

Benefits of Using Credit (CR) and Debit (DR):

- Accuracy: Ensures all transactions are recorded and balanced.

- Traceability: Makes it easier to track the flow of money and identify errors.

- Financial Reporting: Provides a clear picture of your company’s financial health.

Here’s a breakdown of their meaning and how they work:

Debit (DR):

- Represents an increase in asset accounts (things you own) or a decrease in liability accounts (what you owe) or equity accounts (owner’s investment).

- Imagine “debit” as “delivering something to an account,” so it increases its value.

Credit (CR):

- Represents an increase in liability accounts or equity accounts or a decrease in asset accounts.

- Think of “credit” as “creating” or “taking something out of” an account, so it reduces its value.

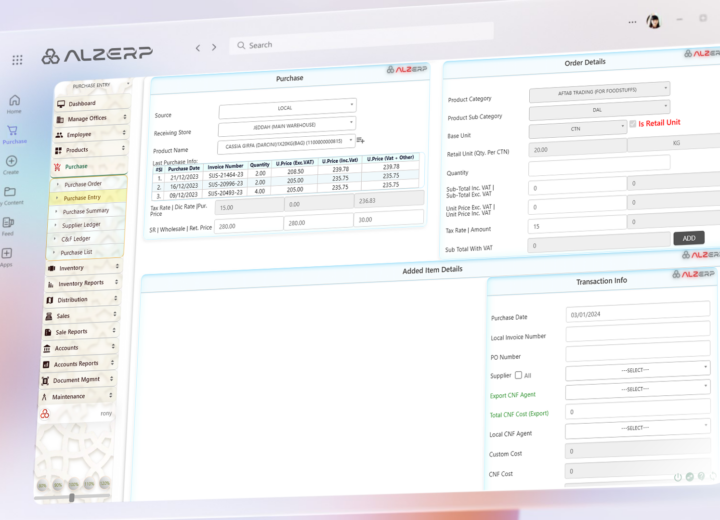

Cloud accounting software automates many bookkeeping tasks, automating Credit (CR) and Debit (DR) bookkeeping systems for interpreting financial reports and making informed business decisions.

Try using our Cloud Accounting software by signing up at alzerp.com